Swing Trading Mastery Recording

$ 995.00

Are you looking to sharpen your skills?

Many traders believe that the quickest way to improve their results is to add more indicators, like Time by Degrees or Road Maps. While Mat uses all of these techniques in his trading, he believes they are only beneficial to competent swing traders. With this in mind, Mat has put together a comprehensive day of practical lessons designed to test your competence at each stage of the trading process.

To find out more about Swing Trading Mastery, take a moment to watch this video.

Over the course of this program, you will cover the following topics in details:

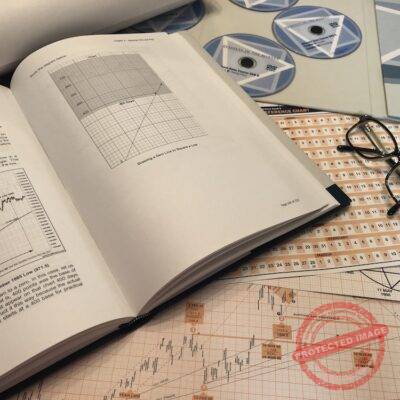

1. Swing Charting

In the early days, Mat spent a month drawing bar charts and swing charts from all of the data tables found in WD Gann’s books. Needless to say by the end of that time, he knew bar charts and swing charts very well! Don’t worry, we won’t make you chart for that long, however drawing charts by hand is a consistent and reliable way to increase your understanding and confidence in the market. All of our top Safety in the Market traders have drawn hand-charts at some point and many still do it this day.

2. Interpreting the Direction of the Market

Sometimes, less is more, and in an era where we can access instant live data to construct charts on any time frame, having a dozen or more time frames to watch at once can lead to analysis paralysis. Mat walks you through his process for interpreting the direction of the current market, both on the larger and smaller time frames.

3. Completion of Moves

The best trades tend to come from the start of big moves. Since big moves can only start once the previous move has completed, it goes without saying that recognising signs of completion of moves is a valuable skill to have. Identifying points of completion as or before they occur will help you know when to lock in profits, and also pinpoint areas for your next high Reward to Risk Ratio trade.

4. Form Reading the Market

Form Reading is one of the most important skills that any trader can have. While many in the Gann field like to highlight and promote Gann’s more esoteric techniques, such as Time Analysis, they often overlook the fact that Gann’s courses began with lessons on swing trading, and that his book How to Make Profits in Commodities devoted a whole chapter to the science of Form Reading.

5. Taking Low Risk, High Reward to Risk Ratio Entries

Mat walks you through his step by step approach for entering trades with the smallest risk possible, and the maximum reward possible. He explore Case Studies as well as investigates some current, to the time of recording, market opportunities.

6. Trade Management

Once you’re in the trade, a lot of your work is already done. However, it is crucial to manage the trade correctly to ensure that you get the most profit out of a move while also removing risk as quickly as possible. We will explore different methods for trailing stop losses, how to compound and the best place to exit a trade.

7. Trading Psychology

In the last lesson of the day, Mat walks you through Trading Psychology, to ensure that you are sent on your way with not only the right tools and the right training, but the right mindset to put them into action.