Sequence for Success

Welcome to the May edition of the Platinum Newsletter. We are now well into the second quarter of the year, and I hope everyone is making great progress towards their trading goals. There have been some great moves across many different markets, and as always there is no shortage of topics to cover. This month I’m going to look at the idea of the ‘sequence for success’ and Bitcoin.

Recently on Lewis Howes’s School of Greatness podcast, Lewis asked businessman and author, Patrick Bet-David, “do we need to know the next five moves or just the first move?” This was referring to Patrick’s recent book and the process of achievement. Patrick responded saying “this came about after years of people asking me what the secret to success was. The difference I see in people that take things to the highest level, was their ability to do things in the right sequence”.

I hadn’t heard someone put it that simply before, and it made me think about my own sequence of approaching tasks and how I structure my day. The more I looked the more I found opportunities to improve, starting with my daily routine.

This process has been enjoyable and productive. For anyone that’s interested I highly recommend listening to the podcast.

Later it triggered me to reflect on a conversation I had with a friend recently. Funnily enough, he rang to ask about Bitcoin (BTC). I managed to get in about half a sentence before he cut me off then spent the next 30 minutes giving me every reason why BTC could go to 100k very soon and that I should get on board.

So I sat down and worked out his sequence he’d taken to get to the point to buy, which went something like this:

- He watched as BTC rose to around 65k US

- Wanted to profit from such a volatile market

- Decided to invest in BTC

- Spent a month researching on YouTube

- Opened an account

- Witnessed a dip in price and bought at market.

This sequence of steps seems hardly like that of a successful investment strategy, although not uncommon. David Bowden said, “…it’s hard if you try to do it easy”.

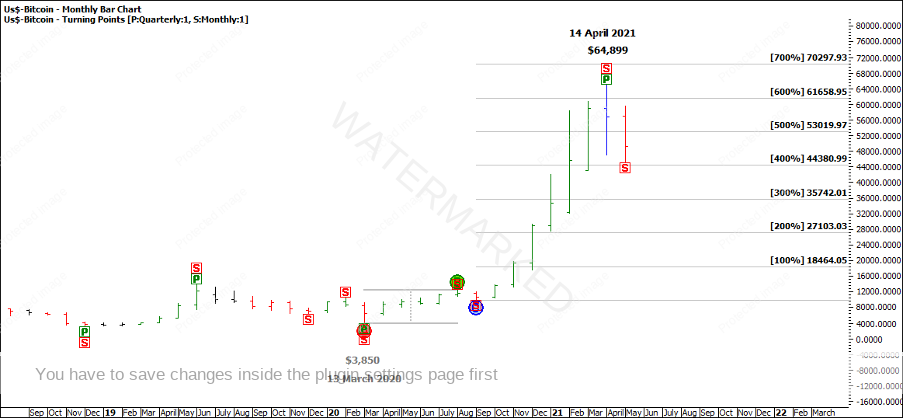

I then went through my analysis process on BTC, FXBCUS in ProfitSource. So far, BTC’s All-Time High came in on the 14th April 2021 just shy of $US65,000, coming off a March 2020 base of $3,850. That makes it a bit over 600% of the monthly ABC range or a staggering 1688% increase. This highlights the point that markets can go up a long way and may go further than you may anticipate.

Chart 1 – Bitcoin Monthly Bar Chart

As for BTC going to 100k, that is yet to be seen! Rather than basing a decision on the fear of missing out, I’d prefer to look to the swing charts. The last monthly swing to the upside can be broken down into a series of weekly swings with signs of completion at the end, and BTC has now put in the first weekly lower swing top since August last year. The question is, is this a pull back on the monthly swing before more upside, or the start of something more to the downside? Anyone with the Master Forecasting Course may like to apply David’s final lesson to get a potential road map going forward.

Chart 2 – Bitcoin Weekly Swing Overlay

These mega-high returns on crypto are starting to feel like the norm these days and must be very enticing to the new investor. However, how long can that last? What’s interesting to note is the emotion around these high levels and what is said and by who! For now, the weekly swing chart is pointing down, so I shall watch with interest as this digital currency unfolds.

Happy trading,

Gus Hingeley