Trading currencies can be confusing, do you look at the FX market or the futures market? In this video, Mat takes you through choosing a currency and discusses the options you have available.

Introduction

Welcome back. In this video, I’m going to take you through a simple process for choosing some currencies to trade. When it comes to currencies, a lot of traders just put their hands up and say, this is too hard, I’m not even going to bother with these. And that’s actually the experience I’ve had as an instructor, as I’ve taught students about currencies, and it’s also the experience I had when I was a student and I first came across currencies. The funny thing with currencies is, that when you start to trade them, you realise it’s exactly like trading a stock. There’s very little difference, it’s just a concept that you have to get through your mind that it’s not actually that difficult. I remember taking my first currency trade and going from a state of currencies are too hard to – this is easy I’m going trade these, in a matter of seconds! That’s how quick it was! So please don’t just write off currencies because they seem hard. David Bowden actually said that if he was only allowed to trade one kind of market, it would be a currency because out of all the different markets, currencies tend to trend the best.

Choosing a Currency

When it comes to choosing a currency, the first thing that I would recommend is that you jump onto our YouTube channel and watch our FX Trading Series on the Safety in the Market YouTube channel, where I’ll take you through all of the nitty-gritty stuff of currencies and give you a really good solid base to start your currency trading from. It’s all free it’s just sitting there on our Safety in the Market YouTube channel. Jump on and have a look at it and then when you’re ready, start by picking out two to three currency pairs, preferably sticking with the major pairs and I’ll explain what the major pairs are in a moment. And also make sure you know the difference between the FX chart and the futures charts. With currencies, you do have an option of trading either the futures or the FX market, and I’ll explain what those are now.

ProfitSource Software FX Codes

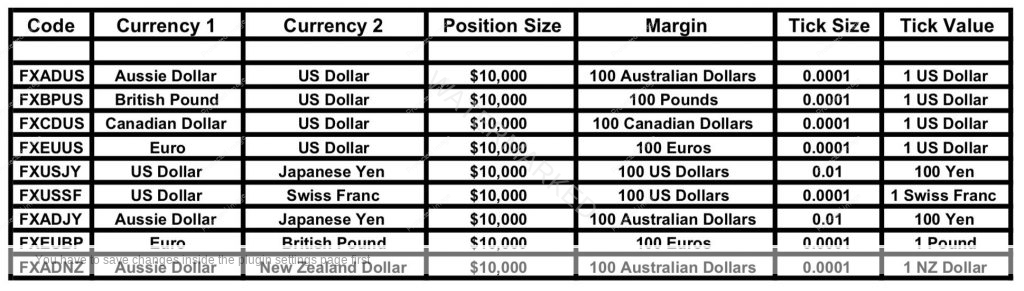

When you’re trading currencies, there are always two currencies, a Currency 1 and a Currency 2. If you take a look at this chart on the screen, and we just look at the top row, you’ve got FXADUS. An FX chart in ProfitSource software will always start with the code FX, and then you’ll have a code for the first currency and a code for the second currency.

So up the top, you’ve got FXADUS, that’s an FX chart measuring the Australian Dollar or the Aussie Dollar against the US Dollar. Now you’ll notice that I’ve called them Currency 1 and Currency 2, and there’s a reason for that. If you move across from left to right, you’ll see position size of $10,000 which is normally the smallest base unit that you can trade an FX position. Although you will find brokers who let you trade $1,000 positions. But you can see for a position size of $10,000 that’s going to be a position size of $10,000 Australian Dollars and your margin is going to be roughly $100 in Australian Dollars. But your tick value, which is on the far right-hand side of the screen, is going to be in US Dollars.

So what does that mean? It means that when you’re trading currencies your position size and your margin are all calculated in Currency 1, but the tick value or the profit and loss on every trade is calculated in Currency 2. That’s about as difficult as currencies are going to get and as I said I go through all of this and step through some examples in that FX Trading Series on our YouTube channel.

ProfitSource Software Futures Codes

If the FX side of things seems a little bit confusing for you, you can always trade currency futures, and in the software, here are the codes for the six major currency futures.

- Australian Dollar (AD-SpotV)

- British Pound (BP-SpotV)

- Canadian Dollar (CD-SpotV)

- Euro (EC-SpotV)

- Japanese Yen (JY-SpotV)

- Swiss Franc (SF-SpotV)

You’ve got the Australian Dollar, the British Pound, Canadian Dollar, Euro, Japanese Yen and the Swiss Franc. And these are all traded against the US Dollar. So, if you’re trading currency futures, just look up the futures contract specifications by going to the CME Group website CMA Chicago Mercantile Exchange www.cmegroup.com or, as I said previously, a simple Google search for “Australian Dollar Contract Specifications” will bring that up for you. So let’s jump into the software now and have a quick look at some currencies.

Currency Examples in ProftSource

Once you’re in ProfitSource you can open up a Quote List of foreign exchange, which you can see here is Forex and it’s basically going to list every single currency pair that you could possibly want to trade. For example, FXADBP, the Australian Dollar/British Pound or the Australian Dollar against the Canadian Dollar, the Australian Dollar against the Euro. While you can trade any of these currencies and there’s going to be a fair bit of volume going through there, I’d strongly recommend that you trade one of the six major currency pairs which, as we just saw with the Futures codes, are the Australian Dollar, the British Pound, the Canadian Dollar, the Euro, the Japanese Yen or the Swiss Franc, all against the US Dollar. To find those codes you would either find them on this list, or you can simply type in FXADUS, for example, and open a chart of the Australian Dollar against the US Dollar.

If you want to trade currency futures, there is a Quote List called All Futures, and you can find it by going to Quotes, Open Quote List, Futures and All Futures. This All Futures Quote List is great because it takes you through pretty much any futures contract that you might want to trade. Just keep in mind that it’s not just currency futures here, it’s all sorts of futures. You’re going to have Wheat and Corn and Sugar. You’re going to have the currencies, but then you’re also going to have indices as well, so there’s all sorts of futures here. But as you can see, Australian Dollar CME, that’s the Chicago Mercantile Exchange, AD-SpotV, and if we open that one up, you’re going to notice it’s almost identical to the FXADUS chart that we’ve just looked at. The reason for that is it’s basically doing the same thing, it’s tracking the price of the Australian Dollar against the US Dollar, and if you think about it, if you could buy Australian Dollar versus the US Dollar more cheaply in either the futures or the FX, you would just go and buy a whole lot of it in the cheap one and then sell it in the more expensive one. So, what happens is these prices generally tend to converge very tightly together. As I said, when it comes to currencies, I would start out just by following the main six currencies. So, there’s your Aussie Dollar and as you can see apart from this period of distribution in 2011-2012, the Australian Dollar tends to trend pretty well.

If we open up the next chart which is the British Pound, and we scroll backwards, again, you can see that even though this looks like a sideways period, there’s still about 3,000 points of movement there, which is quite a large range for you to trade. So, the British Pound does actually trend very well and as you can see several times during its history it has actually fallen off a cliff. For example, in 1992 this is the period of the market where George Soros actually made a billion dollars trading the British Pound short on just one day of trading. He made a billion dollars in a day and you can find more about that in our British Pound case study lesson which you’ll find on the Safety of the Market website.

The next one we’ll have a look at is the Canadian Dollar CD-SpotV. Again, if we zoom out there, there’s a lot of trending, a lot of price movement in there. The Euro, EC-SpotV is a little bit more of a newcomer. It only started in 1999, but again you can see some massive trending moves there, a little bit sideways during this period of 2015-2016, but generally speaking, a very good strongly trending market. With currency markets, if you do happen to find them going a little bit sideways, just wait until they break out of that sideways range. You usually find it’s a little bit better for trading then.

Then we’ve got the Japanese Yen JY-SpotV and if we zoom out a little bit there, once again, you’ll see very strong trends, very strong movements. So, you can start to see why David Bowden said if he could only trade one thing, he would trade a currency because they do tend to trend the most.

The last of the major currency pairs we’ll look at is the Swiss Franc SF-SpotV and this is the currency that David Bowden traded the most heavily. I believe that if he were trading today, he would be more likely to trade the Euro Futures contract rather than the Swiss Franc for a couple of reasons. Number one, the Euro is bigger now, whereas the Euro didn’t exist when David was trading from 1985 to the year 2000. The other reason is that since the Swiss Franc was pegged to the Euro, and then unpegged, it’s been very wild and choppy. Now I know that you can see a lot of sideways moving in here, and while you could still trade these ranges it hasn’t been as good for trading as it normally would be, and it hasn’t really recovered from that peg. And when you start applying some of the swing charting techniques, and some of the Price Forecasting techniques we’ll be getting into a little bit later in this program, you’re going to find it difficult to analyse the Swiss Franc because of this enormous spike bar here in 2015, and that’s when the Swiss Franc was unpegged from the Euro and everything just went chaotic. So because of that, it’s become a little bit difficult to analyse the Swiss Franc, so I’d probably go so far as to say if in doubt just leave it alone for now and stick with one of the other five majors that we’ve just looked at.

Currencies - How to Trade Them

When it comes to currencies there are a few different ways that you can trade them and again this is all explored in more detail in our YouTube Series. A common way to trade them used to be the Spot FX Market, however, these days that’s basically been overtaken by CFDs. When it comes to private traders, you’re going to find CFDs are a little bit easier to trade than the Spot FX Market. And again, if you’ve traded CFDs before on stocks, you’ll find it very easy to adjust into trading CFDs on currencies.

You can also trade currencies using futures contracts or options contracts, however, the options contracts in currencies do actually tend to have lower volume, and given that one of the main reasons we trade currencies is because they’re the most liquid market, it doesn’t really make sense to go in and trade the options contracts as much. Remember if you are interested in trading futures you can check out Appendix B of the Smarter Starter Pack. Options are covered in Appendix C and Contracts for Difference are covered in Appendix D.

Things to Watch Out For

Finally, when it comes to trading currencies, there are a few things to watch out for.

There Is No ‘Close’ In The FX Market

Keep in mind that the FX market is literally a 24-hour market, so from Monday morning through to Saturday morning it doesn’t actually close. There’s no close, a price bar represents a 24-hour period of the market and the close of one bar and the open of the next bar will be almost identical because it’s just a timestamp, the market doesn’t actually physically close.

Currency Futures On The Other Hand Close For One Hour Per Day

Now generally speaking when currency futures close it’s just after the close of the US stock market and normally there’s not a lot of news that comes out during those times. But from time to time you will see moves occur during that one-hour period and that’s why you see some gaps on the futures markets that don’t appear on the FX market, because the futures markets might be closed for that hour and the move happens, so the market will need to gap up to account for that move but the move has already happened in the FX market so it doesn’t need to move.

Remember That Your Profits Or Losses Will Be Calculated In Different Currencies

So if you’re trading the Australian Dollar against the US Dollar your profits and losses will be in US Dollars. But if you’re trading the Australian Dollar against the New Zealand Dollar, your profits and losses are going to be calculated in New Zealand Dollars, whatever Currency 2 is. If you’re trading futures, they’re always calculated in US Dollars, so that might be a little bit easier to keep track of.

Daily Interest Calculation

Just like with CFDs on stocks, there is a daily interest calculation in the FX market and that’s based on the interest rates of the two currencies that you’re trading. Essentially, you’re going to receive interest for the currencies that you’re long, at the Reserve Bank interest rate of whichever currency you are long of, and you’re going to pay interest on any currency that you are short of, at the Reserve Bank interest rate for that currency. So if you’re trading the Australian Dollar against the US Dollar, if you go short on the Australian Dollar/US Dollar you are short the Australian Dollar, which means you’re going to pay interest at Australian Dollar interest rates, and you are long the US Dollar which means you’ll receive interest at the US Dollar rate. However, this is all explained in the FX Trading Series on YouTube.

Liquidity Can Drop Off After The Close

Another thing to watch out for is that even though currencies are the most liquid market in the world, there are a couple of times during the week when liquidity can drop off a little bit and that’s after the US stock market closes, but before the Australian and Asian stock markets open up. During that time the spreads can widen a little bit, so just be aware of that. Also note that spreads can change during the day, so during the morning session in Australia, spreads can be a little bit wider than say during the evening session when the US markets are open.

Remember, Currencies Are A Heavily Leveraged Product

And the final thing that I’ll say with currencies is that they are a heavily leveraged product, so be careful if you ever receive a margin call when you’re trading currencies. It means you are over-trading. You’re taking position sizes that are too large. Occasionally with stocks, if you’re trading a stock with a high margin you can get a margin call, and it’s not a big deal, but with currencies when you can trade on basically half a percent leverage if you get a margin call you are grossly over-trading and you need to back off right away because a margin call with currencies means you’re over-trading and you’re at serious risk of wiping out your trading account.

So that’s all for currencies, just keep in mind that they’re not as hard as they look. You just have to persevere with them. Jump into a virtual account or a demonstration account on your broking platform take a couple of currency trades and you’ll see what I mean.