Tradeable Tops

Since then, we’ve seen a very tradable move out of the 8581, 14 February Double Top on the SPI200. This was one of those times where there was plenty of price and time evidence to support a turn.

In the February Safety in the Market newsletter I went into detail on all the Price Forecasting milestones that came together to help call this cluster and the type of swing entry that anyone with the Active Trader Program could have taken, so I won’t re hash that here. However, I will look at some time-based techniques that helped to have you on top of this setup.

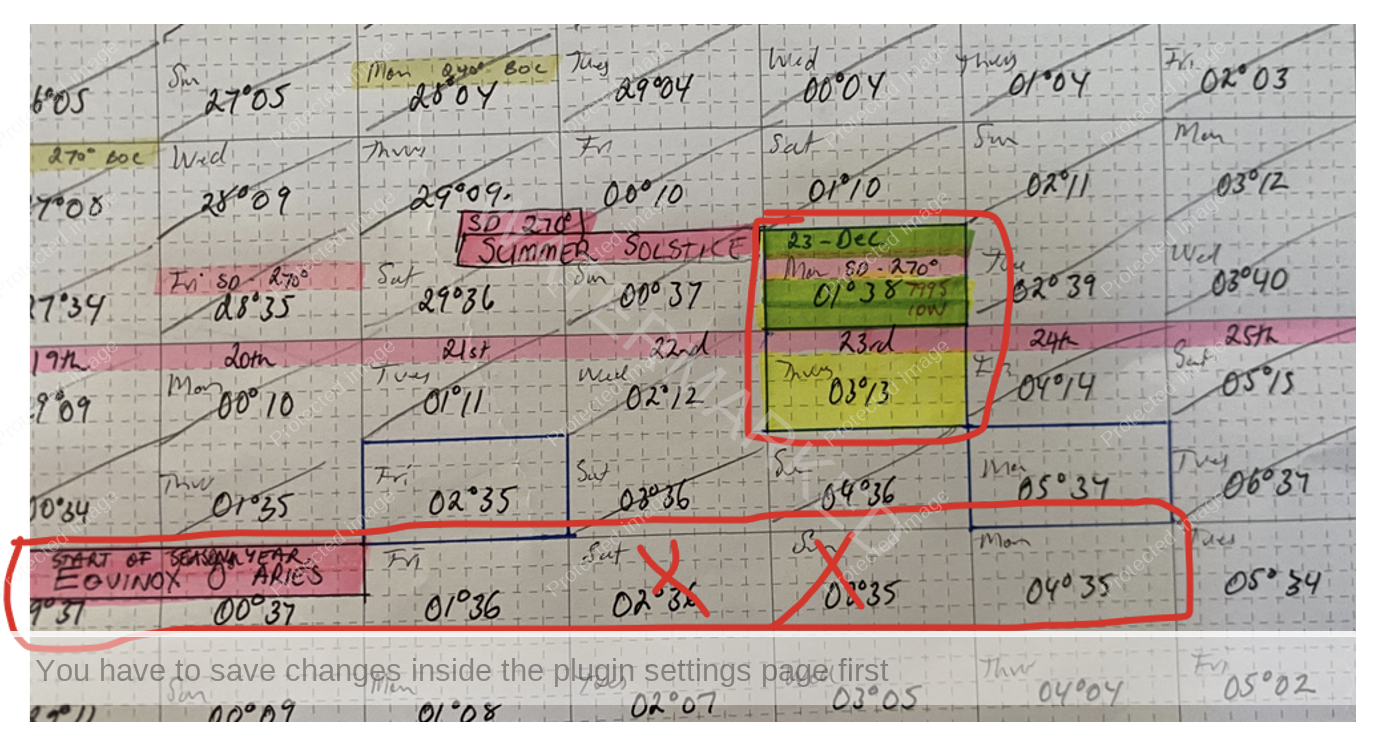

Time by Degrees was the anchor point in terms of Time. In Chart 1 below I’ve added the chart from last month’s article highlighting the 3-day window to watch. Lucky for us the first possible entry wasn’t really presented until the February 14.

Chart 1 – 30 Degree Vibration Wall Chart

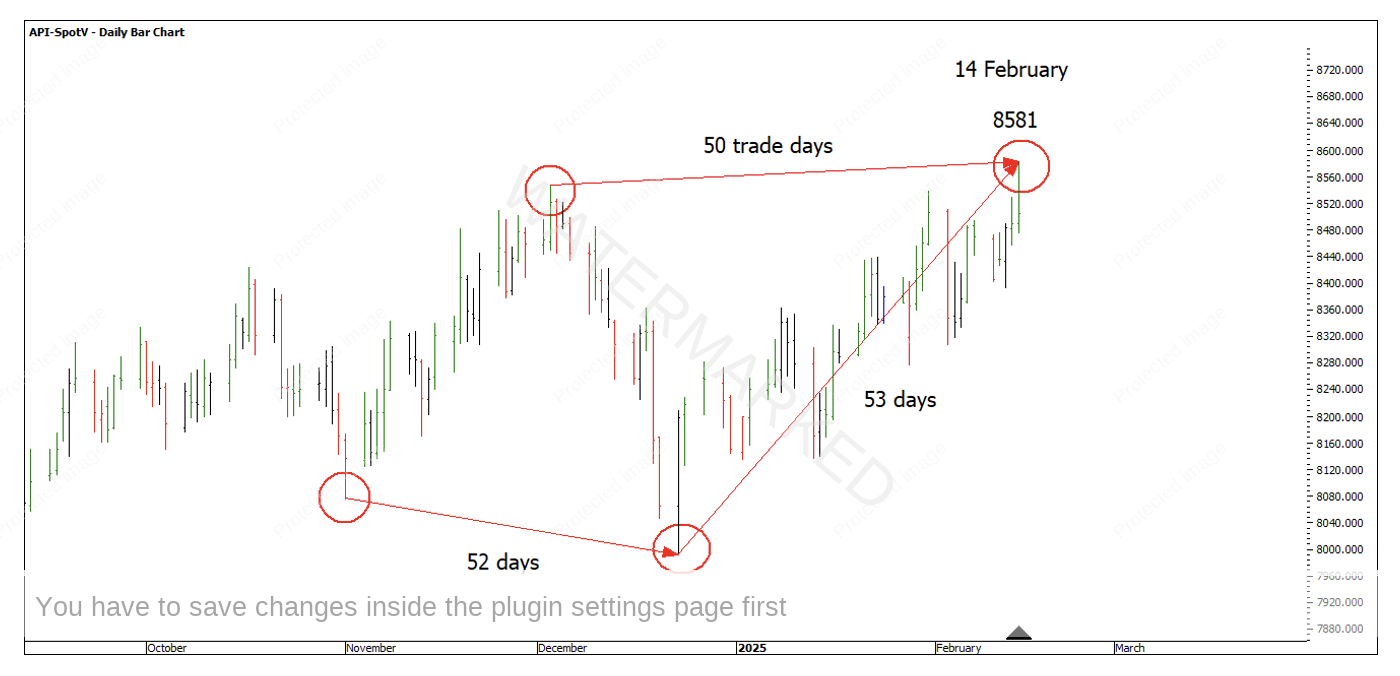

Balancing of Time also got within 1 day of the top. This was a 52 day count low to low, low to high. What you can do with calendar days you can also do with trading days and the harmony was also there with a 50-trading day top to top time frame.

Chart 2 – 52 Day Balancing Time

There was also a 73-day balancing time frame that had been showing up in the market recently.

Chart 3 – 73 Day Balancing Time

The above ProfitSource charts are for illustration only, balancing time either calendar days or trading days are best done on a hand drawn chart exactly how David Bowden described doing it in the Ultimate Gann Course. That is, running time counts from all the major and semi major tops and bottoms. Doing it this way really makes the repeating day counts stand out!

What you do on a daily chart you can also do on a weekly and monthly chart. In this case I see similar harmony.

52 days prior gave the December Seasonal Date low of 7995, 50 trading days prior gave the 3 December top of 8546, 52 weeks prior (1 year anniversary) gave the 7421, 14 February 2024 weekly swing low and 53 months back gave the 22 September, 2020 COVID higher bottom.

Chart 4 – 52 Count Harmony

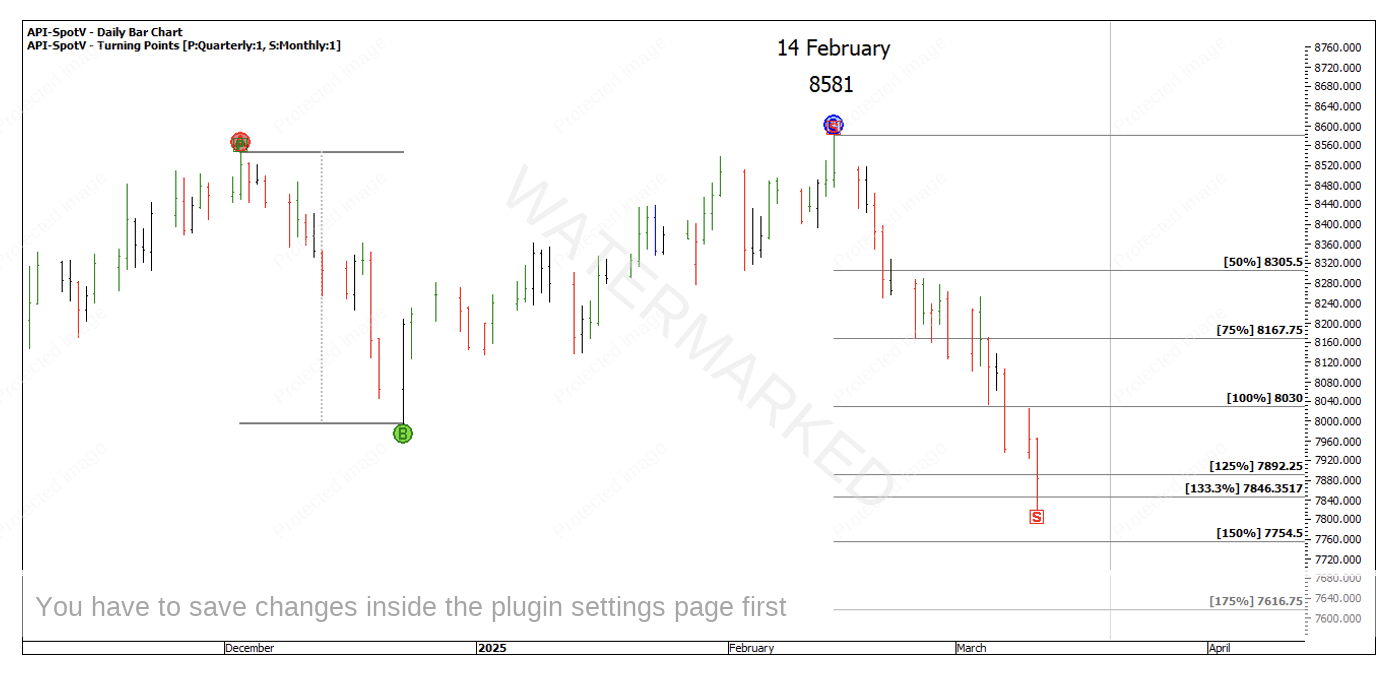

So far, the Double Top has certainly provided a great trading opportunity and at time of writing has just touched the 150% milestone.

Chart 5 – Double Tops

If you didn’t trade this top the best thing to do is relax and just wait for the next Time by Degrees date that coincides with a high-quality price cluster. Next approaching is the March Equinox being Thursday 20 March and 90 degrees from the 23 December low.

Chart 6 – 30 Degree Vibration Wall Chart

The last two turns around this time has come in a little later at 1 degree 38 and 3 degrees 35. Even though Wednesday 19 March to Friday 21 March is probably the best window, if a turn is made Friday evening it will show up on Monday’s bar.

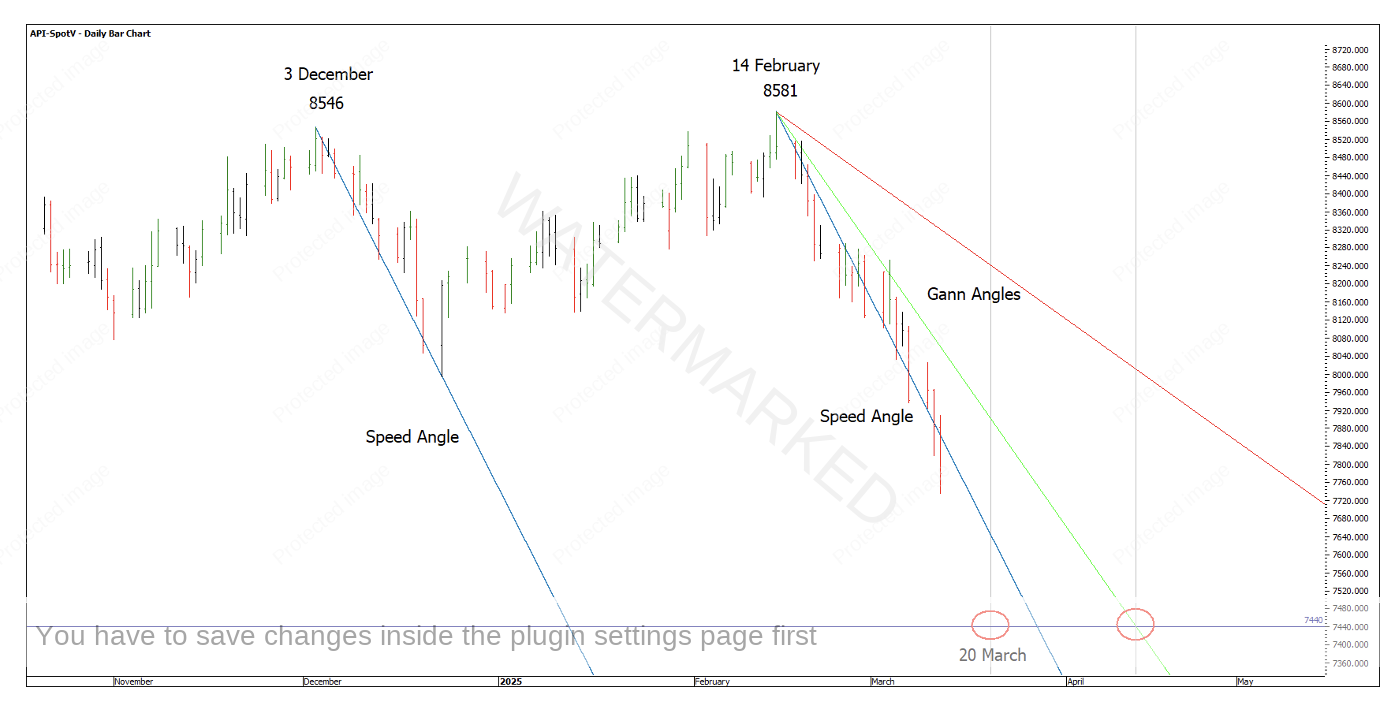

Now we can either come up with potential scenarios to watch out for or just wait for the date and see what the market gives us. I like to think about what could play out so potential scenarios could be a weekly or daily lower top setup, a daily higher bottom or 200% into Double Bottoms but either way if the setup doesn’t fit the trading plan you can keep your capital safe and wait for the next high-quality setup.

Chart 7 – Potential Scenarios

If the SPI200 happens to be around 200% of Double Tops around the March Seasonal dates, then there is some price and time harmony for support to watch out for. Some things I see are:

- 200% of Double Tops = 7479

- 6 August 2024 low = 7472

- 28 July 2023 Monthly high = 7444

- 5% retracement of 8581 – 6746 = 7434

- 50% retracement of 8581 – 6296 = 7438

- 1×1 from 8546 high on 21 March = 7466

Something for the Master Forecasting Course owners, if the SPI was down around 200% on the March seasonal date you might like to check out the Time and Price alignment on the Square of Nine around 7440.

The caution I have with 7440 on 20 March is that the SPI would be trading well below the previous range downs speed angle and well below the 2×1 Gann angle from the February top! 7440 would look a lot better later in April above a 2×1, otherwise it may be a case of trying to catch a falling knife!

Chart 8 – Previous Range Speed Angle

Happy Trading,

Gus Hingeley