Have you ever thought about who trades the markets? If so, what type of person do you think of? The answer is that traders come from all walks of life, from 9-5pm office workers, to tradies, to FIFO workers, to nightshift workers & people who work from home. They are all at different stages of life from students to parents to grandparents & retirees! So the question is, how do they manage their trading during their busy lifestyle?

During my trading journey, which started when I was a stay-at-home dad, I have worked all sorts of shifts, some full-time, some part-time, some early, some late. All this while spending most of my free time coaching sport, in the evenings and at weekends. My coaching became my profession and like many professions these days, it meant spending time away from home for periods of time. Sound familiar? Life itself can be one of your challenges when trying to stay on top of your trading!

Does your market match your lifestyle?

Why did you decide to trade the market/s you are trading and are they right for you?

Maybe you trade your Tutor’s favourite market and find comfort from hearing their insights, or you trade a market that was highlighted at a webinar that you attended. Maybe it’s the SPI because you’ve studied David Bowden’s work or Gold because you’re drawn to its splendour somehow?

All of these reasons are justified and very common, and Safety in the Market students have often continued with these markets with great success, making friends with fellow students along the way. The problem can be that a particular market may work for someone else’s lifestyle, but not quite fit yours!

So is it possible to choose our markets more carefully, so we can access them more often and manage their characters alongside our own?

Here we have a partial idea of market trading hours around the world at the time of writing:

As we can see our choice of market and when to trade it can be determined by which part of the world its’ exchange is based. A ‘postie’ for instance may not be able to watch the Australian market open but might be home in time for it’s close! A ‘stay-at-home mum’ might find trading particular Asian markets during the day difficult at times, when they close for a 1-2 hour lunch!

Currencies trade almost around the clock which helps, but still have their favourite times of the day when they are more active than at other times of the day. The JPY & AUD can be very busy during our Asian morning, while the Euro & GBP may remain quiet until Europe awakes later on.

As an example, let’s take a look at the Silver market.

As you can see from the snapshot of the hourly chart below – over a 4 day period (21 – 25th) the most active times within the market are predominantly from around 9pm. This activity is typical of the Silver market as a whole. Commodities which include the Metals & Crude Oil, can be traded all day and into the night, but can often lie asleep until the US markets open. Having traded Silver previously, I found that I could get home from coaching around 8pm just in time for Silver to make it’s move for the day, which was very handy. See the volume example on Silver below:

Coffee & Sugar as an example open for trading late into our afternoon and close soon after midnight. Not much good for a daytime trader, but if you work in Food & Beverage during the evenings, you could manage your trade before and after your shift.

Indices will mainly react to their place of origin so European indices like the FTSE & DAX will be active early evening in Eastern states of Australia which may suit more rather than waiting for the US indices which open around midnight! Meanwhile in Perth you may include the Nasdaq & Dow Jones as the time difference is smaller, so the open can be managed once the kids are in bed!

Nightshift workers may use Australian Stocks to trade if they were getting home in time to set their trades for the day before the ASX opens. They might have time before their shift starts to re position their stop losses for the following day.

Larger Time Frames

FIFO workers have a different trading dilemma in that they are away for weeks at a time. Some may have an extra problem with connectivity depending on their site and its location. In that situation you might look at trading your market on a larger time frame, like a weekly or monthly chart. You can still use all your skills learnt with Safety in the Market, but just on a bigger scale. This way you could set up your trades before leaving home with your entry orders in place and let the market come to you! Ideally, you’re able to manage your positions (if entered) from afar on a weekly basis until getting back home to the PC. If not, our stop loss strategies will keep your capital safe and give you peace of mind, while you’re away.

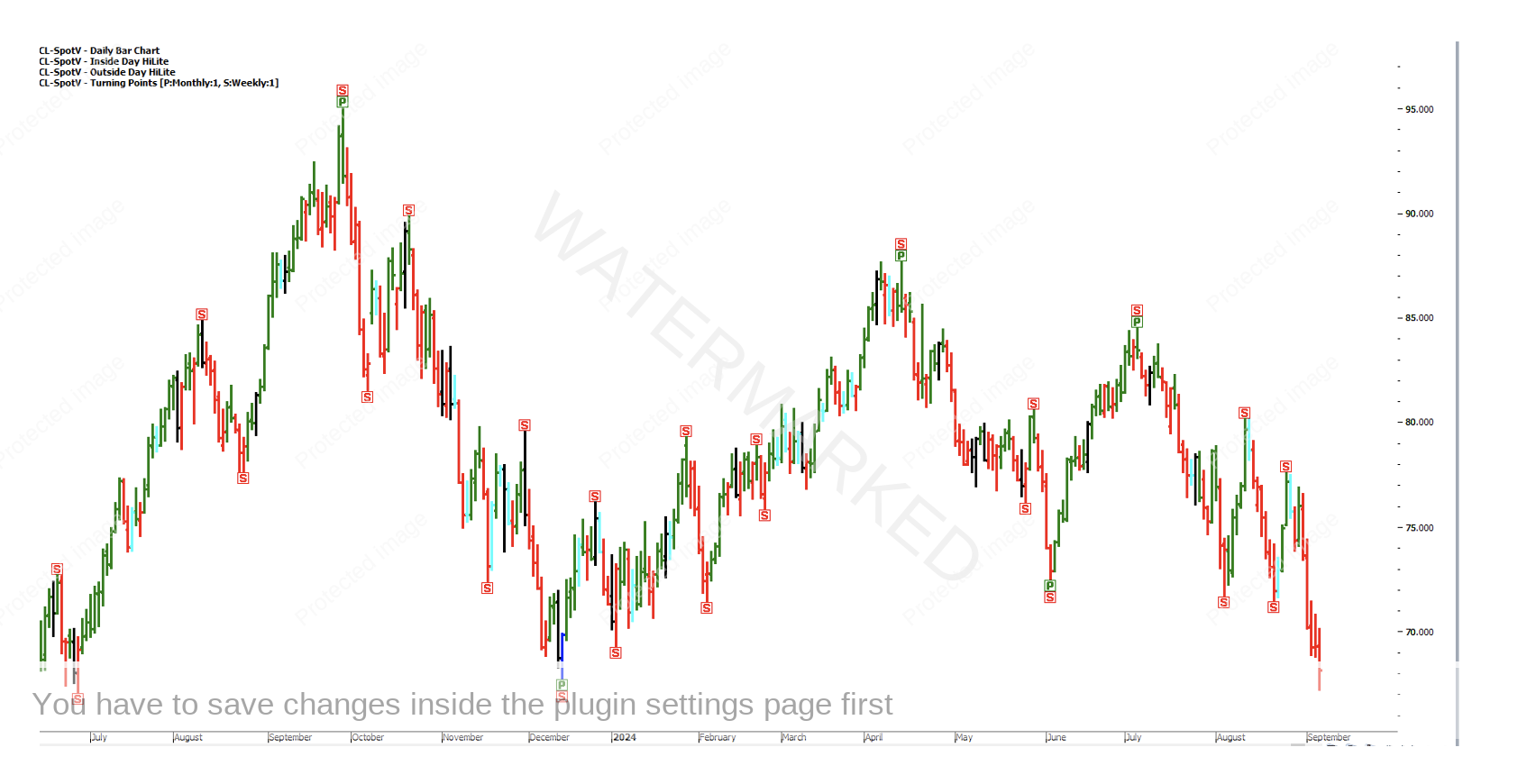

We use bigger picture charts like this in our Active Trader Program to find entries on a daily or smaller scale, so you would already be set up for trading weekly turns.

The chart above from our software shows a daily bar chart on Crude Oil with weekly & Monthly turns. This information would be useful for a FIFO worker looking to take longer term trades. The grains markets can move slow & steady which could also work in your favour while away.

During our journey as traders, we can see our lifestyle as our enemy, or we can look more carefully to find the markets that will become our friends.

Scan & Plan!

All of our students start with the Active Trader Program. You can find out more here.

I don’t feel afraid of trading across the globe…

After purchasing ATPOT I had the courage to venture out of India and opened my first US stock trading account… I would also like to thank David, Mat, Andrew, Gus, Aaron, Diana and the entire team of SITM. I don’t feel afraid of trading across the globe and in fact I feel the night market helps me stick to my rules better as I do not watch the ticker for US equities as it’s night time in India.