The Six Logical Levels of Change

Last weekend, I attended a three-day educational webinar. This is fairly typical for me – over the past fifteen years or so, it’s rare for a year to go by without me attending seminars for a couple of weeks, and buying new books and courses, mostly related to trading but sometimes relating to other areas of interest. I love learning new things, and I’ll probably keep doing so for the rest of my life.

Anyway, at the webinar, the instructor briefly mentioned a concept called ‘The 6 Logical Levels of Change’, by Robert Dilts. As I considered these six levels from my own perspective, I thought that they would be both of interest and of use to many of our Safety in the Market students, so I thought I would share a brief overview of the lesson with you.

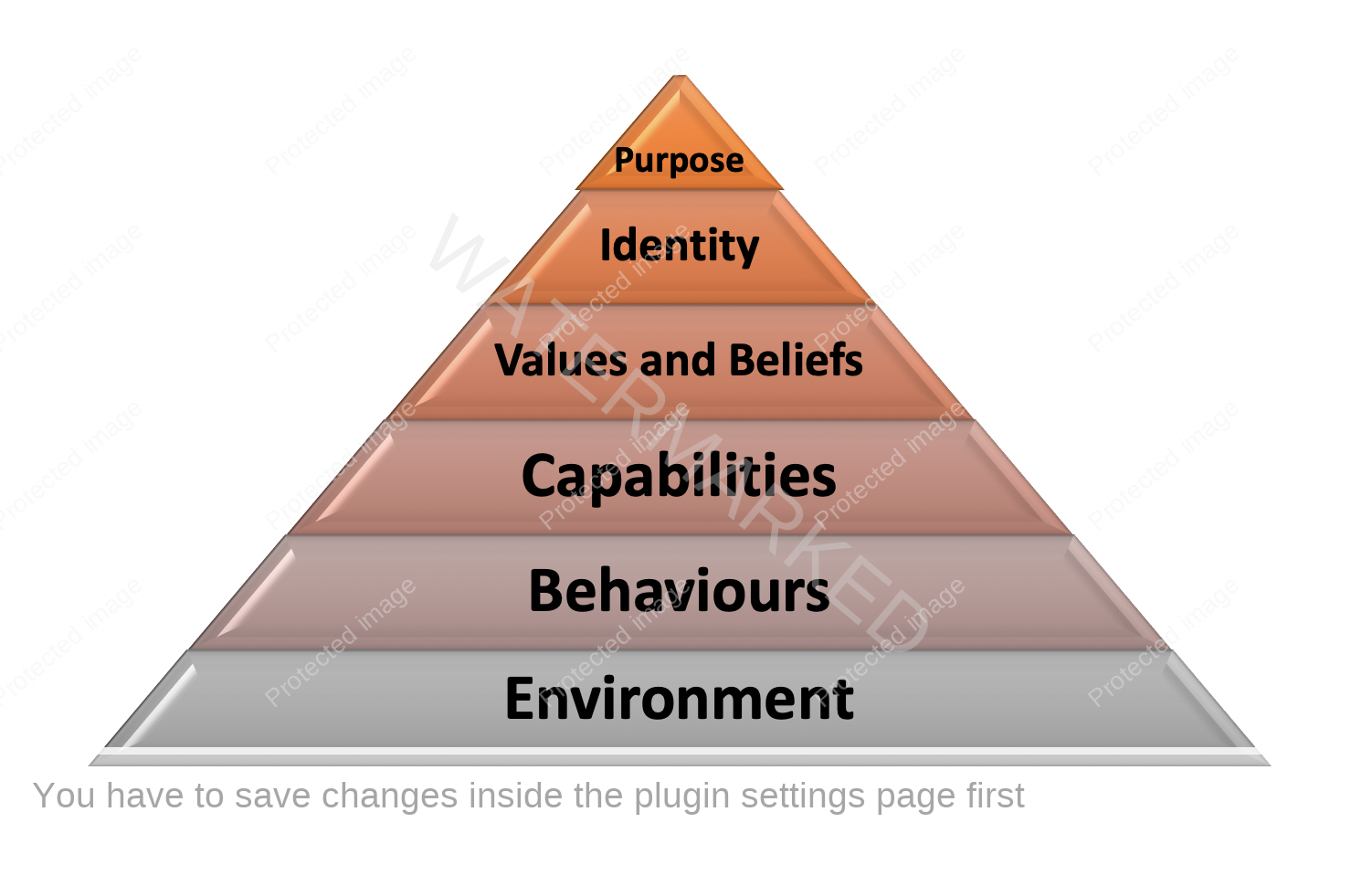

The 6 logical levels form a pyramid, and are listed as follows:

The idea is that when you are looking to create change in your life, or in your organization, or perhaps in your trading, you can consider each of the six levels listed above individually. Keep in mind that making a change in one of the higher levels of the pyramid, like purpose or identity, is going to flow down and positively influence the lower levels of the pyramid, whereas making a change at the lower levels, like environment, will still be powerful, but won’t necessarily have the same effect on the higher levels.

Let’s start from the bottom of the pyramid and work our way up.

Environment

How does your environment currently affect your trading? Do you have a dedicated trading space, such as an office, a desk, or even just a chair and a laptop? Is that space organized or is it cluttered?

What other influences are surrounding you while you are trading or studying? Is there a tv on in the background? Are there people making lots of noise? Or, are you reading newspapers or online articles, or watching Youtube videos, and perhaps bombarding your brain with too many messages, causing confusion?

Is there anything that you can change about your environment that could potentially lead to a positive change or improvement in your trading?

Behaviours

What are some things that you do (or don’t do) that currently affect your trading? Do you have a consistent trading routine? Do you follow it?

Do you check your markets every day? Do you have a system in place for keeping track of future Price Clusters or Time Pressure Dates so that you don’t miss them when they eventuate?

Do you set aside dedicated study time each week, to learn new skills and practice and perfect your existing skills? Do you attend courses and seminars, read newsletters, or even just revisit your existing Safety in the Market course materials?

Do you spend time watching television or browsing social media? While these things are neither good nor bad, and an argument can be made that they are great for providing downtime and relaxation, it is also worth considering whether some of that time could be better spent researching the markets or becoming a better trader.

I know that when I purchased my Ultimate Gann Course in 2005, I gave away my Playstation 2 because I found myself spending too many hours playing video games.

What behaviours are you undertaking (or not undertaking) that have the potential to improve your trading?

Capabilities

What skills and abilities do you have when it comes to trading? For example, thanks to David Bowden’s courses, we are ALL capable of putting together Price Forecasts on markets, and of determining pressure dates and times to watch in the market.

Do you take time to refine those skills, by practising the techniques and backtesting them on markets? Do you take time to learn new skills and new capabilities? Do you seek out new or improved knowledge when it becomes available? What price do you place on education and on your capabilities?

Values and Beliefs

I could run a very long seminar just on ‘values and beliefs’ but for now, I will encourage you to ask yourself these questions:

(i) What do I believe about trading, and does that belief serve me?

For example, you may believe that “trading is hard”. This may cause you to get overwhelmed or disillusioned, making it hard to motivate yourself to study. Or, you may believe that “trading is easy”, which may make you lazy in your work, and stop you from keeping your charts and analysis up to date.

If the belief is positive for your trading, keep it. If it does not serve your trading, consider discarding it or changing it to a more empowering belief.

(ii) What do I value in life? Which things do I value more than others?

Many years ago, I saw financial planner and author Suze Orman on television, sign off on her show by saying “People first, then money, then things”. In other words, she was stating what she values, in the order that she values it. If she valued money first and people last, do you think she would have many people in her life? Conversely, if she valued people first and money last, do you think she would have much money in her life?

Again, this is a complex area that we could discuss a lot further.

Identity

Who do you imagine yourself to be? In 2003, I was working for minimum wage in a bookstore, earning $27,000 per year, with a credit card debt that was higher than my annual salary. However, I always saw myself as a person who was bound to be successful. I wanted to have money, I wanted to be financially free, and I saw myself as a benevolent philanthropist, who made money and donated it to worthy causes.

Can you see how this ‘identity’, one of the higher levels on the pyramid, influenced the lower levels on the pyramid? It made me realize that I DID value money, and it inspired me to increase my capabilities so that I could make money, which is why I made the decision to buy my Ultimate Gann Course. My desire to improve my capabilities then influenced my behaviours (I gave away my Playstation 2 because making money was more important than having fun playing video games), and also made me optimize my environment to assist me in my trading journey.

Purpose

The top level of the pyramid is a purpose. For many, this purpose is a spiritual purpose, however, it can be anything that you want it to be. Your purpose for trading may be to become a Billionaire Philanthropist, or it may simply be to elevate your family out of inter-generational poverty. It could be to make money for your favourite charitable cause, or your purpose could simply be ‘financial freedom’.

One of my favourite sayings is that ‘when the WHY becomes big enough, the HOW takes care of itself’. Ask yourself, “why do I trade?” What is the purpose of all the work that you do? It’s not just about money – it’s about what that money can do for your life or bring into your life.

Take some time to reflect on your purpose for trading, and to remember why you got into trading in the first place.

As you can imagine, we could spend many days discussing and working on each of these levels. However, even if you just made a single change based on this lesson, you will see improvement in your trading. My suggestion is that you brainstorm some ideas for each of these six levels and think about ways that you could use each level to improve your trading. When you have finished brainstorming, circle the three answers that you have listed that you believe would have the biggest positive impact on your trading, and then just focus on those three things alone.