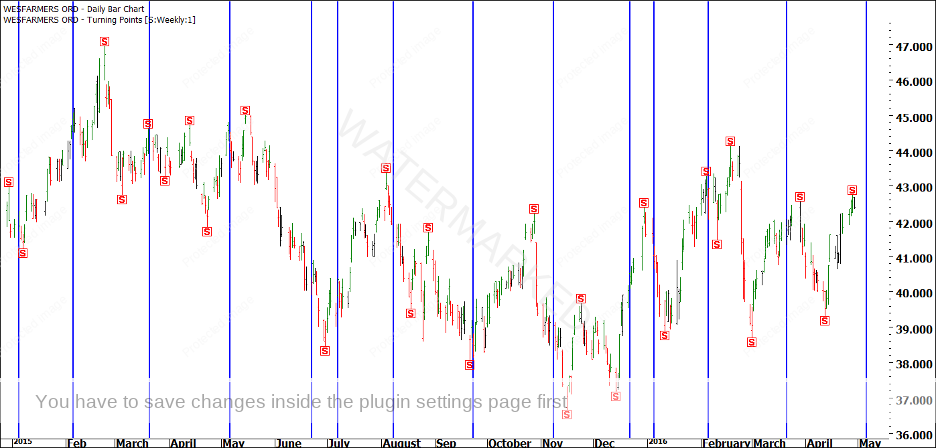

First, here is a chart with the Seasonal Dates marked on it with blue, vertical lines:

Now, let’s go through each Seasonal Date individually and objectively.

5 January, 2015 = we saw a weekly swing low 2 days later, on 7 January, then a run up into the yearly high.

5 February, 2015 = we saw a daily swing top and Signal Day on 6 February which only saw a short pullback.

21 March, 2015 = we saw a weekly swing top on 20 March, but it was hardly a strong trading opportunity. Remember back to our Ranges – we may have thought this was the beginning of a new section down, which highlights why we use stop losses!

6 May, 2015 = No hit. The actual top that started the second section down came in on 15 May.

22 June, 2015 = No hit.

7 July, 2015 = No hit. Keep in mind that we saw a major low on 30 June, which was the end of the second section on the Monthly chart. We will revisit that turn when we look at the January, 2016 Seasonal Date.

8 August, 2015 = a major swing top on 4 August which started a third section down on the monthly swing chart. It was both a weekly and a monthly swing top.

23 September, 2015 = a major swing low on 21 September which completed the third section down on the monthly chart. It was both a weekly and a monthly swing bottom. You can see that WES ran from a top on one Seasonal Date down to a bottom on the next Seasonal Date, a move of 45 degrees.

8 November, 2015 = no hit. The actual yearly low came in on 16 November, 2015. It was the end of the fourth section down. It was also 180 degrees after the May high. Note that both turns happened around a week after their respective Seasonal Dates.

22 December, 2015 = no hit. Notice, though, that we had a big weekly swing top (and subsequent gap down) on 30 December. Remember earlier in the year, when we had a turn on 30 June? These turns were 180 degrees apart.

5 January, 2016 = no hit.

5 February, 2016 = a weekly swing top on 4 February, although it wasn’t a particularly strong short trade.

21 March, 2016 = no hit

I am preparing these answers at the end of April, so you will need to look at the May and June Seasonal Dates yourselves.

Our work has shown that the market did indeed turn around Seasonal Dates, but there are three things to note:

- You cannot expect the market to turn exactly on the Seasonal Date, 10 times a year like clockwork. You will get exact turns at times, but they won’t all be exact.

- It is ESSENTIAL that you combine this work with your Ranges work. Ask yourself, which is easier, to get to a Seasonal Date and say “I wonder if the market is going to turn”, or to get to the end of a Price Range and then check which time of the month the market has been turning?

- The relationships between the Seasonal Dates (eg 180 degrees from the June to December Seasonal Dates) can work just as well when the turns come in late (eg 15 May to 16 November was 180 degrees). This is Time by Degrees, and was David’s preferred method of timing a market.