Support

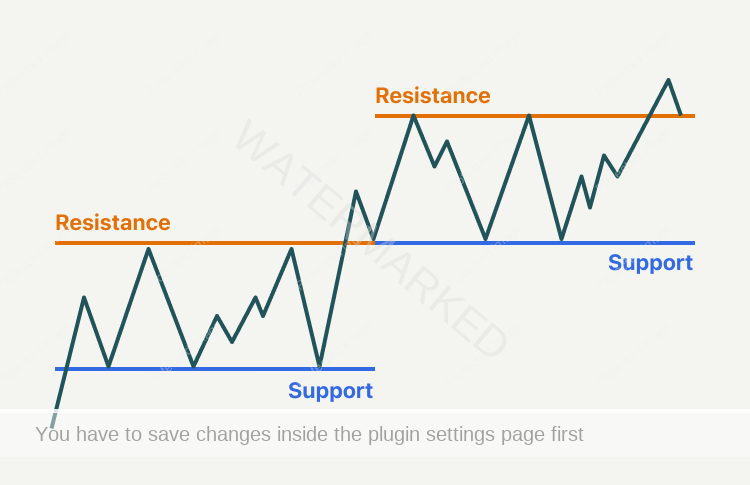

Support is a price level where buying is strong enough to interrupt or reverse a downtrend. Support is represented on a chart by a horizontal or near-horizontal line connecting several bottoms. The more times a support line has ‘held’ prices from going downward, the stronger that support line is said to be.

Resistance

Resistance is the exact opposite and is a price level where selling is strong enough to interrupt or reverse an up-trend. Resistance is indicated on a chart by a horizontal or near-horizontal line connecting several tops. If you look at your chart you’ll often see occasions where a market moves up to a certain price, falls back and moves up again only to be turned back, once again, from the same price. When this happens at a particular price area we can say that the market is meeting ‘resistance’. To further illustrate this point, let’s take a look at a recent (2024) chart of QANTAS (Code ASX:QAN) – however this could be any market, and any period of time. The lines of support and resistance are very clearly visible, and the market is currently oscillating between these two points, and has been since 2020. The price of around $4.20 is proving to be a strong point of support in the market, with the market hitting, or pulling up just shy of this point 6 times since 2020. Similarly, the price of $6.90 is proving to be a point of resistance, with the market pausing or reversing just below this point 6 times since 2020. Taking a bigger picture look and understanding where the market currently stands in between these two points of support and resistance would help you to determine whether you would buy, sell – or do nothing, if this was your chosen market to trade.

It is said that a picture paints a thousand words – and trading is no different. For us as technical traders here at Safety in the Market, the charts tell a story and the market leaves us clues along the way. Analysing your charts and identifying key levels of support and resistance is just one very basic example of the Technical Analysis tools we teach at Safety in the Market. If you would like to know how to analyse your charts and, more importantly, learn how to profit from these market setups, then this is just one of the things we teach in our Active Trader Program. It’s where all of our students start, and many of our students at this foundational level are achieving 10 to 1 Returns on their Trades – with minimal risk. Find out more in our Active Trader Program brochure. Request your copy here.