“Go back-test that and you will get your answer” is often an answer you might have received from a Safety in the Market instructor. While it is not always what we want to hear, if you put in the work and actually do it, you will be surprised at what you will learn.

Sometimes, back-testing isn’t as easy as just starting. You need to know what you are actually trying to accomplish. While I could run a day long workshop on back-testing alone, this article will give you an outline of the process I use.

There is no rigid process to back-testing a market, and it is very much up to individuals to apply their own discipline and decide to what level of detail they want to go. I might also suggest though that the effort someone puts into back-testing often corresponded to the results achieved in his or her trading.

If we take something as simple as an ABC trade, we can work our way through a back-testing scenario. While ABC’s are only one element of the whole Active Trader Program, I have started here because it is the most obvious and no doubt you have something in your trading plan around ABC’s. It is just a matter of what trade management strategy is most useful in the current market environment.

If you use ProfitSource, you will find the back-testing process is incredibly efficient. It is, of course, important to manually back-test to understand the initial concept, but let’s focus on efficiency here. Below you will find a number of steps to back testing ABC’s, using both ProfitSource and Excel.

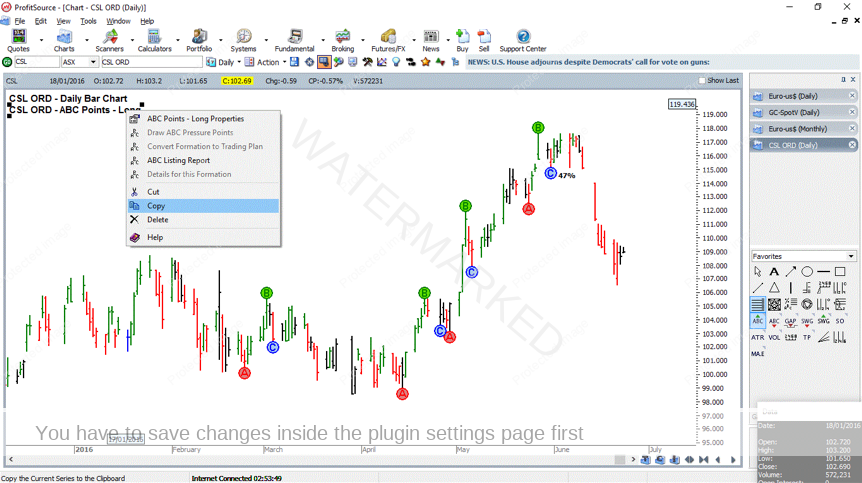

Step 1: First things first, in ProfitSource bring up the chart of your chosen market and put on the ABC Hilites.

Step 2: Right click on the label in the top left and select Copy as shown in Chart 1.

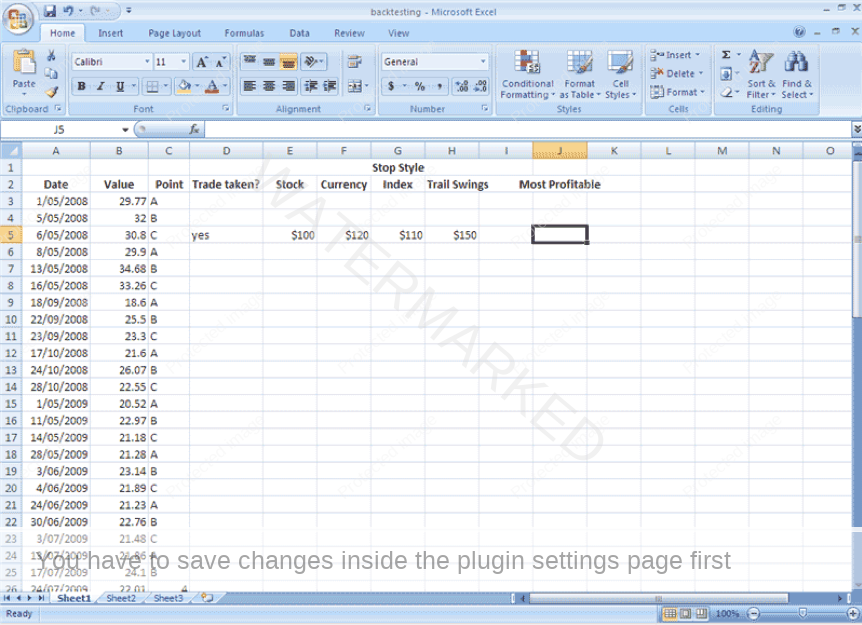

Step 3: We can then paste the list of trades into Excel and start to analyse each ABC trade.

Step 4: For every trade taken you will then apply each of the stop management strategies you have learned, noting down the profit or loss.

I have mocked up an example for you in Chart 2. If you find the prospect of this overwhelming, at least work through the trades during select periods, i.e. a bear market, a bull market and a sideways market. At the end of this process, you will begin to have a picture of which stop management strategy works best on your market.

I remember in the early part of my trading that I was constantly being stopped out, and watching the market continue onto 100% – I am sure you know the feeling! It was very frustrating with my stop only being at C+/-1. This frustration made me seek answers. I decided to back-test the false breaks past Point C. I went through the exact same process as above and tested every single ABC trade, to work out by how much Point C was broken and generated a false break, and how much indicated a genuine change in trend. The ability to take the control into my own hands and figure out how far above or behind Point C to place my stops has been rewarding.

Take some time and back test your market. This exercise alone will provide you with more knowledge and ultimately confidence to continually execute your trading plan. Remember the Gann Methodology is based on history repeating, so therefore what has happened in the past is a great way to plan for what is going to happen in the future. Plenty of employers like to look at your CV prior to giving you a job – they are looking at what you have previously done, or what you’re capable of doing, which will dictate if they will hire you or not. Would you hire yourself as a trader?

It’s Your Perception

Robert Steer