After a varied career in a number of professional positions in several locations around the State, I am currently working in the public service. This will most likely be my last job as retirement beckons once our three adult children leave the nest. My wife runs her own business so the goal for trading at the moment is to build up an additional form of income that fortunately is not required to be drawn on for everyday living expenses. Once we retire from the “job” we can then keep on trading to generate an income.

Over the years we have dabbled in investing in shares and experimented in trading options however due to our other business and family interests we never really got into trading seriously. The circumstances of life were aligned such that when I was introduced to Safety in the Market I was in a position where I could take on trading (and the associated study) seriously.

The concept of swing trading and the ABC methodology made sense to me whereas I never really got the hang of all those options strategies. With the support of my wife, we made a decision that I would do the SITM courses and make trading a successful and profitable venture for our future. SITM has such good teachers that I learn many new things every time I do a course.

The concepts of the SITM methodology are relatively easy to understand, especially as they are explained so well by the teachers. However, there is a huge difference between understanding the concepts in an academic sense and really mastering the concepts in a practical sense (i.e. trading profitably). My advice to traders just starting their journey is to make sure you go over the basics time and time again before rushing to the next topic and adding the next layer of complexity. Everyone’s journey is different and everyone has to make mistakes to learn so even though the teachers at SITM can highlight what you really need to know and the areas where most students make mistakes (and hopefully this helps shorten your journey), you have to be realistic about how long it takes, how many mistakes you will make, and how much work it takes to become a consistently profitable trader.

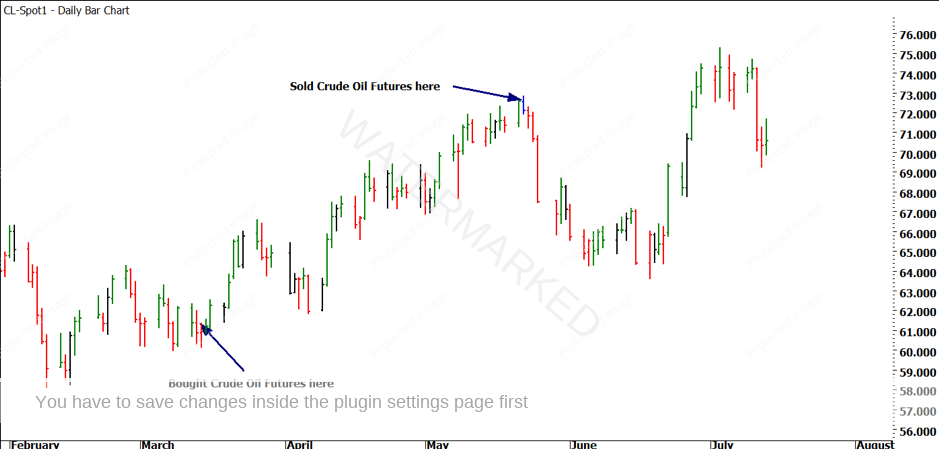

I trade futures contracts on an index, a currency and a commodity. I entered a Crude Oil trade on 9 March this year. Oil had made a swing top on 25 January, a low on 9 February, a swing top on 26 February and potential higher swing bottom on 8 March, holding them until the reversal signal bar on 22 May. This time and price point gave a quick short trade. Then due to travel and more urgent family matters I had to pause trading so I wasn’t watching the market during most of June.