Should Have, Could Have, Would Have?

2025 has delivered in ways that even I am surprised at what markets are throwing at us! Not so much that volatility has returned, but the headlines, drivers and commentary of the market is now so rich in both the amount of content that is delivered but also the speed at which it arrives.

It’s fair to say I am “saturated” with inputs and managing those inputs I am comfortable to say is challenging. Factored into this is the list of life’s other distractions due to a busy external to trading landscape I am currently navigating, so I feel like my grip on markets is not as I would like.

If I step back from the charts and the inputs, I can regroup and understand that it’s not my job as a trader to pick all turns all the time and trade them to perfection. Due to the current large moves, we feel like we should be in the right way and banking windfall profits at the same time. Can it be done? Of course, but times like this require all the ducks to be in alignment, I will expand on this later.

I wanted to address the psychology of the markets currently, at least how I see them. We are experiencing events that are unique in the sense that trade wars being created by the world’s largest economy are not regular events. The narrative of why markets are falling is just window dressing. We have likely all seen markets move in similar ways before; the catalyst is nearly always different, but the movement in price and time can be measured and understood.

The leap of faith requires us to have belief in our analysis and hold to our trading rules (to keep us safe) when we are wrong. This is built on the case of having done the work on our markets prior to these events occurring, so we can be in balance when they happen. In my own hindsight I should have extended my stay in NZ when on a break in March to include a few weeks in a log cabin with no distractions! This would have enabled a more singular focus on markets, but that now falls into the “should have, could have, would have” bucket.

I also wanted to remind you that often the big moves are made whilst we are already set in a position. The “Liberation Day” tariff sell offs were part of what was already a bearish market. Trying to catch the big gaps often means being set within the position already, as opposed to chasing them on the run.

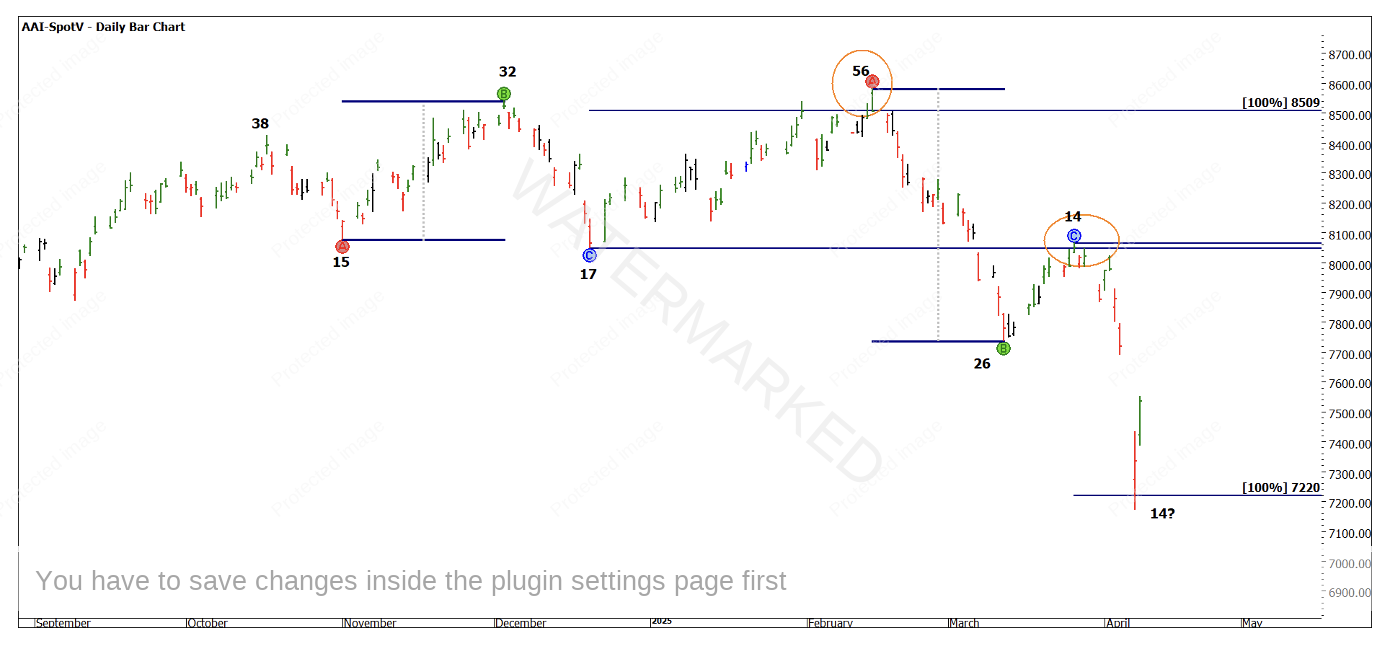

Chart 1 show our local SPI200, and we know from the good work of Gus and Darren in ATP Coaching that the high in February has strong priced-based reasons for a top. The lower top on the 26th of March was a second place to look to be short, but both these turns were well before the announcements by the US administration.

Chart 1 – SPI200 Daily Bar Chart

I recall the same subtle hints around the GFC, the Covid moves and even prior to the September 11 terrorist attacks, markets were all set for downside moves before the headlines and “media described catalysts” were presented.

So, what does this all mean? Well, we must now set ourselves to doing our detailed analysis and to wait for what will be the next major turning point. We must have an opinion about what is potentially next so we can be ready for that possible outcome.

I must confess, with the number of markets we are focusing on in the Ultimate Gann Course Coaching program, it is challenging to feel in touch with them all, but I am committed to working through that process and for me it’s also a time of dedicated research for the next big thing. That could be someway off yet, but the work will be worth it so I can be “match fit” when the time comes.

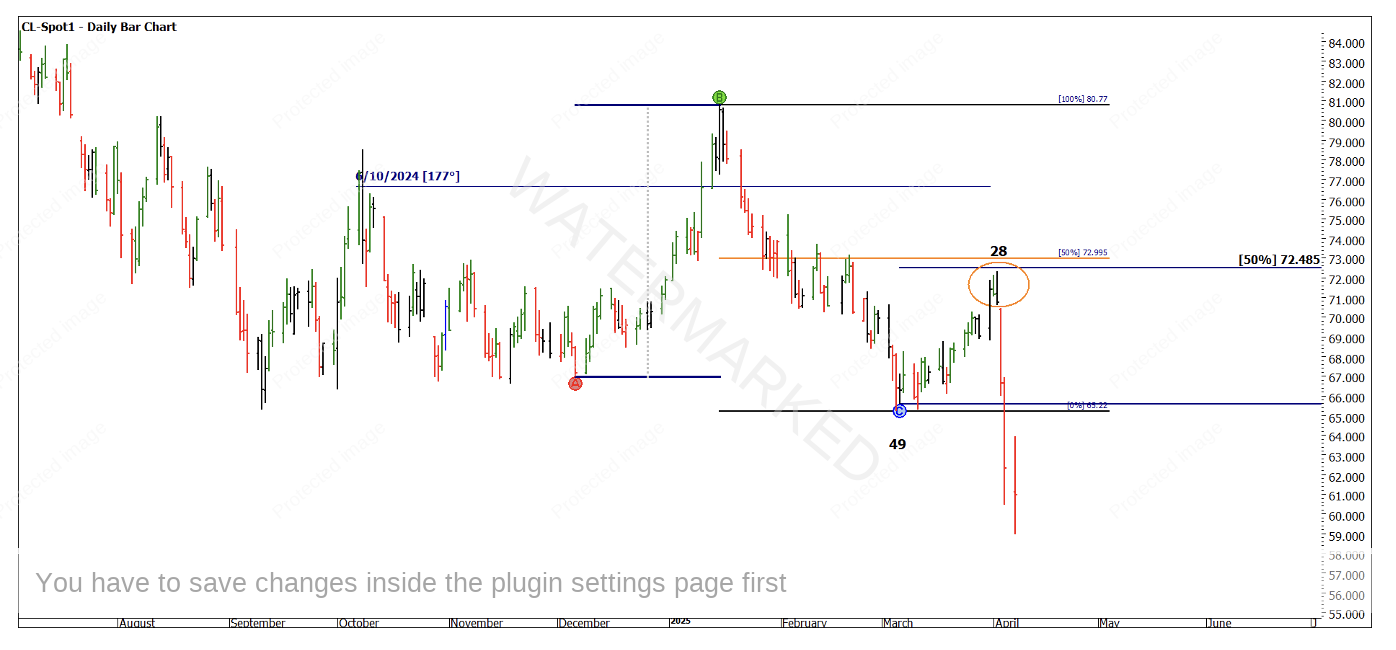

For those looking for a challenge, to make your hindsight foresight, the Crude Oil market provides a seasonal trade from March into early April most years. You should research that in the first instance. I was comfortable to be in that position and bank some profit, what I should have done instead of closing the long position was to stop and reverse my position out of the recent top.

Should have, could have, would have?

Chart 2 – CL-Spot1 Daily Bar Chart

What advice would you give me or yourself in this situation? Now is the time to work on it, so hindsight can be foresight if used often enough.

Good Trading

Aaron Lynch