Routine and Coffee

In this month’s article, we go back to the Coffee futures market to an example of a technical trade from early April of this year. If you’ve been tuned into these articles of late, you may have observed the consistency of their theme and format. The trades in these articles are the result of sticking to a routine. As we all know, sticking to the same consistent routine is sometimes hard. Sometimes it’s easy. Other times it’s exciting, other times it’s boring. Sometimes we have plenty of time in the day for it, other times we don’t. But we must stick to it. That is what it takes.

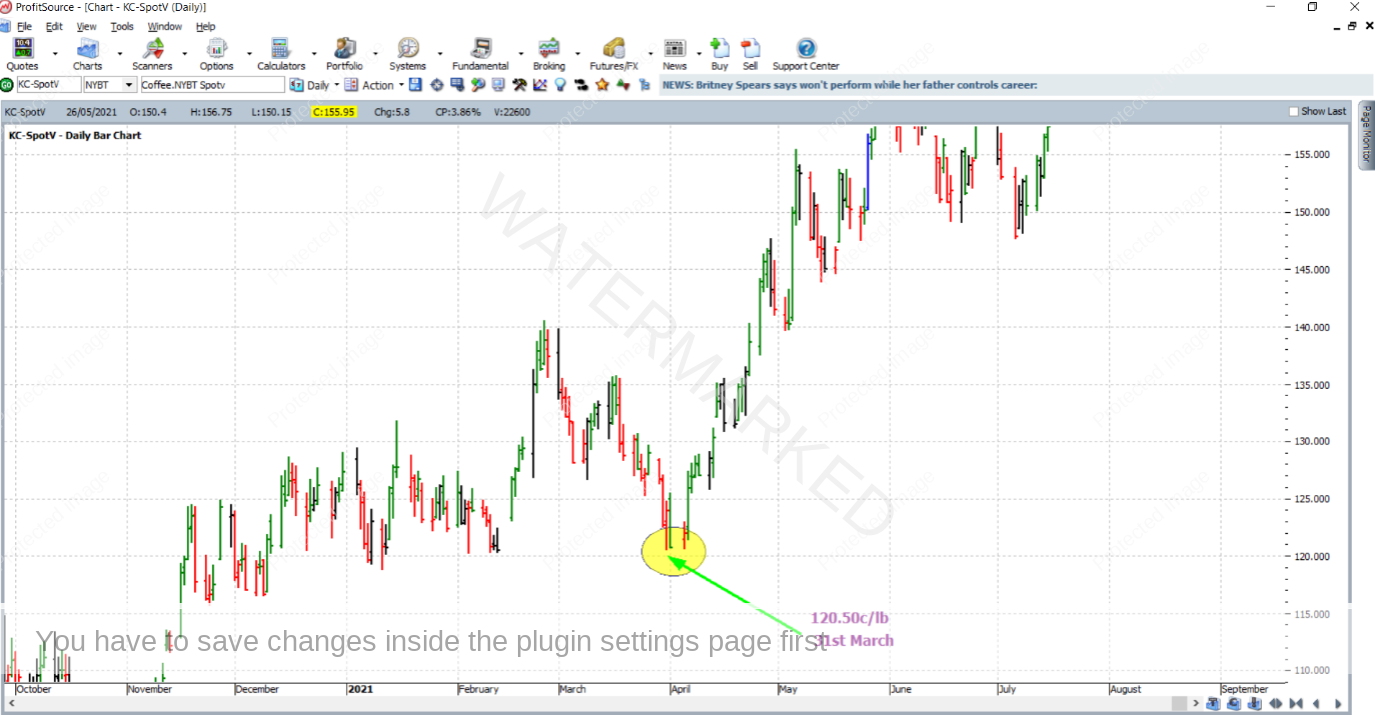

Late in March of this year, there were at least three solid price reasons coming together in the Coffee market, and as Safety in the Market traders these reasons could have had us on alert for a change in trend and hence another trading opportunity. The turning point which did eventually result from those price reasons is illustrated in the ProfitSource chart below, symbol KC-SpotV.

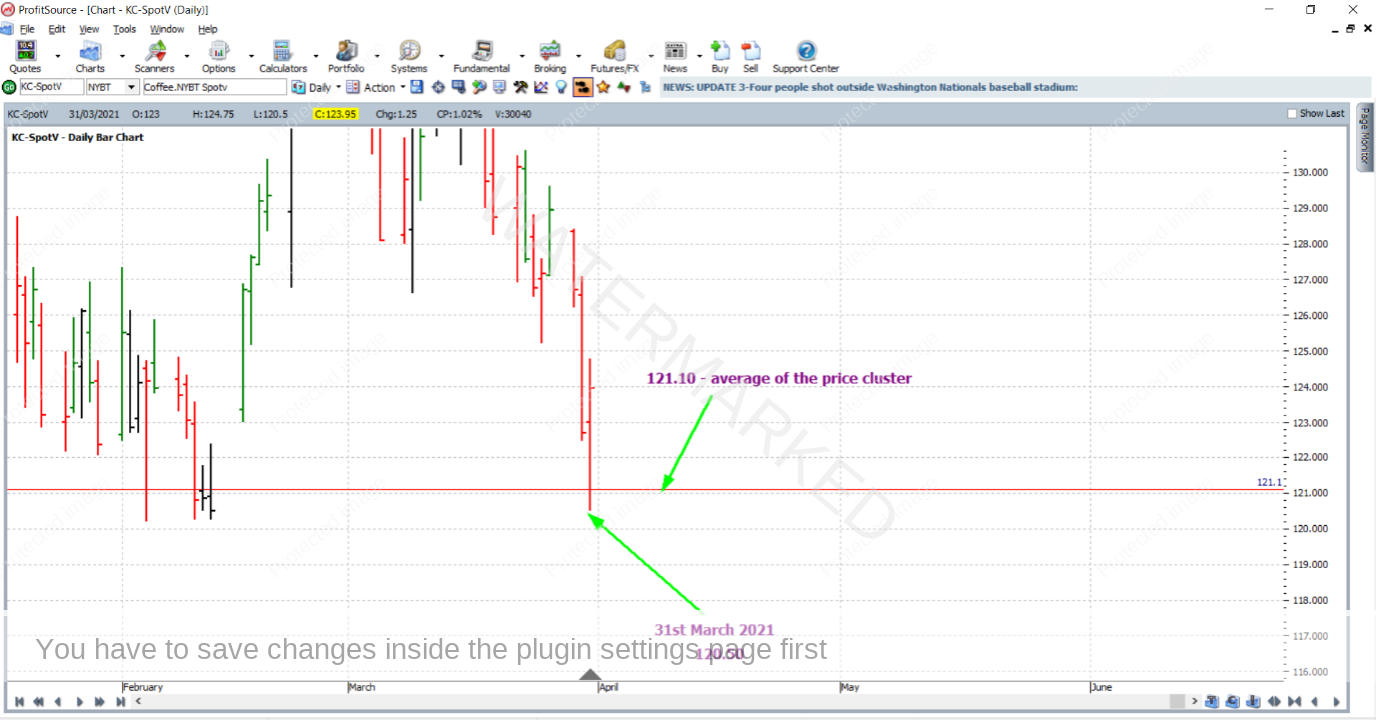

The three price reasons for this low averaged out at 121.10 US cents per pound. The eventual low itself was at 120.50. This is shown in the chart below in Walk Thru Mode.

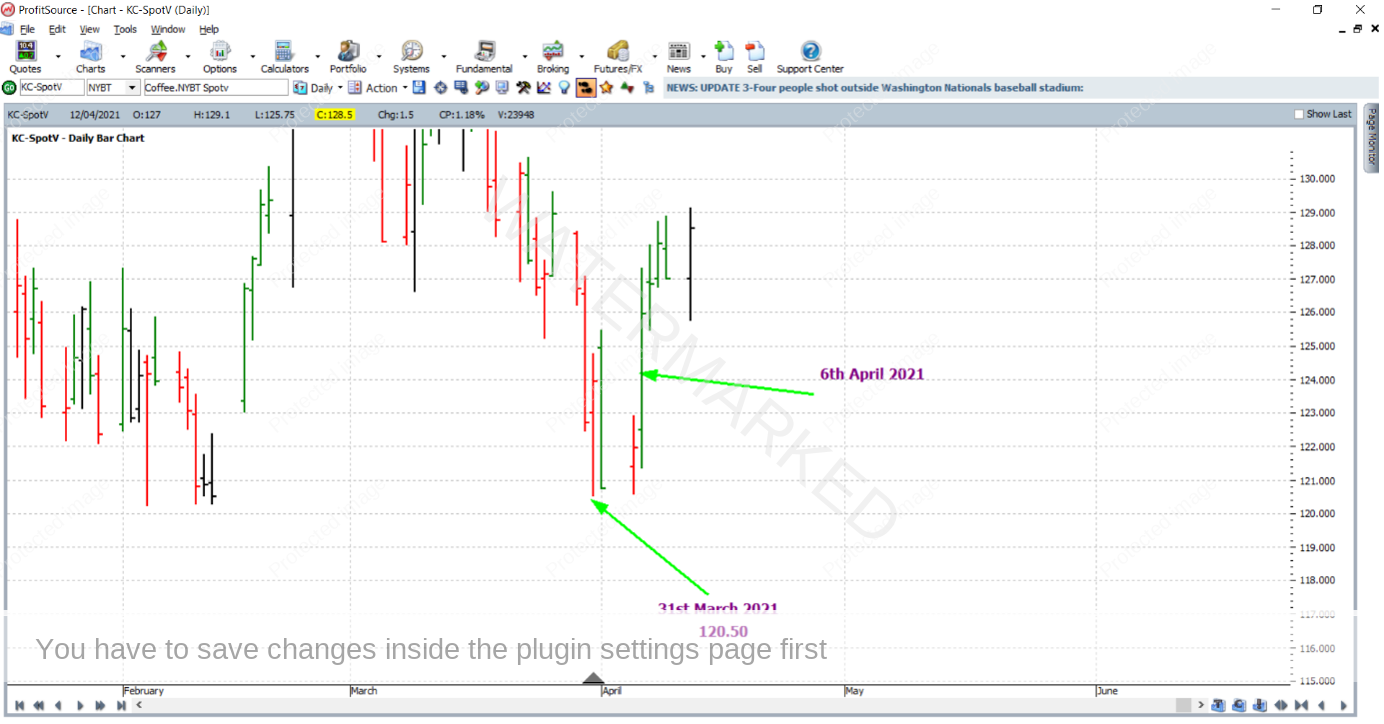

Now for an entry signal. In this article, we’ll take the more conservative approach. This will be to use the daily bar and swing charts and enter at the confirmation of the first higher swing bottom. This entry technique is detailed in the Number One Trading Plan. The entry signal was triggered with the strong up day that was the 6th of April 2021, at a price of 122.95, with an initial stop loss at 120.50 (one point below the low of the 5th). The bar of the 5th of April, being of smaller size, allowed a more favorable entry in terms of absolute dollar risk and/or reward to risk ratio. That analysis will be done in more detail at the end of this article.

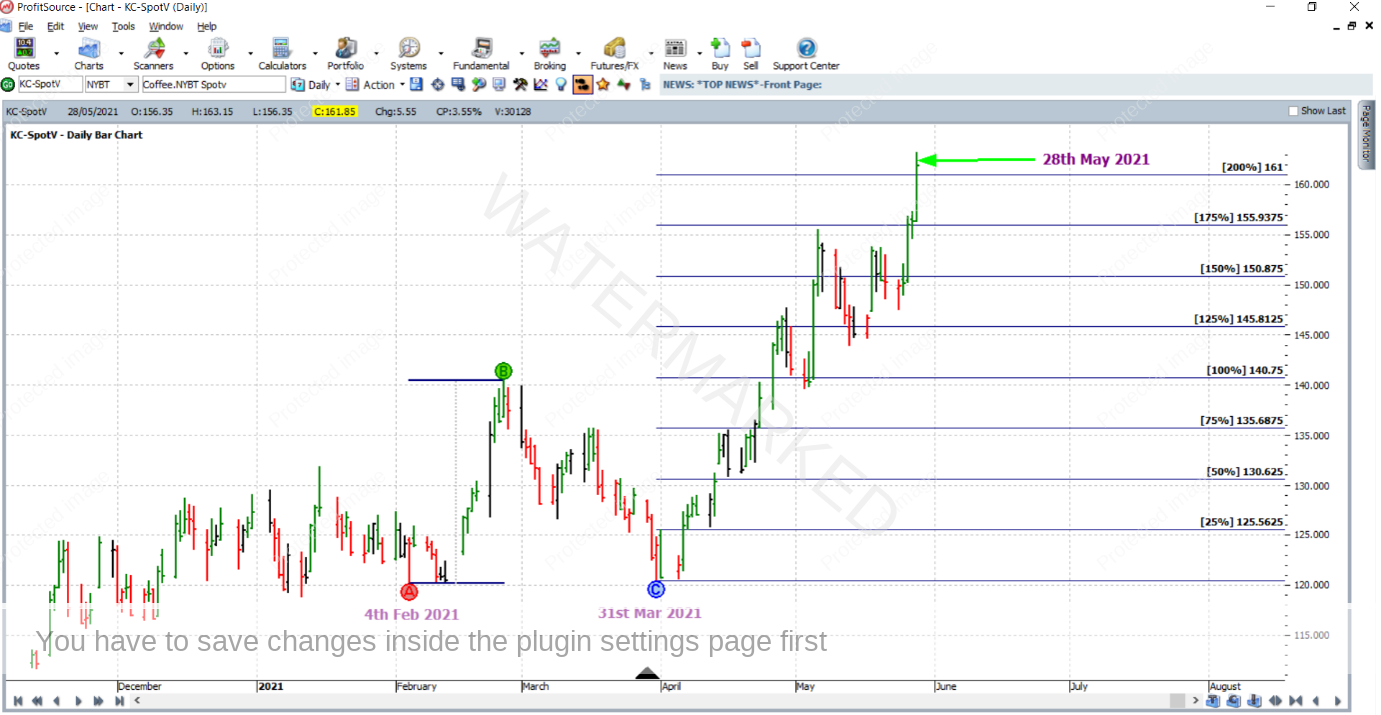

Now that we’re long Coffee, what about the trade management and an exit target? The chart below shows that the 31st of March low made a very close double bottom with the 4th of February low. In his course materials, David Bowden makes the point that with double bottoms we can set our exit target at the 200% milestone, so that’s what we’ll do with this trade. Until then, stops will be managed basically like an extended version of the “Currency Style” management of a normal ABC trade – i.e. stops moved to break even when the 50% milestone is reached. As each subsequent 25% multiple milestone is reached, stops will be moved to one-third of the average weekly range (2.90 based on the last 60 weekly trading bars) behind the milestone prior. In this case, we’ll use one-third of the average weekly range (as opposed to one-third of the average daily range) because the reference range we are using is a bit larger than that of a normal daily ABC trade. This will give the market plenty of room to breathe on the way up.

On the 13th of April 2021, the market reached the 50% milestone – and stops were moved to break even.

On the 22nd of April, the market reached the 75% milestone and the exit stop was moved to lock in some profit at one third of the average weekly range behind the 50% milestone, at 130.60 – 2.90 = 127.70;

Then on the 26th of April, after another very strong up day, the market cleanly broke through the 100% milestone, and the exit stop was moved higher to lock in more profit at one-third of the average weekly range below the 75% milestone at 132.75;

Continuing on in this way (see if you can, as an exercise, manage the other exit stop movements using ProfitSource in Walk Thru Mode) eventually, the 200% target of 161.00 was reached on the 28th of May for trade exit.

And to conclude this article, we will analyse the rewards. In terms of the reward to risk ratio:

Initial risk: 122.95 – 120.50 = 2.45 = 49 points (point size is 0.05)

Reward: 161.00 – 122.95 = 38.05 = 761 points

Reward to Risk Ratio = 761/49 = approximately 15.5 to 1

According to the contract specifications on the ICE website, each point of price movement changes the value of one Coffee futures contract by US$18.75. So in absolute dollar terms the risk and reward (in USD) for each contract of the trade is calculated as:

Risk = $18.75 x 49 = $918.75

Reward = $18.75 x 761 = $1,4268.75

In AUD terms this reward was approximately $18,483 at the time of taking profits.

Assuming that 5% of an account was risked at trade entry, the percentage change to the account size after closing the trade would be:

15.5 x 5% = 77.5%

Note that there are also brokers who will make this market accessible via a CFD, whereby much lower position sizes are available, lowering absolute dollar risk. In this case, the relative rewards (reward to risk ratio and the percentage growth to the account) will still of course be the same.

Work Hard, Work Smart.

Andrew Baraniak