US Outlook

Every year I seem to reflect that there is so much going on in markets, be that technical, economic or geopolitical. I am now more comfortable with the notion that its always the case and I am just more aware or becoming more comfortable with it. As your experience and time in markets grows so does the ability to absorb, collate and process information that previously you would have likely ignored or simply not seen.

I am torn with this article as there are so many markets I am watching and waiting on for signs, signals or opportunities that trends are changing. I have always had to battle the case for not being short all the time, as I have this personality trait that enjoys successful moves that are short and profitable as I feel somewhat like I am fighting the system. Silly I know, but you can either learn to understand who you are and just manage it better or attempt a large personality shift that can be particularly challenging.

The overall take on markets to date is that we have seen some strong trends to the upside, many markets are at record highs, and this can go on for a lot longer than your trading account balance can take being short against it, so metaphorically yelling at markets to go down can be exhausting. Hence as I age and leverage experience, I am happy enough to wait for confirmation of a top or for reasons that the trend has changed. The economic cycle tells us inflation is abating globally, economies are slowing, and interest rates could move lower in terms of direction rather than higher.

The geopolitical landscape is more complicated than say 10 years ago, as we see terrible conflicts, loss of life and in some cases the appetite for that abating seems low. It never ceases to amaze me how we don’t learn from history; the emotional brain forces me to ask why can’t we just be better as the human race, the analytical brain tells me that I should remember everything is cycles and that there is nothing new under the sun.

So given that we are no closer to any profitable outcomes I am forced to look at the technicals. Many markets are running at or over all-time highs (US, UK, Australia, Germany, France) this means we become a little more limited in price-based tools as we cannot use a Ranges Resistance Card until we see highs complete. The use of Lows Resistance Cards and range projection tools can function as a guide for us to look for ranges to complete.

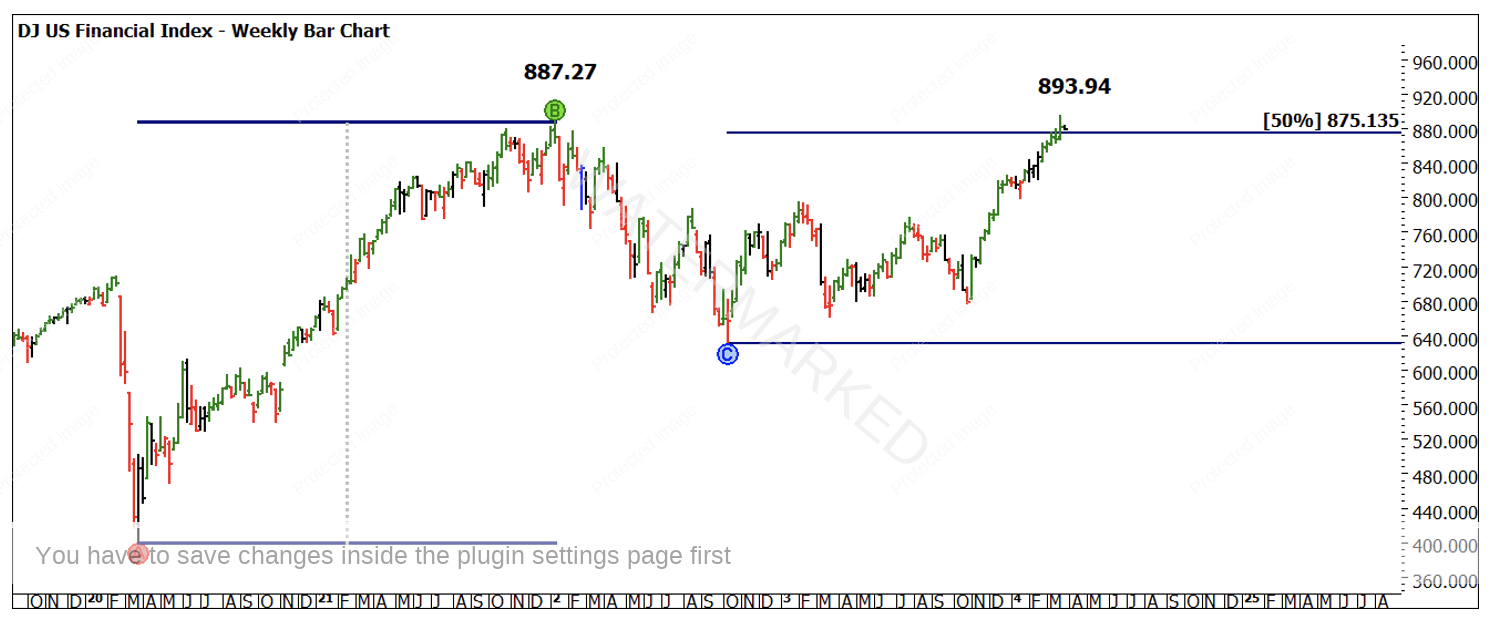

I am forced to revisit the US finance index even though I suggested I would move away from that focus in these articles. I am super focused on banks as I know good and bad times produce great ranges to trade.

Chart 1 shows us the 50% Danger zone from David’s roadmap chart. Whilst no guarantee of resistance, coupled with the old top of 2022 at a similar level, we should be cautious of any new long positions until confirmation either way is given. I always remember thinking double tops around 50% and seasonal time was a pretty decent basis of a trading plan.

Chart 1- DJUSFN Weekly Bar Chart

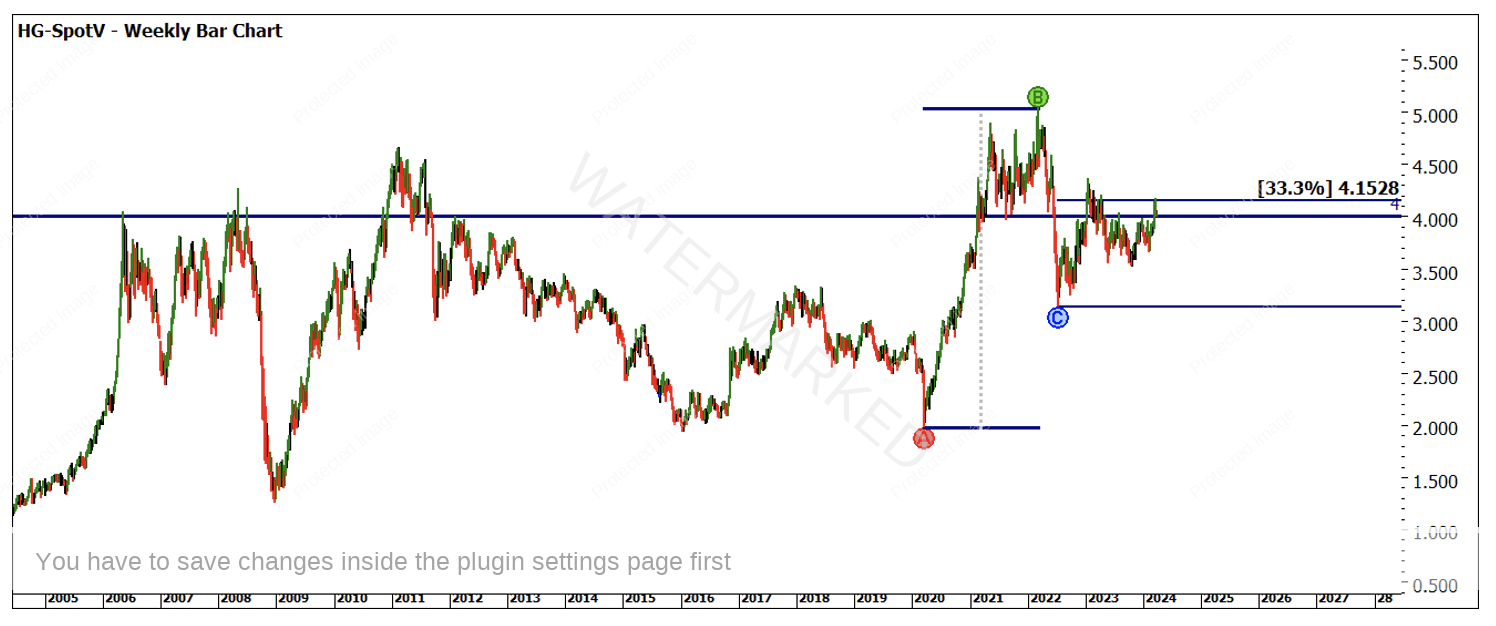

To add a completely uncorrelated market to the mix, we turn to a commodity that is often viewed as a barometer of economic health. The Copper market is one that is not at all-time highs but historically has spent very little time in its history above $4 a pound. Chart 2 and 3 using just price show some pressure points to watch for what is currently resistance. If you undertake some work, you can identify some other price clusters using previous ranges.

Chart 2-HG-Spotv Weekly Bar Chart

Chart 3-HG-Spotv Weekly Bar Chart

To gain the trifecta you might consider reviewing the position of some currencies. The majors I follow are suggesting an orderly market in terms of position, no currencies seem to be trading at record highs or lows.

I do note the Yen is trading towards the bottom of its historical range against the USD, as the world’s 4th largest economy it has certainly had its issues over the last number of decades. By broadening your scope, you can create a patchwork of themes and market activities that allow for an overview. This intermarket analysis is worth investing some time understanding as it looks at money flow from one asset class to another.

If we see changes to the global dynamic, inflation and interest rate moves will drive the flow of money from one area to another. It’s helpful to understand what that might look like. Just remember that in the world of trading it does not replace a trading plan that looks for confirmation of market moves.

This year I am imagining will have quite a story to tell, I am looking forward to it.

Good Trading

Aaron Lynch