Times to Trade

Time by Degrees gives you the ability to watch certain times of the month to trade, so you don’t have to be watching the markets every day waiting for a setup, if that’s not your style.

In last month’s article we identified 16 June and 22 June as areas to watch as the strong Time by Degree dates.

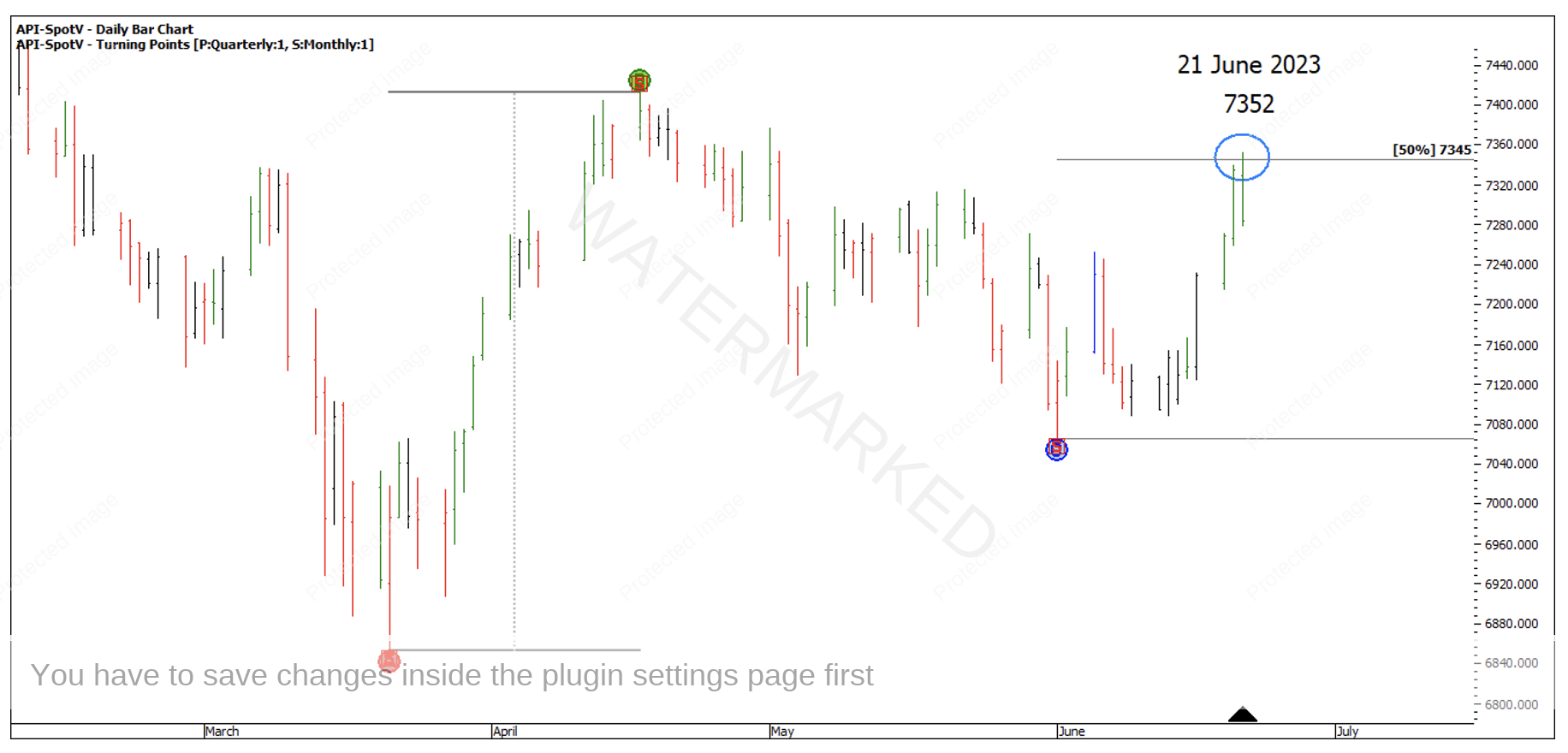

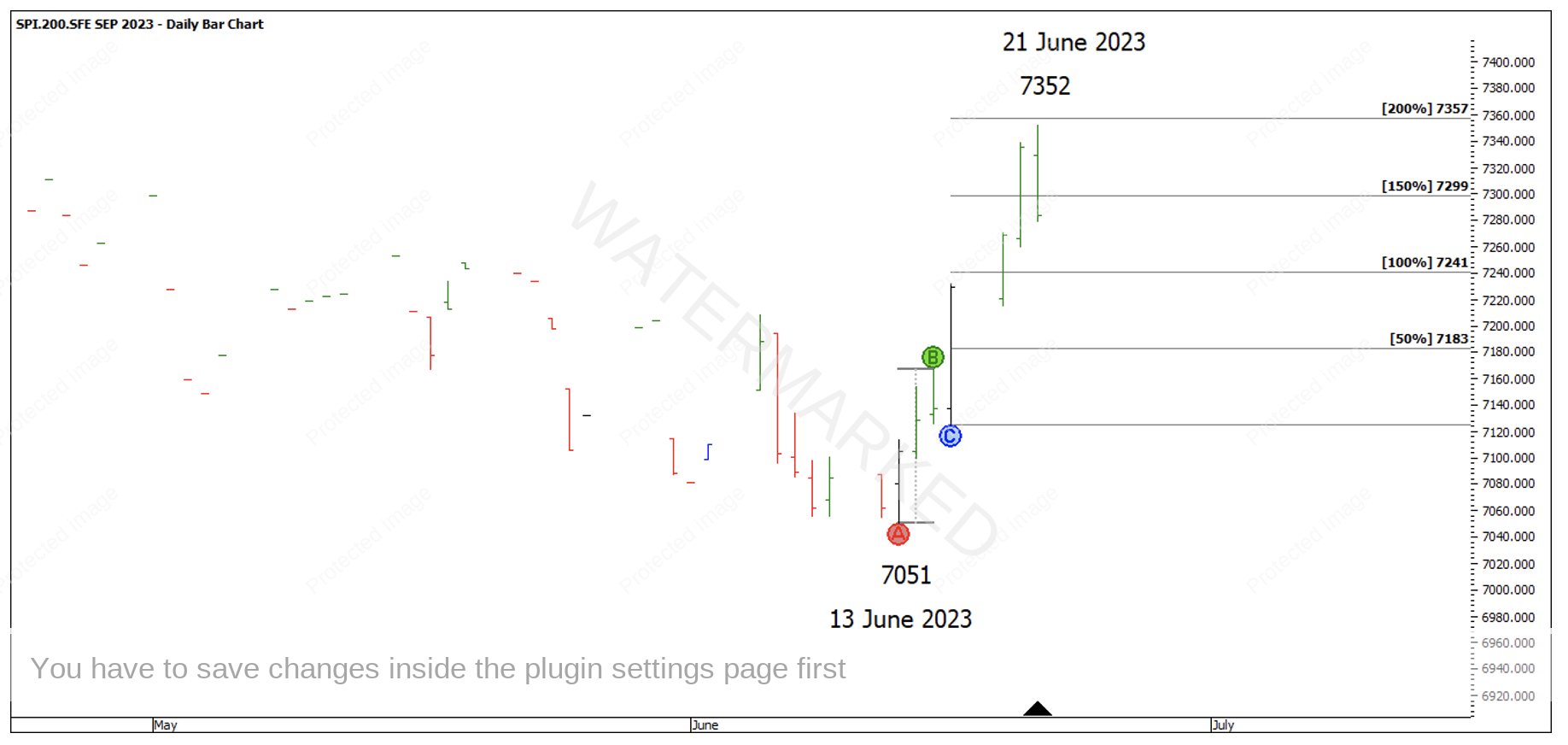

16 June was a ‘nothing date’ in terms of a strong setup however, there was a weekly top on 21 June at 7352. See Chart 1 below.

Chart 1 – 21 June 2023 Weekly Top

Using Walk Thru Mode we can go back to how the market looked at the time and apply our ABC Pressure Points tool.

The monthly swing at the time is displayed in Chart 2 below. Even though the monthly swing hadn’t turned up, you can still use this range in anticipation. There was a 50% milestone at 7345.

Chart 2 – Monthly ABC Pressure Points

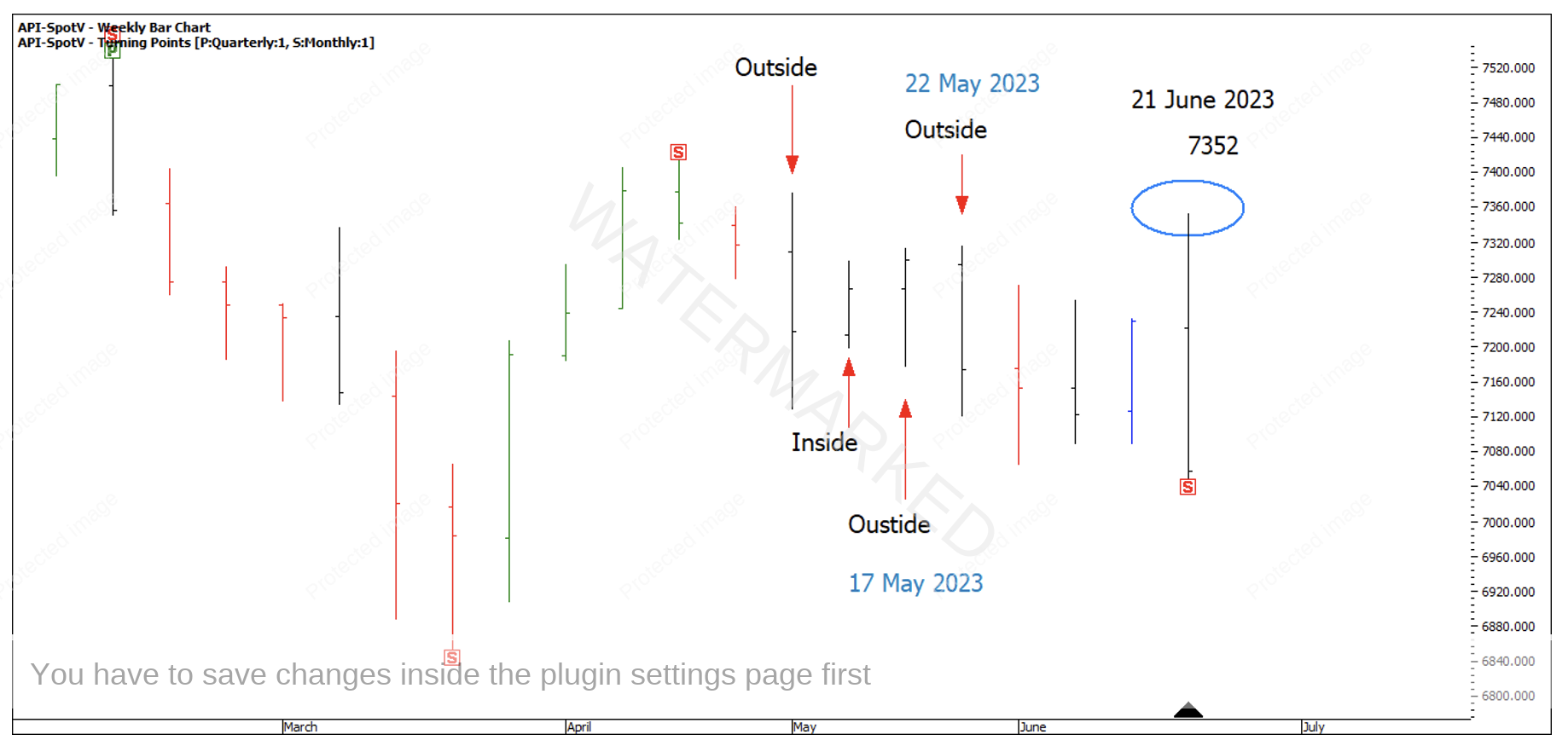

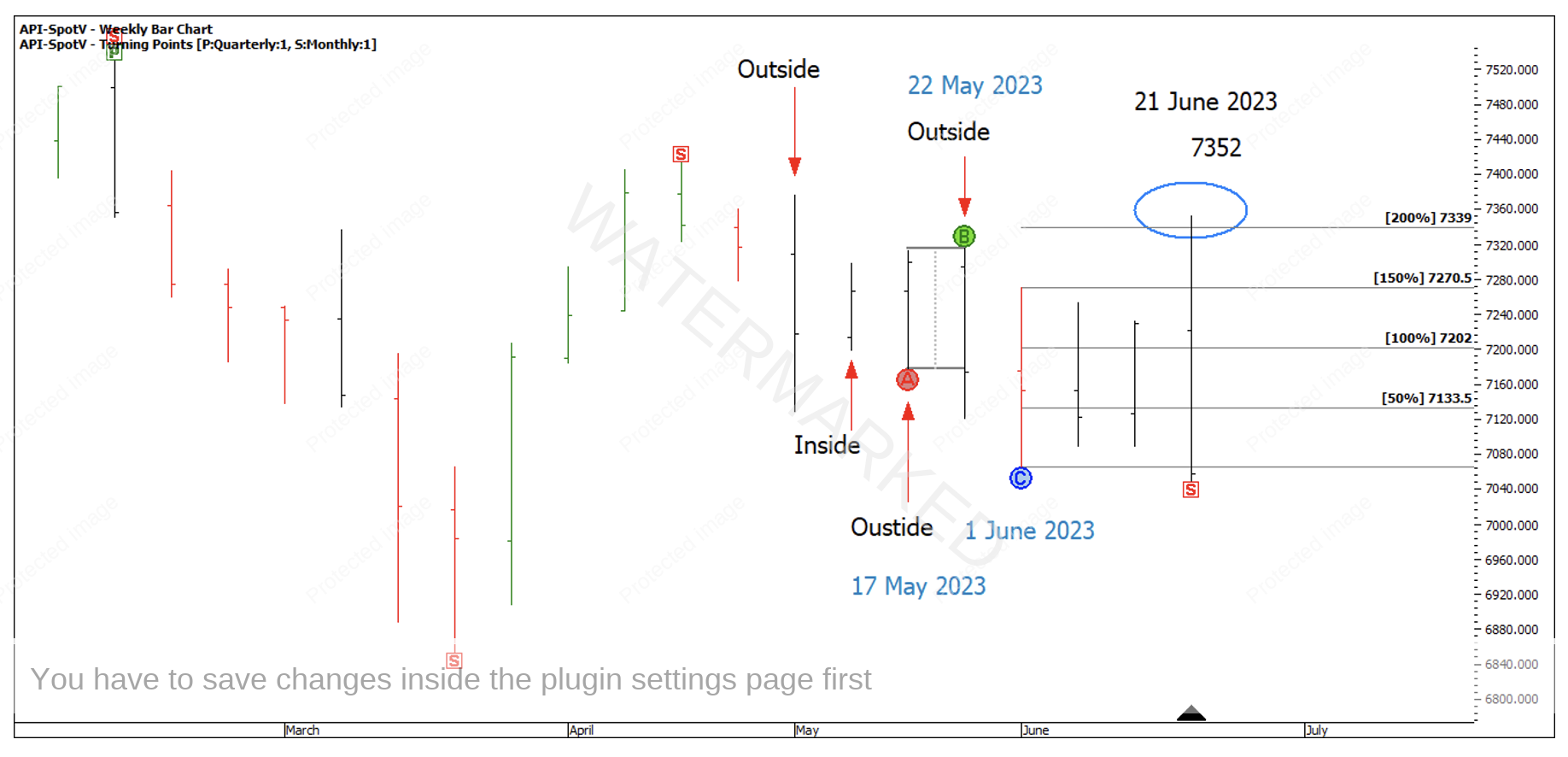

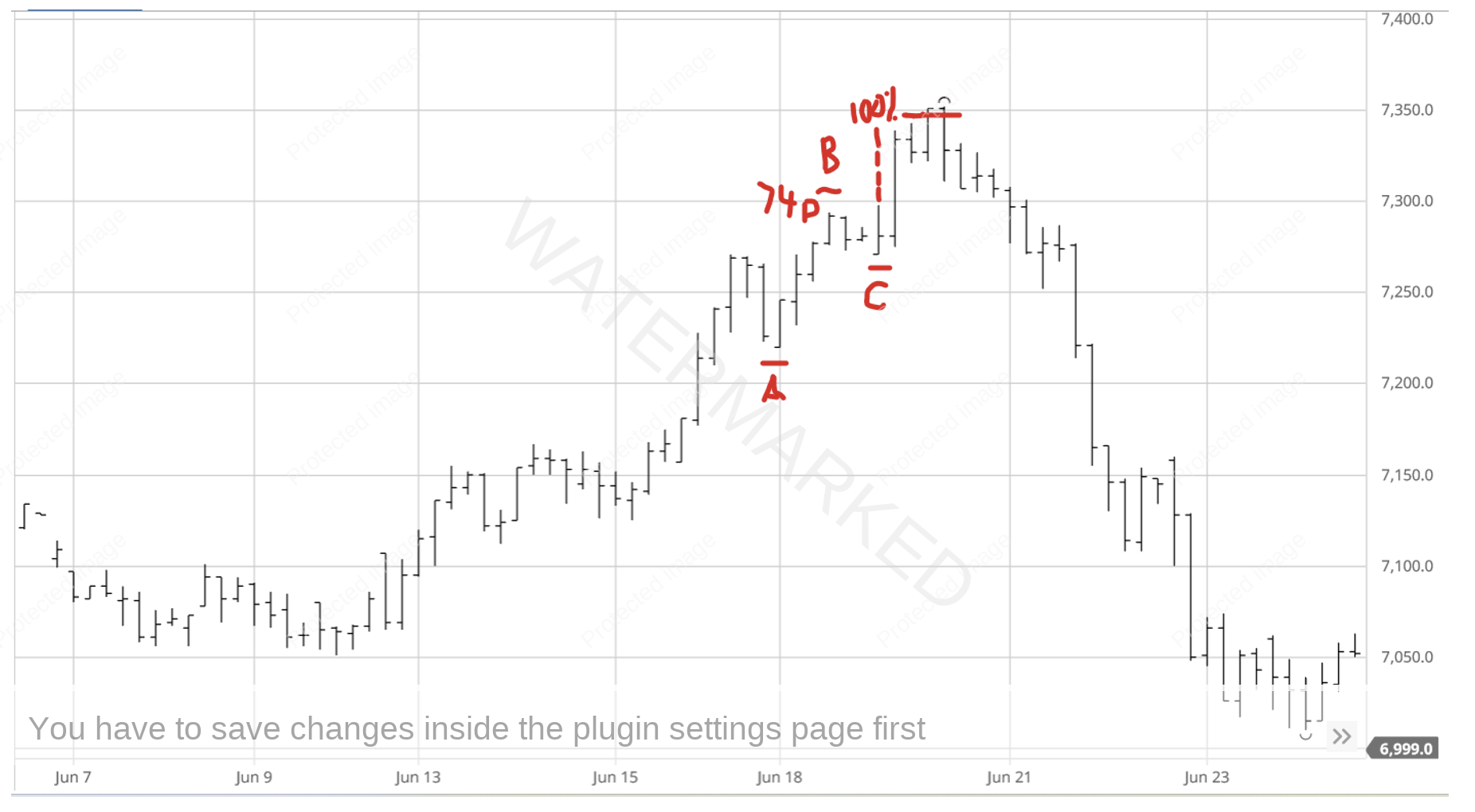

Dropping down to the weekly swing, this is best shown on a weekly bar chart as there was a series of weekly inside and outside bars that made swing charting that little bit more difficult.

Chart 3 – Weekly Bar Chart

The issue is, how do you draw your swing chart and apply your milestone tool to measure the correct ranges? I see there was a low on 17 May followed by a high on 22 May which I can use as my weekly reference range to run my weekly ABC milestones. You can verify this for yourself by looking at the daily bar chart.

I can then run Point C from the 1 June 2023 low and the 200% of the last weekly swing range gives 7339.

Chart 4 – Weekly Swing Milestones

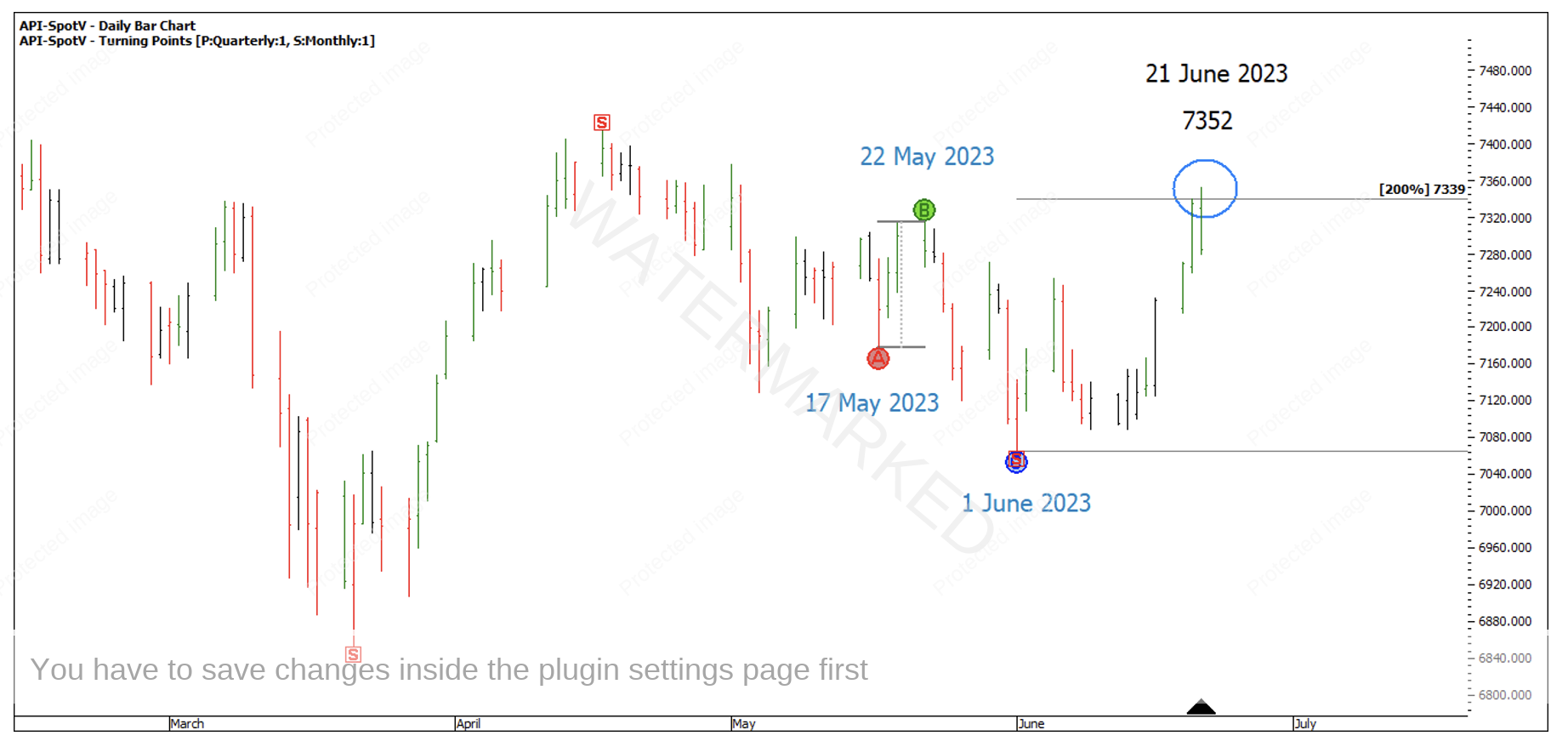

Looking at that on the daily bar chart is a little bit clearer.

Chart 5 – Weekly Swing Milestones

So far, we have two solid Price Forecasting milestones giving a good base for a cluster.

- 50% of the monthly swing = 7345

- 200% of the weekly swing = 7339

However, finding a daily swing milestone to add to the cluster may have been hard! One reason for this is because the SPI had a contract roll over from the June contract to the September contract on 14 June.

Chart 6 – Contract Roll Over

13 June 2023 on the June Contract had a low of 7089 whereas 13 June on the September contract had a low of 7051 as it was trading at a ‘discount’ to the June contract. This affects our ABC ranges projection!

If you look at the September Contract (API-2023.U in ProfitSource) and run the ABC milestones over the last daily swing, you see the 200% milestone gets a lot closer to the cluster at 7357, within 5 points of the top.

Chart 7 – September Contract

Even though the market fell short of the 200% milestone, we can break down this last daily swing into smaller ranges. Looking at the 4-hour swing chart, 100% of the last 4 hour swing of 74 points gave us a price target of 7345.

Chart 8 – 4 Hour Bar Chart

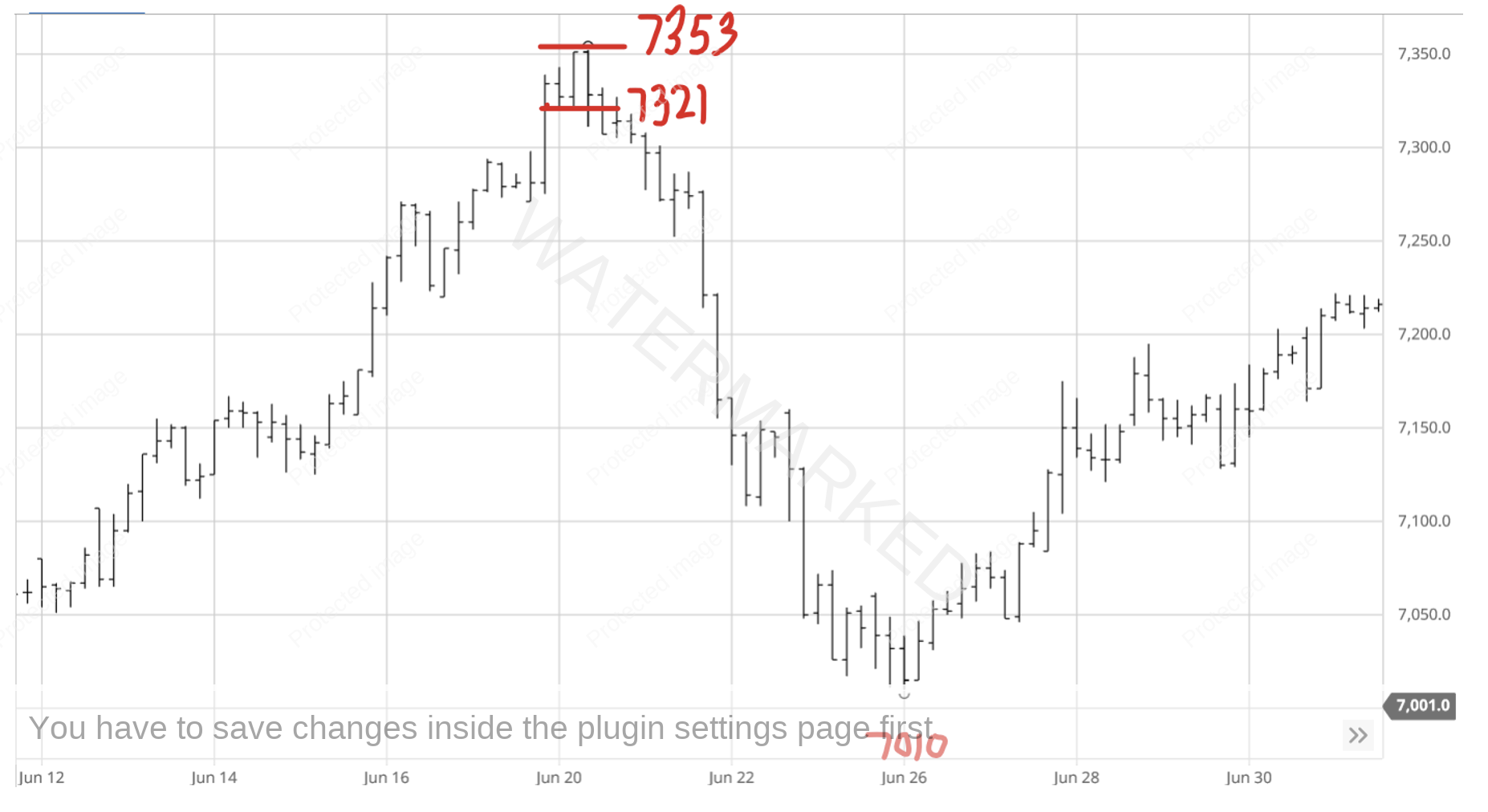

If you had entered into this trade as the 4-hour swing chart turned down, you could have entered at 7321 with a stop at 7353 which equals a 32-point risk for this trade.

Chart 9 – 4 Hour Bar Chart Entry

The market fell agonisingly short of a 10 to 1 Reward to Risk Ratio trade as 320 points from 7321 = 7001. Then the SPI had a large retracement, and you would have to ask yourself would you be able to sit through such a large pull back?

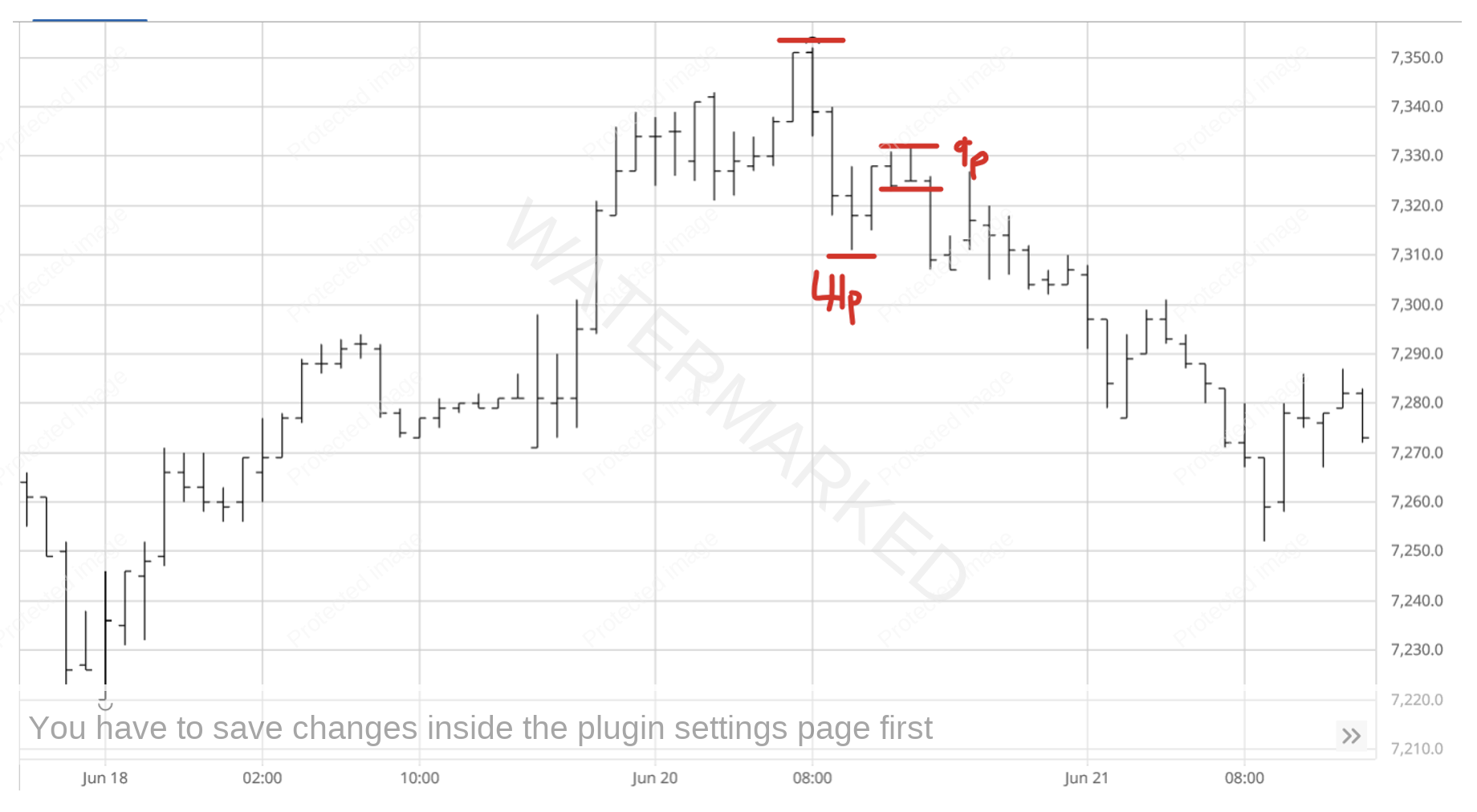

Alternatively, looking at the 1-hour bar chart, out of the top was an overbalance in price of 41 points, followed by an exact 50% retest. If you had chosen to enter as the 1-hour swing turned back down at 7324 it’s possible to have a risk on entry of 9 points.

Chart 10 – 1 Hour Bar Chart Entry

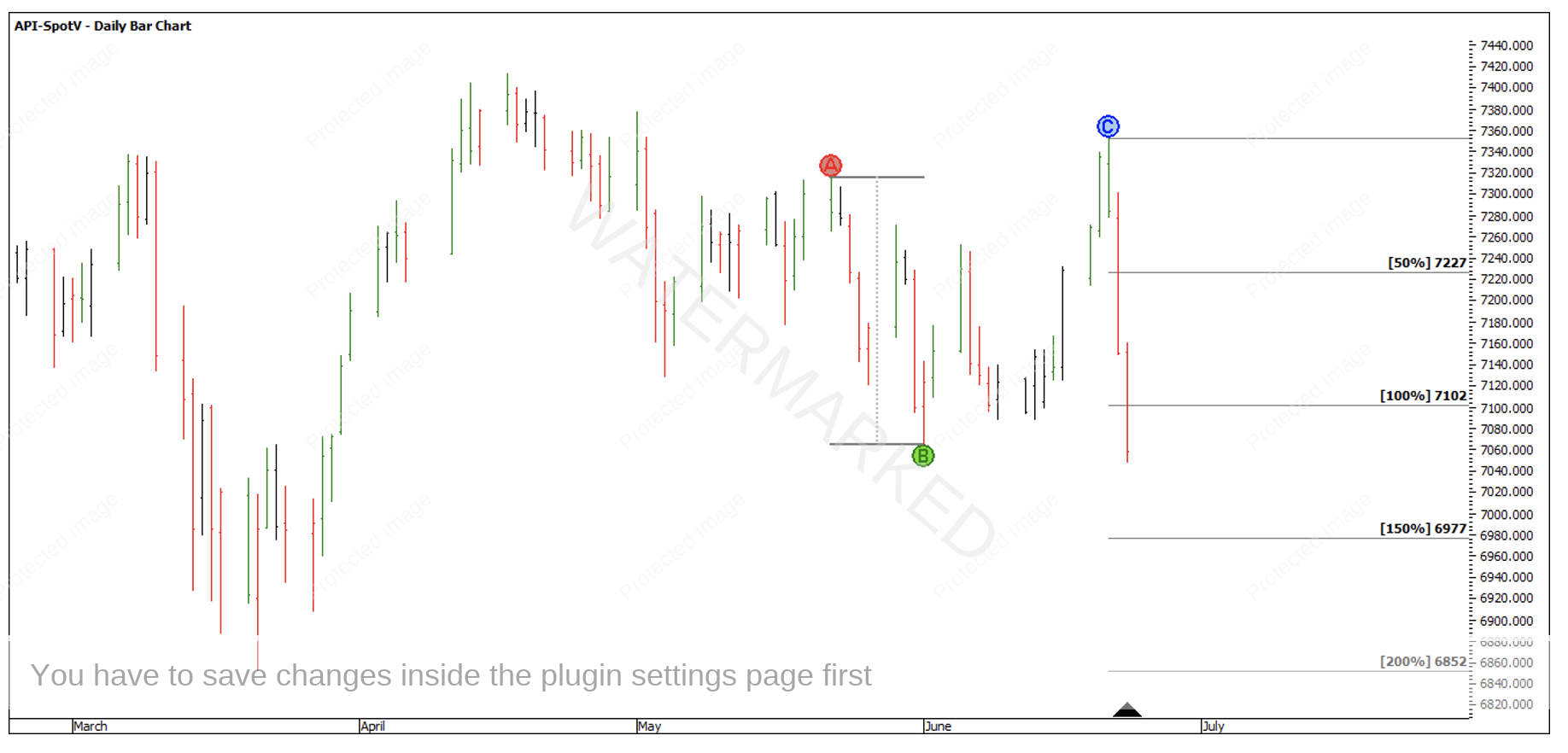

Knowing where to exit is always a lot clearer in hindsight! However, if you had used your weekly ABC milestones to manage this trade, taking profits at the 100% of the last weekly swing at 7102 would have seen you bank your profit in two trading days! An entry at 7324 and an exit at 7102 gave you a 222-point profit. Divide 222 by 9 points of risk and that trade is just over 24 to 1 Reward to Risk Ratio.

Chart 11 – Weekly Profit Target

Time by Degrees gave us a reliable time of the month to be watching for a turn. Our Price Forecasting then gave us the cluster to watch and swing charting skills gave us the entry and a high Reward to Risk Ratio trade.

Happy Trading,

Gus Hingeley