Stocks Going to Half?

Well possibly, but is that half down or half up? Perhaps both?

The whole purpose for having the Ultimate Gann Course is to take higher quality trades. It gives you the ability to layer on extra techniques on top of a strong Price Forecasting base to add a few extra strings to your bow! Techniques like Position of the Market, Form Reading, Time Trend Analysis, Time by Degrees, Squares and Squaring Time and Price can work incredibly well when combined with price work. Seems like a lot? Not really if you keep it simple.

Straight out of page 106 of the Smarter Starter Pack, David says:

“I want to teach you to rate the strength of any potential trade you are considering…”

“Always calculate the mid-point of a range”….. “A 50% retracement …. shows a ‘balanced’ market”…. “you certainly still consider this a high quality trade”

Well, fortunately, this month there are plenty of markets trading below or around their 50% retracements that could certainly be considered as high-quality trades.

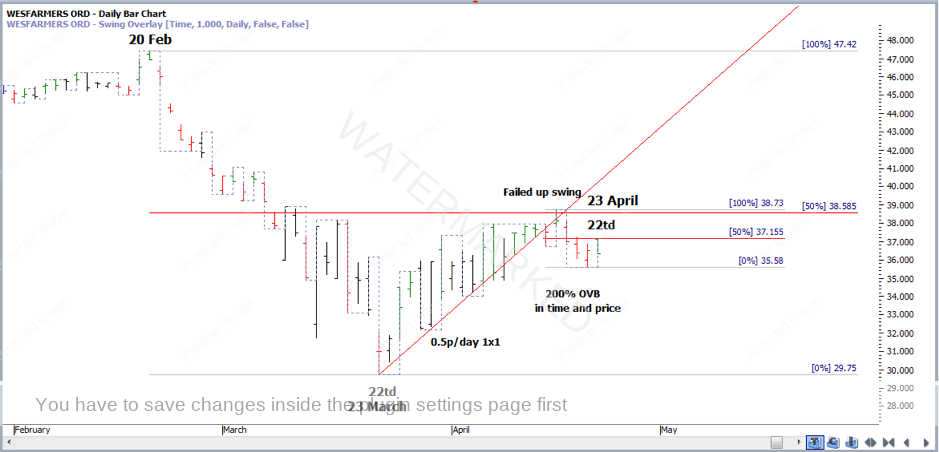

A friend of mine loves the stock Wesfarmers, (ASX code: WES) and has been very eager to buy since the ‘mild’ sell-offs, so it’s been one I’ve been watching for a while out of interest.

Chart 1 below shows a sprinkling of all the techniques I mentioned above to help identify a Classic Gann Setup on Wesfarmers. I’ve been telling my friend “if Wesfarmers is hovering near the $38 mark around the 21st to 24th of April, it is looking pretty weak and good buying opportunities may be a long way off”.

Obviously I can’t tell him why I think that but in this article, I’ve laid out a few techniques in the chart below.

Chart 1 – Wesfarmers Daily Bar Chart

Are you able to identify everything in the chart above that makes this a good looking Time and Price Cluster?

Can you see why that particular 2×1 could be important to watch if the market gets there? What about the Square of 168 (David’s favourite square) and why this could be important to watch? Are there any 50% levels? What about time? Why do I think the 21st to the 24th April are going to be important? Well, part of the answer is actually found on Page 95 of the Smarter Starter Pack, History Repeats!

Remember the quote above about a 50% price retracement? Well, what about combining that with a 100% time retracement? If price is balanced, what is time?

I’ll be honest, as I finish writing this article the price component of this cluster has already been hit on Friday the 17th of April so the entry strategy of ‘enter as the swing chart turns down’ may have past if that top holds. However, the time component hasn’t quite balanced out yet, and Gann’s ‘safest place to sell’ entry strategy is still up for grabs (at the time of writing). Chart 2 below shows a slightly different 1×1 angle and how an extra bit of Form Reading could help your analysis.

Chart 2 – Wesfarmers Daily Bar Chart

The question is ‘is your Price Forecasting, Form Reading and Position of the Market work strong enough so you can layer on a few extra techniques to come up with a high-quality Classic Gann Setup?’

You be the judge?

Happy Trading,

Gus Hingeley