Swings and Roundabouts

Inflation and interest rates certainly seem to be the flavour of the month for the SPI200 as traders reacted negatively to the RBA’s decision on 7 June 2022 to raise the cash rate by 0.5%. The market dropped around 1.5% on the day and has gone down further since.

I want to use this recent move on the SPI200 as a case study to see whether or not techniques learnt in the Active Trader Program could have had you trading the right direction to capture these profits before any news announcements, or if this move would have caught you totally off guard.

We can’t aim to be right in the market all the time, however, you can set yourself up for success by diligently marking up your swing charts to be aware when a trading opportunity presents.

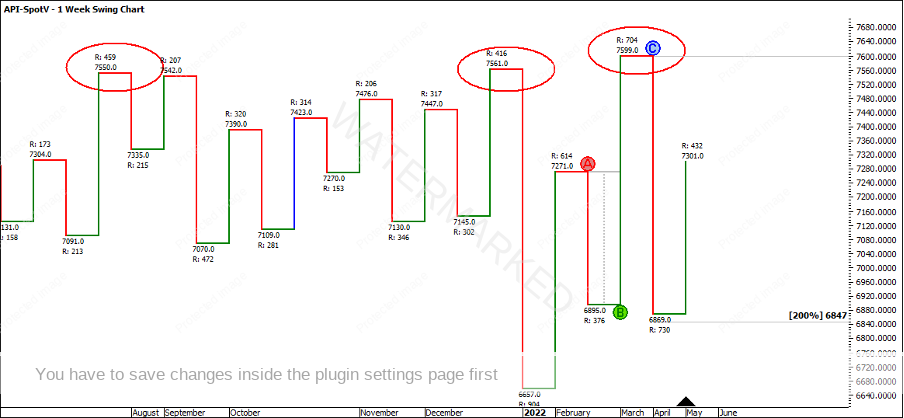

Starting with the weekly swing chart, the SPI200 has put in a weekly First Range Out of 730 points after triple tops in January this year. See Chart 1 below.

Chart 1 – SPI200 Weekly Swing Chart

After a First Range Out and overbalance in price, we should be on high alert for a contracting swing range up, then the re-test.

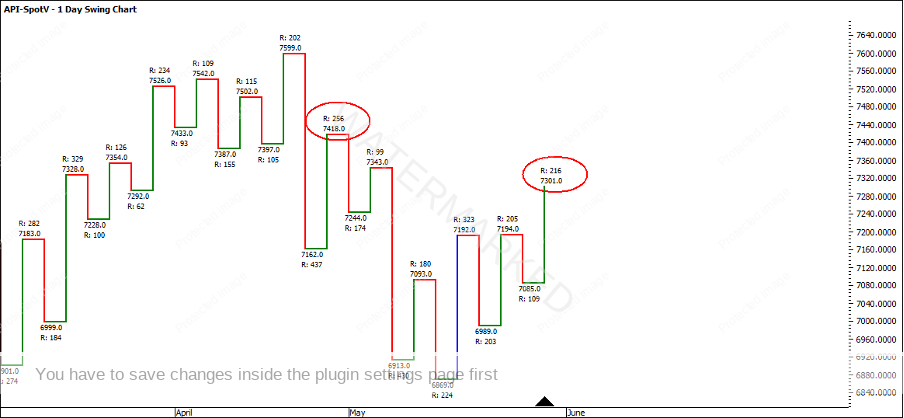

If our Wheels within Wheels methodology says ‘a swing on any time frame can be broken down into a series of smaller swings on the next time frame down’, then we must look at the daily swing ranges to call the end of this weekly swing.

Looking at Chart 2 below, you can see this weekly swing comprises of three daily swing ranges up, with the current daily swing just slightly expanding by 11 points, but very close to a repeating range.

Chart 2 – Daily Swing Chart

However, there was one key part to this cluster that was possible to have been identified in advance, as soon as the weekly swing low was confirmed. This was called by a Ranges Resistance Card. Anyone with the Active Trader Program Online Training can access this section and find the above lesson if you are unsure how this technique works. I’ve left you a clue in Chart 2 above!

As for the rest of this cluster, I’ve left some work for you to do. Can you fill in the blanks below?

- ……………………………………. = 7297 (Advanced Ranges Resistance Card)

- ……………………………………. = 7312

- ………………………………….… = 7290

- ……………………………………. = 7302

Repeating our Wheels within Wheels process, this time using a 4-hour swing chart to dissect the last daily swing, we could use this as our means of entry with 30 points of risk or less!

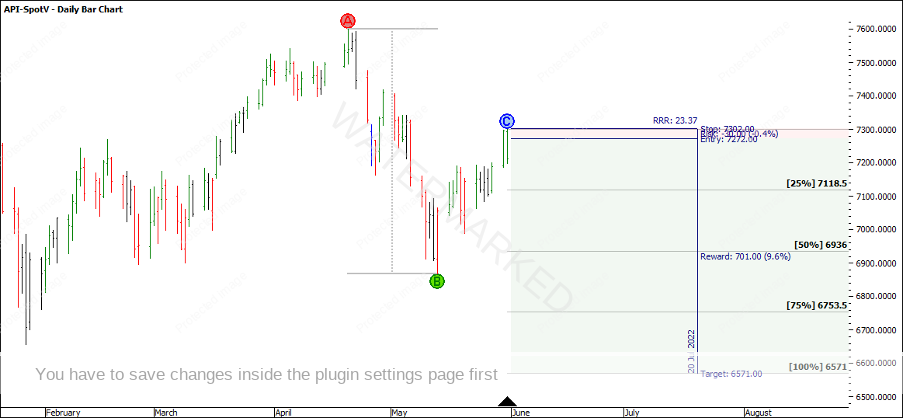

Once we believe the re-test is complete, we run our ABC milestones over the weekly swing range to look at our potential Reward to Risk Ratio. If the exit target is the 100% milestone, this provides a potential outlook for a 23:1 Reward to Risk Ratio for one entry.

Chart 3 – Reward to Risk Ratio

I think it’s worth recapping, we’ve used an intraday swing time frame as our means of entry to trade a weekly swing, and within the springtime of the move. Risking 5% of capital with a potential 23:1 RRR ahead would mean doubling your account if the 100% target is reached.

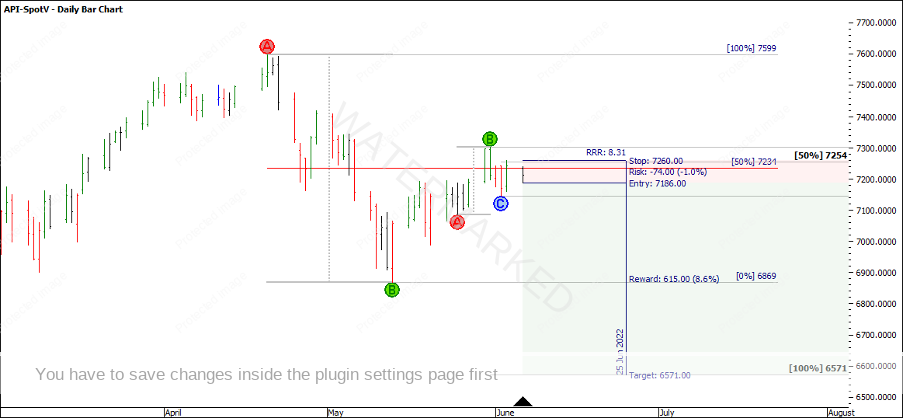

As noted earlier, the current daily swing range into the top was expanding by 11 points and if you had applied a weekly Ranges Resistance Card, you would have noticed the top above the weekly 50% retracement.

Another option could have been to wait for further confirmation in the way of a first lower swing top entry or an expanding swing range down and a contracting swing range up. When this presented, the SPI200 was now approaching from underneath the 50% retracement of the weekly swing milestone and failed at the 50% daily swing range milestone.

Chart 4 – First Lower Swing Top

At worst, an end of day entry confirming a first lower swing top still gives a trader a potential 8:1 Reward to Risk Ratio if looking to exit at the 100% milestone.

Chart 5 – Reward to Risk Ratio

There have been multiple opportunities to enter this market short, swing trading around price pressure, regardless of the news in the media.

I find the best way to see clusters in advance and be ready for potential trading opportunities is to have a set of hand drawn swing charts of all swing time frames for at least one market. You may just happen to see things you have never seen before!

Happy trading,

Gus Hingeley