The Year That Was…

For the final time this year we can connect via this newsletter and discuss the markets and their mysteries. As I approach 25 years in and around the markets there is always some reflection at this time of year in terms of the road travelled, the scorecard of outcomes and a glance to the future and what may come next.

Many times, I have discussed the value in reviewing your trading diary and trades taken (or not) as a reflection on the period that has passed. There is much to be gained by reviewing your own history and your “state of mind” when making trading decisions, as often there is a measurable cycle of your own that can be overlayed on markets.

To recap 2023, it has been a year of trends (both directions) and if I look back over the footprints there would be too many trading opportunities rather than not enough. This I see as a good thing as it means the industry of markets and the reason we participate are still operating as needed. This year I took a focus to the banking sector in the US and the large companies that make up that space. I am intrigued by how they would perform in a high inflation and rising rates environment and overall, the DJUSFN index and the proxy of Morgan Stanley have given me (and hopefully you) a place to apply and hone the craft of trading markets.

Chart 1 shows how the DJUSFN has crept back above the 50% level that acted in places as resistance over the last two years. The pattern suggests that any price break has been followed by a sell off. It would be wise to watch this level for any support in the event of a downturn and with the potential for a Christmas rally at this time of year it could be a good signal of what 2024 looks like.

We might also overlay the principle of Gann’s work here, he often mentioned that the fourth time a market reaches a level it usually goes through. The August, February and July tops loom as an example of that theory playing out.

Chart 1 – Daily Bar Chart DJUSFN

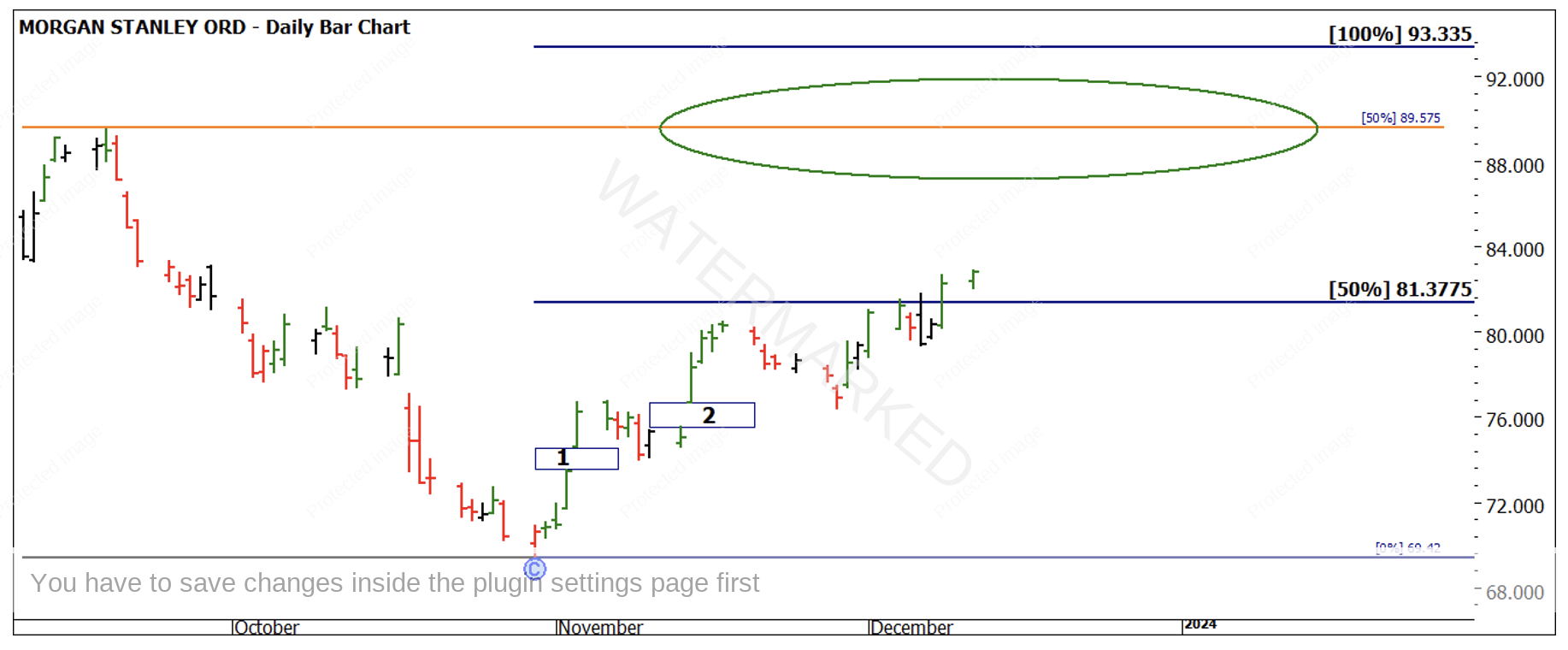

If we move to the price action of Morgan Stanley in Chart 2, we can see that it has underperformed relative to the index as it still trades well below the 50% of the most recent range and for context, I have added its movement relative the last decent bullish run that commenced in October of last year. We are hovering at the 50% level for that range.

Chart 2 – Daily Bar Chart MS.NYSE

We could also add over this the market index of the S&P500 for greater context of a stock within a sector within a global index. Chart 3 allows that comparison, and we can see that the 50% level on the S&P 500 is well in the rear-view mirror so Morgan Stanley is lagging both in it’s sector and the broader market in terms of returns. The 50% level confirmed the ‘old tops become new bottoms’ view-point when it comes to support and resistance, and we should always watch for confirmation around these levels.

Chart 3 – Daily Bar Chart SPX

If we zoom in and look at points 1 and 2 on Chart 4, it shows that the price action has failed to close the gaps on the downside. Each time the price action has fallen running stops behind the gaps has proved an effective strategy to hold a long position.

Chart 4 – Daily Bar Chart MS.NYSE

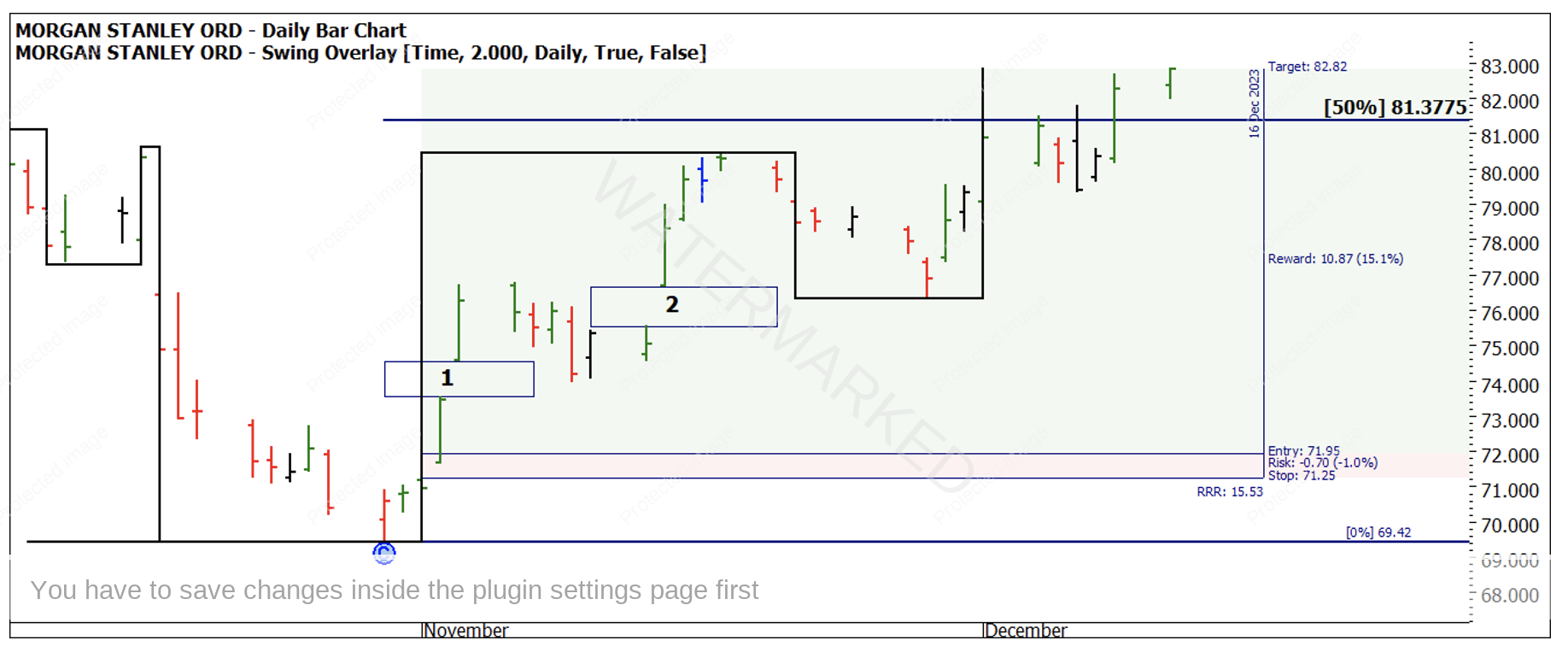

If we review the entry from November’s newsletter, we can see in Chart 5 a healthy Reward to Risk Ratio, that good analysis, management and patience has allowed for using the close price of 11th December 2023.

Chart 5 – Daily Bar Chart MS.NYSE

A repeat of the current weekly upswing would suggest a price of $87.35 and at this time of year we could expect that to stretch somewhat as volumes and liquidity start to reduce as we get closer to Christmas. If that price was achievable in this move, then we could suggest a good campaign was achieved in this move.

I wonder if there has been any research undertaken on my bonus chart included in last month’s article. If we utilise the rhythm of time to understand what could be on the horizon we can unlock around 1st January 2024 as an area to contemplate. For those who had read Gann’s work on the seasonal aspect of the New Year’s period we may have some price and time targets we can align.

I would like to wish you all a Happy Christmas and safe, healthy, and happy 2024.

Good Trading

Aaron Lynch