As I have said before, there are three points of major significance in price analysis; the highest price at which the stock or contract has traded, the lowest price at which the stock or contract has traded, and the distance between these two points. That distance, or “space,” is called the fluctuating range, and it is this distance upon which we based our first trading plan. However far you go in your study of technical analysis, you cannot get away from these numbers.

Gann illustrates the importance of these three points of major significance as follows:

Tops forecast future bottoms or low levels

“By using the percentage of the TOPS you can determine Resistance points or BOTTOMS on the way down. Follow this rule. You must also use the range between extreme high and extreme low, 50% of this range is a very important resistance point; 75% next important, and 100% MOST IMPORTANT.”

(Gann, W.D., How to Make Profits in Commodities, 1942, p.33-34)

Resistance levels

“If we wish to avert failure in speculation, we must deal with causes. Everything in existence is based on exact proportion and perfect relation. There is no chance in nature, because mathematical principles of the highest order are the foundation of all things. Faraday said, “There is nothing in the Universe but mathematical points of force”.

Every Commodity makes a TOP or BOTTOM on some exact mathematical point in proportion to some previous high or low level.

The movement of Wheat, or any Commodity between extreme high and extreme low, either in a major or minor move, is very important and a proper division of this range of fluctuation, we determine the points where Resistance or support will be met on a reverse move, either up or down.”

(Gann, W.D., How to Make Profits in Commodities, 1942, p.33-34)

(My emphasis)

In trading, it is important that you do the right thing at the right time. There is a cycle or rhythm to markets, and we should either get into step with it, or get out. The purpose of this trading course is to make sure that you are taking the right steps to be “in sync.” with this rhythm. It is a bit like Arthur Murray’s dance studio.

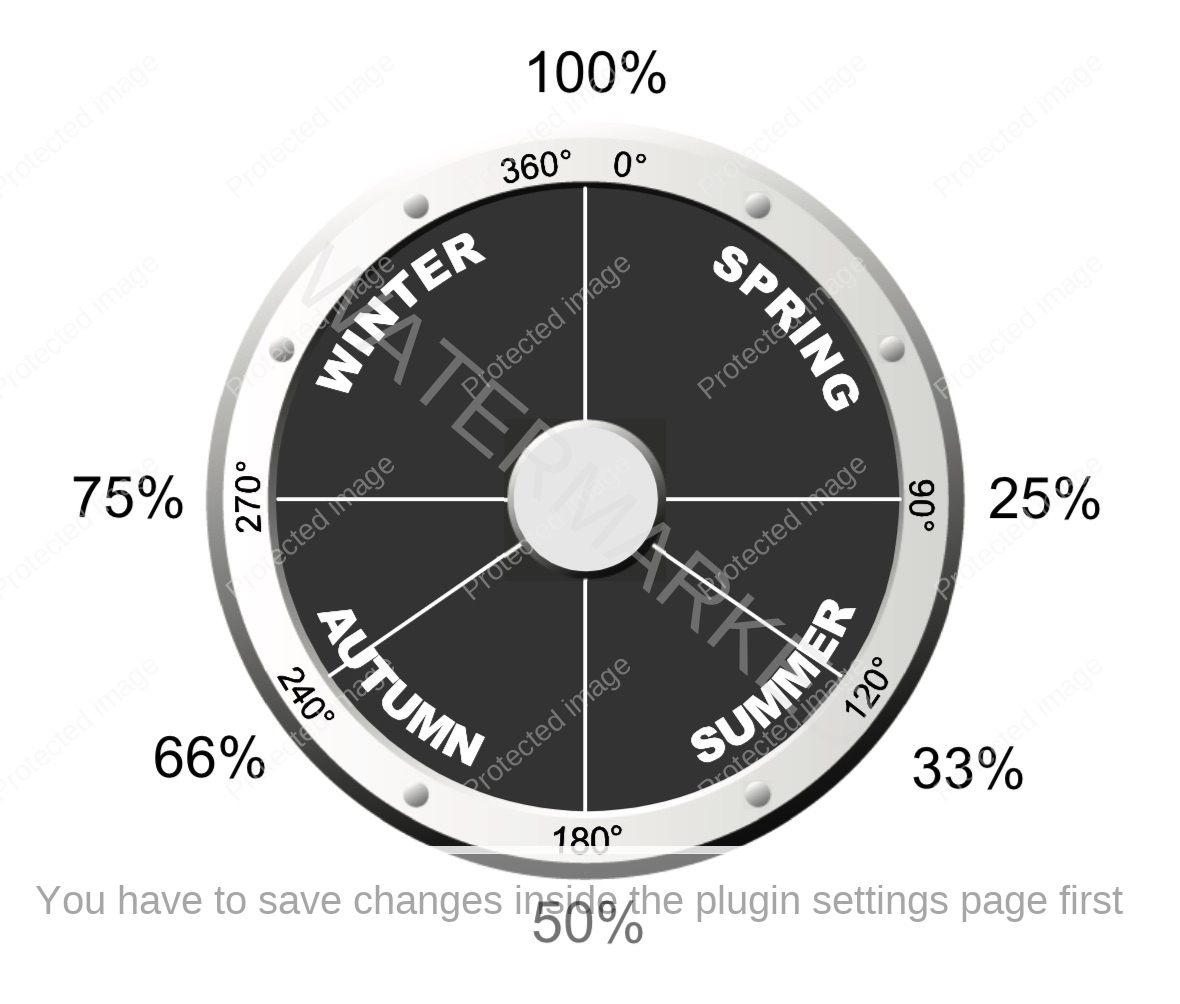

We can look at the course of any trade as a cycle all on its own. Look at it as a circle. We break it into four quarters and these become the seasons of our trading range. Using this analogy, the market turns at the end of winter. At this point, a change in trend begins. We must select our trade and take our position during spring. We hold throughout summer, at the end of which we reach a crossroad because we are at the opposite position to the birth. Should we pass through this danger zone, we hold our trade all through the autumn. At this stage, many will harvest their crop, but we may decide to hang on throughout winter – if the conditions look favourable.

Once we accept this flow, we also accept the inevitability of change. At the end of every winter comes a spring; at the end of every summer comes an autumn. While our aim is to trade with the trend, we must remember that the longer we delay our entry, the closer we are to another change in trend, which can take back the profits we have already accrued.

An understanding of this rhythm is a key component of this learning process, and perhaps the start of your understanding of God’s gift of numbers. Prices at extreme market tops and bottoms, as well as the ranges, are mathematically related and can be used as forecasting tools.

You may never have thought of the process in this manner, but it is the most logical way of doing your analysis, as it conforms with nature. I regard this as seasonal trading and it is in harmony with every facet of my research. The Bible tells us to go about our business in this manner. As Solomon says:

The time for planting, the time for pulling up.

Ecclesiastes 3:2

and

Whatever happens or can happen has already happened before.

God makes the same thing happen again.

Ecclesiastes 3:14-15

This is the basis of all my time forecasts in the Ultimate Gann Course. I want you to accept the cycle theory.

There are many subtleties in any trading plan. Your personal decision may be to adjust your entry or exit parameters just to suit your mood – or you may not trade at all unless you feel that you can handle the stress that is part of the game.