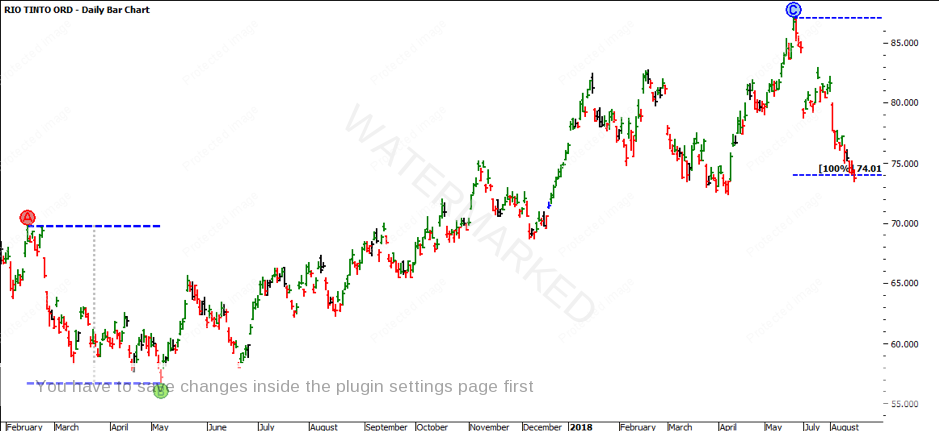

I want to pay respect to the true essence and revisit RIO to see how the seasonality of the trend played out. To recap, RIO on the Australian Stock Exchange (ASX: RIO) started its seasonal trend in February 2016 with a bull market run. I am not going to be explaining what occurred in the February article, but I do encourage you to revisit the article before commencing.

In this article, we will focus on the ‘obvious’ turning points and measure them in time and price, taking note of the repeating patterns. The key though will be around how you could monitor and measure these moves in order to execute trades with reasonable comfort.

In reference to the February article, the chart below breaks down the ‘wheels within wheels’ approach into colours. The larger section is blue. The sections within the blue sections are pink and the sections within them are green. I often find that starting the process like this allows you to visually see what you are trying to break down. You even get a sense of similar range sizes when you copy and paste the arrows and apply it to the next low.

It is essential to start with the ‘First Range Out’ (FRO). The FRO will play a big part in Seasonal Trend Analysis. You can use the FRO to break down each sequential section and more often than not the FRO will have something in common with the top.

It’s Your Perception

Robert Steer