The Value Of History – BHP

The world of commodities and their relative stocks were highlighted during boom times and as with most news headlines, when new noise presents itself the headlines follow. The story of BHP is iconic in terms of Australian business, its history as a company and its trading story on the markets lends itself to be a great market to study and trade. This of course is evident with the Smarter Starter Pack trading exercises focused in part on this stock.

BHP rises and falls like all companies now at the whim of global markets, BHP is not just an Aussie company serving the domestic market, it provides multiple commodities to the globe from sites located all over the world. Given it has a great deal of history, this makes it a great market to dig deeper into (pardon the pun) to understand all of Gann and David’s methods.

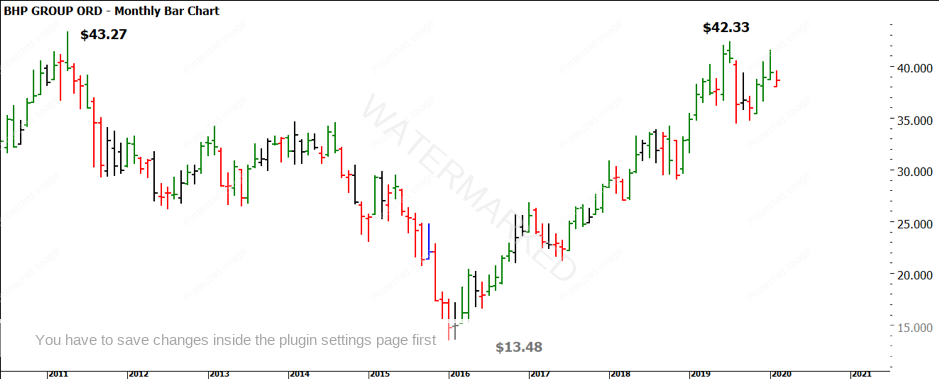

If we look at Chart 1, we see the price action since 2011, from highs of $43.27 down to the 2016 low of $13.48. We see that we need to be willing to trade both long and short based on the market’s signals. Again, our great advantage over buy and hold is the ability to be out of markets or trade the “other” way as conditions dictate. The move from 2016 to July 2019 yielded a range of over $28. David said he would be happy to take 50% of the major move, so plenty of reward for long opportunities in this period.

Chart 1 – Monthly Bar Chart BHP

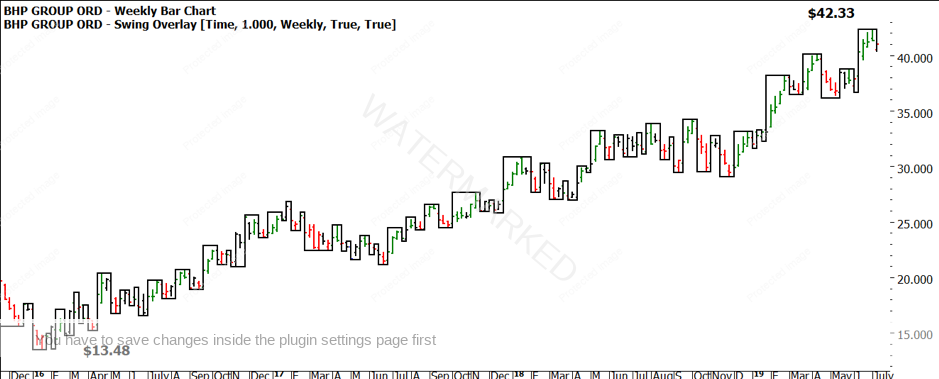

The trend during this period was clearly up, in Chart 2 there are 38 swing bottoms on the weekly chart. Over the same period there were only 11 lower swing bottoms and a basic price filter would have eliminated some false breaks during that time.

Chart 2 – Weekly Bar Chart /Swing Overlay BHP

One of our tasks is to break down the sections of the market in the current move. This is one of the more challenging aspects of analysis as the markets are always changing, hence it can be difficult to assign sections per Gann’s rule of typically 3 to 4 sections.

Chart 3 – Weekly Bar Chart BHP

The good news in terms of the current picture, is that the sections we see are closely aligned in terms of price moves. This makes them easier to identify, but the next question we must resolve regards the current top. Is the major top in at three sections or is a fourth section underway?

The price action at $42.33 does signal we are at major resistance with the previous highs around this level. That being said the flipside holds true as well, if we can break this resistance from a technical perspective the market could rally higher. Here is where the Lows Resistance Card becomes helpful in setting price levels, also combining that with pressure point theory. These are the lessons David prepared you for in the Smarter Starter Pack and the Number One Trading Plan, so if you have not completed those exercise (by hand on charting paper) now is a great time to tie in the lessons.

Chart 4 – Monthly Bar Chart BHP

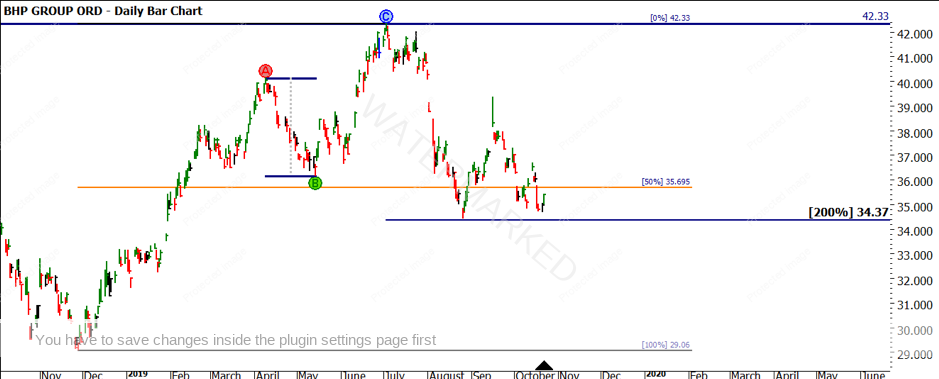

Let’s now jump into the small picture and analyse the reactions of the $42.33 high. The move from December 18 to July 19 was followed by a strong reaction to the downside. This was 50% of the last section (Ranges Resistance Card, 50% level in Orange) and 200% of the last major down swing (marked A to B). Typically, I would like to see reactions of major tops to break down harder as they pass through 50%. Gann said the 50% rule was on its own enough to make a fortune.

Chart 5 – Daily Bar Chart BHP

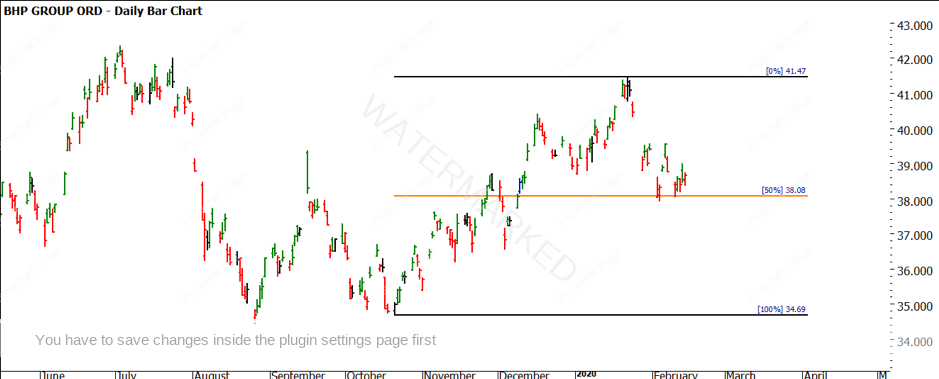

If we were to see the beginning of a sustained bear market, we would likely expect two sections of the market forming under the $38.08 level. As we see in Chart 6, BHP regained most of the losses into January 2020 followed by another retracement into the 50% level where we now see support. The question the market faces is where to next? It has established some clear upside and downside levels to watch and now we must exhibit the patience needed in markets as well as an established trading plan with rules.

Chart 6 – Daily Bar Chart BHP

We must be content to accept that BHP could travel sideways for a period before it retests support and resistance. We can look to clues from other markets, as BHP is listed on other exchanges that allows us to see the opinion of other traders around the globe.

Good Trading,

Aaron Lynch