Risk Calculations

This month we’ll be looking at the calculations you need to do prior to entering a trade.

Greetings all and welcome to a new decade! I hope you managed a nice break over the Christmas and New Year’s period, and that you’re ready to go for a huge 2020. I will begin the year as usual and write an article which relates, in one way or another, to the most commonly asked questions which we receive at Trading Tutors from our Safety in the Market trading students, in particular those students who are new and getting stuck into their Active Trader Program studies.

This month’s article will focus on risk calculations, specifically those that we do just prior to entering a trade. Although there is common logic for risk calculations in all markets, there are some differences in the way we do the calculation when comparing some markets, so I will pick three examples, each from a different type of market. I will assume in this article that you have a good working knowledge of ABC trade entry parameters, as defined in the Smarter Starter Pack manual.

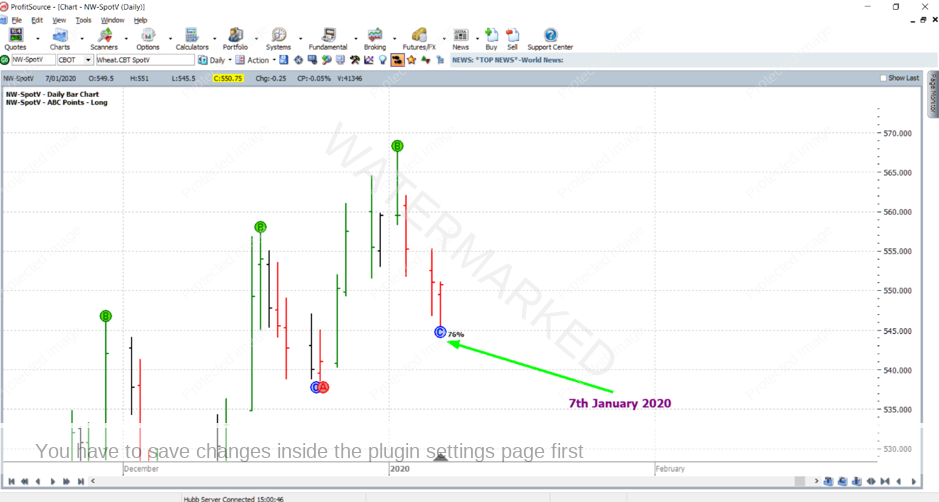

EXAMPLE #1

The first example is from the Wheat futures market. Let’s take a very recent ABC trade, and do the risk calculation which was obviously done just prior to trade entry. Identifying the trade: the Point C date was 7 January 2020, for trading the March 2020 Wheat futures contract – which was and still is, at the time of writing trading with a higher volume than any of the other Wheat futures contracts. Two possible ProfitSource chart symbols are NW-SpotV or NW-2020.H. See the chart below.

Each point of price movement for Wheat is equal to 0.25c per bushel of Wheat, or US$12.50 for a full-sized contract of 5,000 Wheat bushels. Let’s presume we want to be in the trade by the 25% entry limit, which is 552.75. The initial stop loss will be 545.25c. Hence the risk we calculate as follows:

552.75 – 545.25 = 7.50c

7.50c divided by 0.25c = 30 points

30 points x $12.50 = US$375

If we use the rule that no more than 5% of our account is to be risked on any one trade, then the account size required to take this trade would be US$7,500 – 5% of which is the US$375 at risk. Given the fact that a commodity such as Wheat trades for much more extended hours these days, gaps on market open are less likely, so the initial risk will normally end up being less than as calculated above. Note also that if trading this market with CFDs that a much smaller position size is allowed. Wheat futures can be traded through the CME Group, 8.30am to 1.20pm and 7pm to 7.45am Chicago Time.

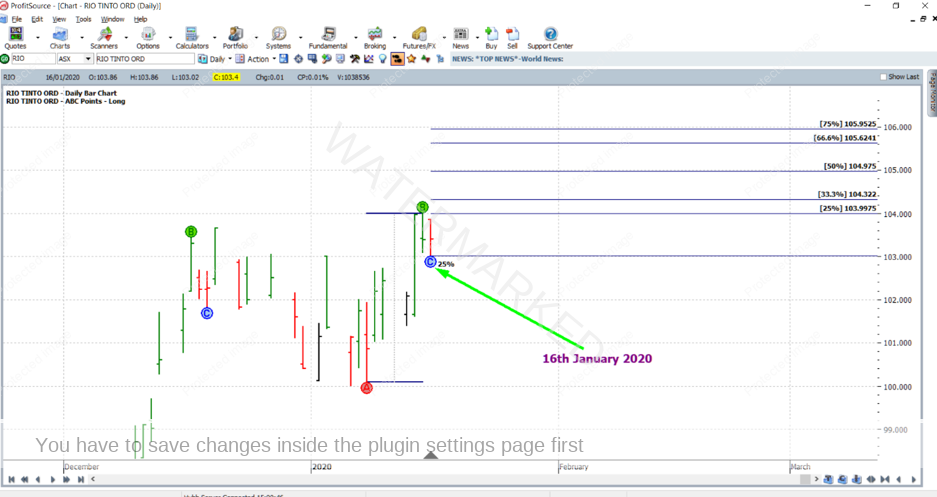

EXAMPLE #2

The second example is a bit closer to home – I’ve chosen an ABC trade from Rio Tinto (RIO:ASX), with chart symbol RIO in ProfitSource. Identifying the trade: the Point C date was 16 January 2020. See the chart below.

Let’s presume that we want to be in the trade by the 33% entry limit, which is $104.33. The initial stop loss will be $103.01. Hence the risk per CFD we calculate as follows:

$104.33 – $103.01 = $1.32 per CFD

With CFDs we have the advantage of choosing our own position size. Let’s assume we are risking 5% of a $5,000 account, which is $250. So the number of CFDs to order for entry into this trade is:

$250 divided by $1.32 = 189 CFDs

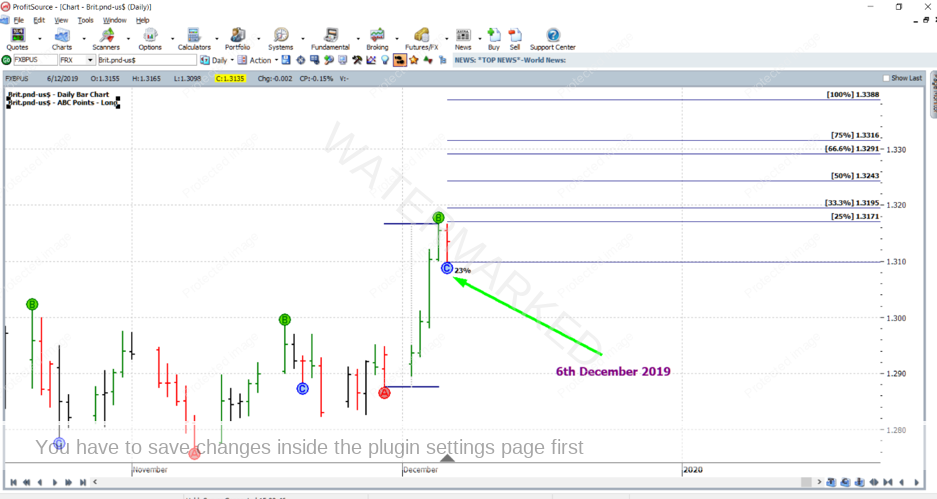

EXAMPLE #3

The third example is from the foreign exchange market – the British Pound versus the USD – chart symbol FXBPUS in ProfitSource. Identifying the trade: the Point C date was 6 December 2019. See the chart below.

As you can see from the chart above, entry within the 25% entry limit is well and truly possible. What I will do in this case however is calculate the risk based on the high of Point C day plus one point minus our initial stop loss price, rather that entry limit minus stop loss price. This is because gaps in the FX market at market open are so incredibly rare as FX markets basically trade around the clock.

The risk for this trade we will calculate as follows:

Point C day high price + 1 point = 1.3166 = safely assumed trade entry price

Initial stop loss price = 1.3097

Risk = 1.3166 minus 1.3097 = US$0.0069 for each British Pound bought

Again with CFDs we have the flexibility of choosing our own position size. If you are trading the British Pound in the FX market, your minimum risk would usually be 1 US Dollar, which means that you would need an account of at least $US1,380 if you wanted to keep your risk at 5% of your account or less. Note that if trading this market with futures, that a much larger minimum position size is required.

If you would like to learn more about trading currencies, please check out our free FX Trading Series on YouTube by clicking on the following link:

Obviously, I have used ABC long trades in the examples above. Simply reverse the logic for short trades.

By the way, for a risk calculation in a given market, there is certainly more than one way of getting the same answer, which is fine. Keep doing your calculations in a way that suits you best, as long as your numbers are correct! If still in doubt about any of the details about a risk calculation, feel free to email us at tradingtutors@safetyinthemarket.com.au

Work hard, work smart.

Andrew Baraniak