Worth Another Go?

It’s happened to us all. The market reaches a strong price cluster. We enter. We get stopped out by a few points the next day. All only to watch the market turn around again and run away without us on board. And it can be one of the most frustrating things in our trading. So how do we overcome this scenario?

The answer is this: look for reasons to have another go! Obviously, this is easier said than done, as your physical capital and your psychological capital have both taken a hit. But the setup you had was a strong one. Therefore we look for definitive reasons to make another unit of risk worthwhile.

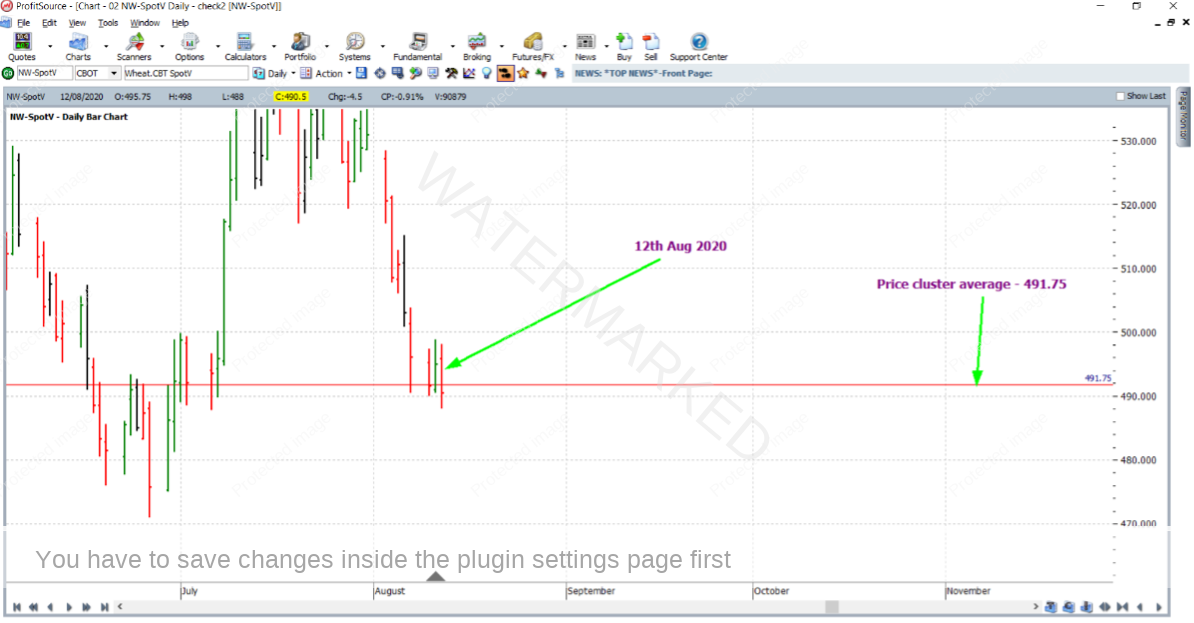

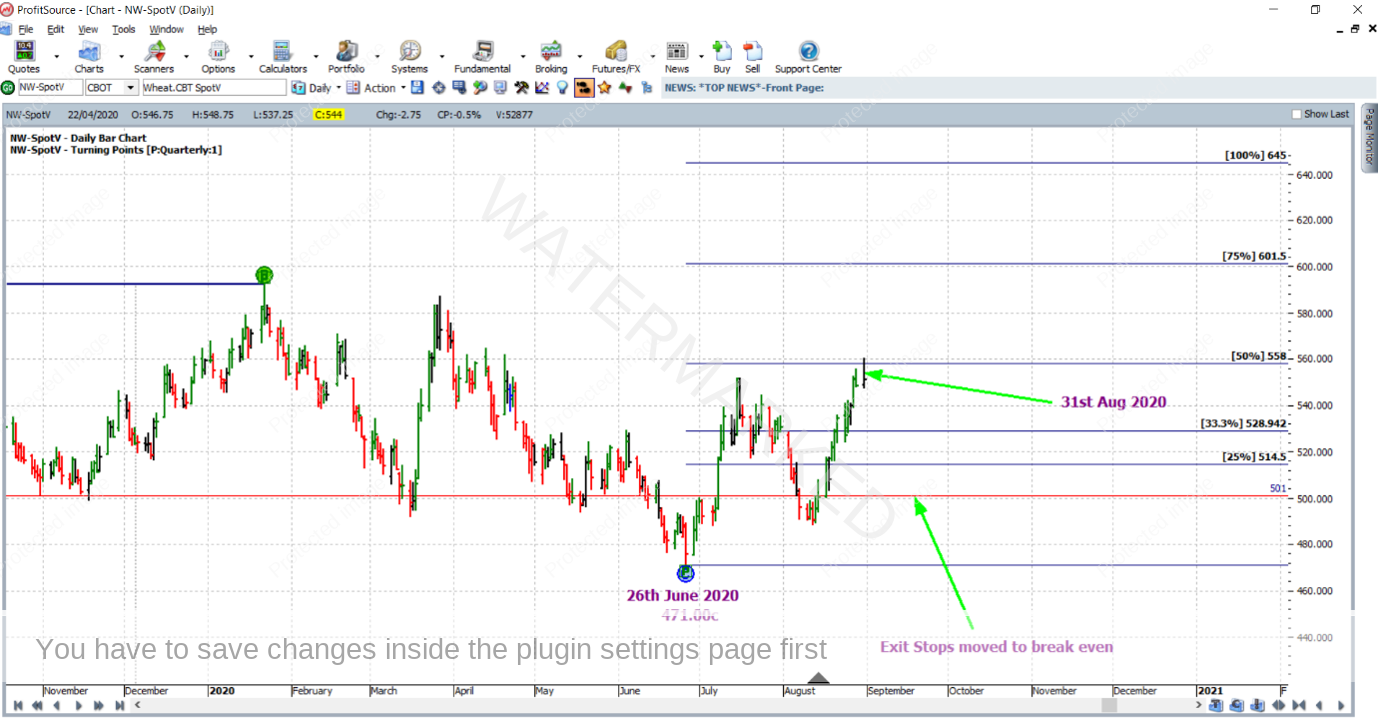

An example of this occurred in the Wheat futures market, back in early August of 2020. Three factors of a strong price cluster averaged out at a price of 491.75 US cents per bushel. As you can see in the ProfitSource chart below in Walk Thru mode (chart symbol NW-SpotV), the market lowed at 490.00 cents on the 10th of August 2020. With this being a relatively small break below the cluster average itself, an order to go long the next day, with the up turning of the one-day swing chart, would have had you in the market on the 11th of August.

But then it happened. Assuming that you had initial exit stops under the low of the 10th of August, you would have been stopped out with the down day that was the 12th.

While a standard-sized unit of risk shouldn’t ruin the account completely, the emotional side of things is hard to ignore. After all, we are human! And we’ve taken a hit. And naturally, we may not feel like having another go straight away. But, with markets being markets, sometimes they don’t give us a lot of time to cool off. We may need to act again soon, even if we’re still feeling a little dirty.

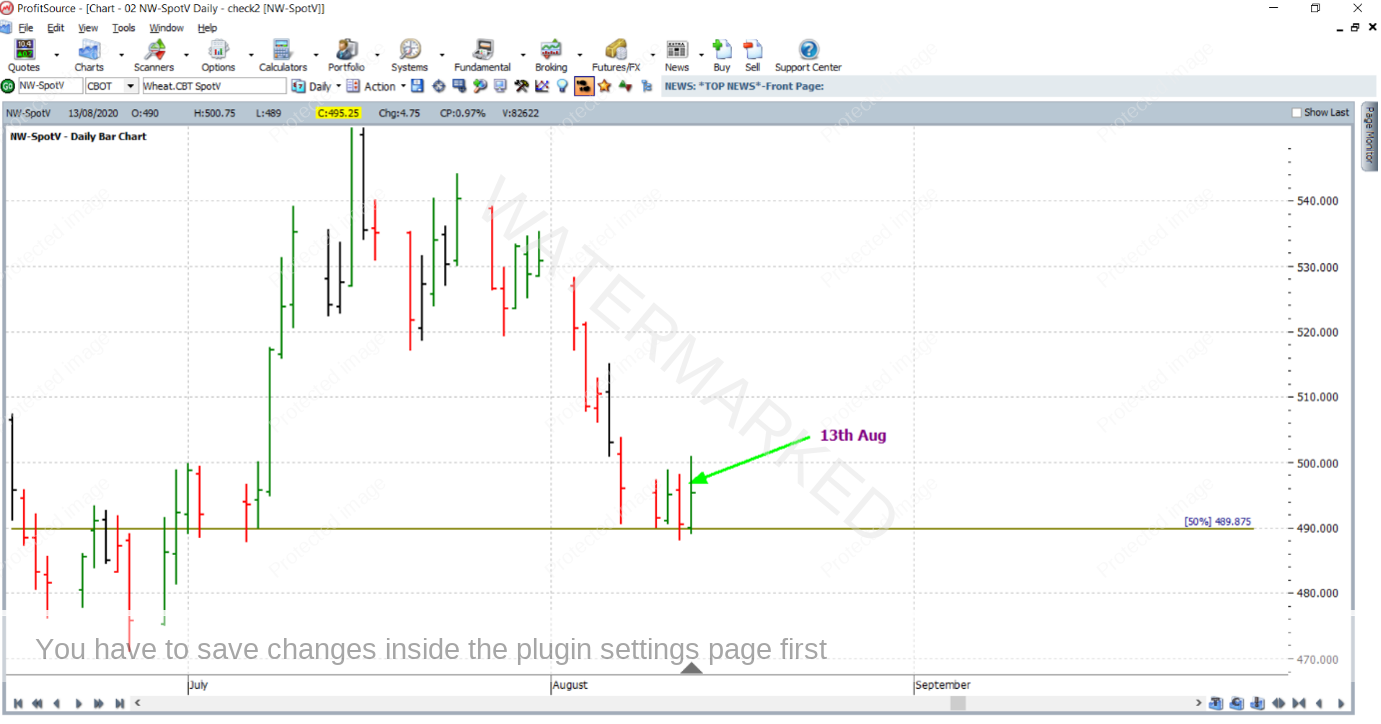

Moving forward another day in Walk Thru mode, you’ll see below that the following day, the 13th of August, was an up day. For reference purposes, something else is shown on the chart – it’s the lowest of the three price factors involved in determining the cluster.

Suddenly the market is looking a bit stronger. But more definitively, why? The reasons can be listed:

- The up day of the 13th had a positive temperature.

- The market kept closing above the lowest of the three price factors – that at 490.00 (rounded to the nearest point, point size being 0.25 cent).

- The break of 490.00 cents was relatively small in relation to the size of an average daily bar in this market.

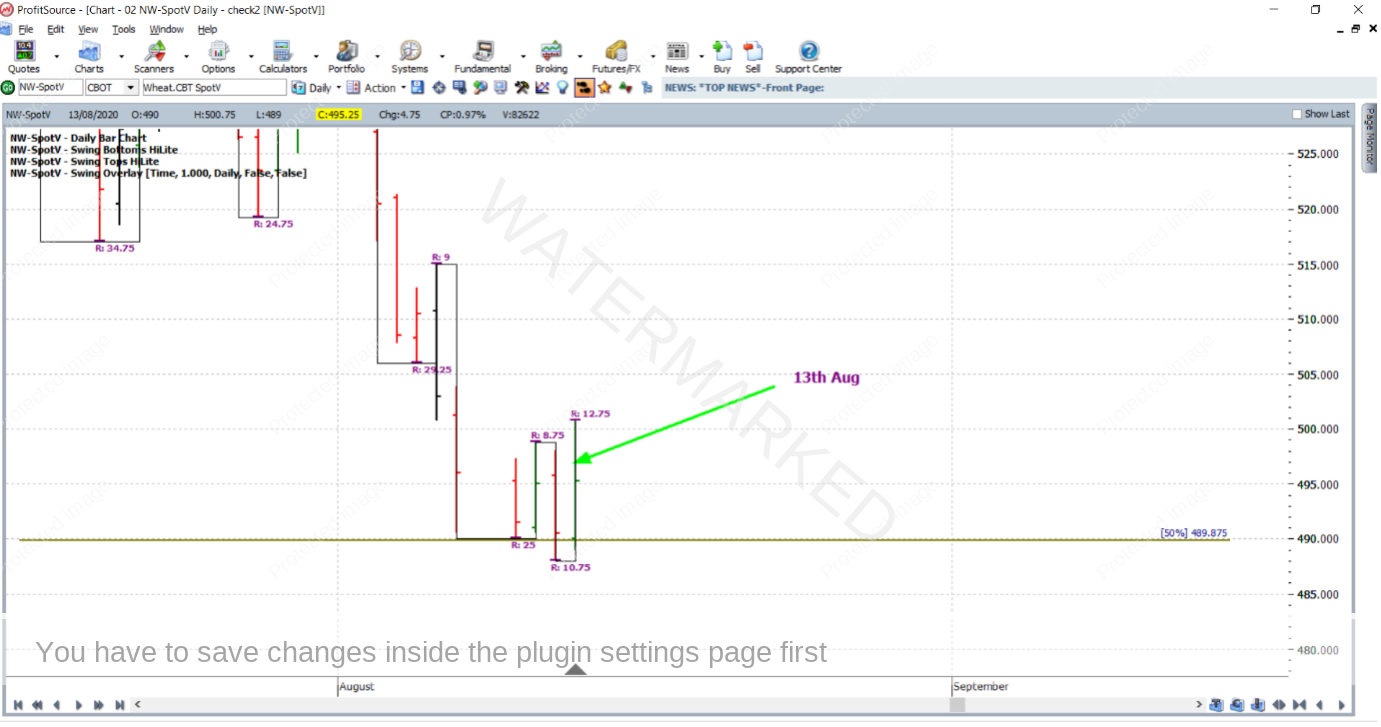

- The swing chart simply says so. In the chart below a daily swing chart overlay has been placed on the chart, with daily swing tops and bottoms highlighted. Notice that upswings are now expanding (12.75 compared to the previous 8.75), and downswings are contracting (10.75 compared with the previous 25.00). And the trend – it has gone from DOWN to UNCERTAIN.

So with the reasons above allowing for some fresh bullish sentiment, how do we get back on board? Again, we go back to the swing chart. As has been shown in these articles before, a strong enough price cluster can give us reason to enter at the turning of the daily swing chart – basically the most aggressive entry based on end-of-day price data. But remember, we’ve already taken a hit here, so are probably feeling more conservative than aggressive.

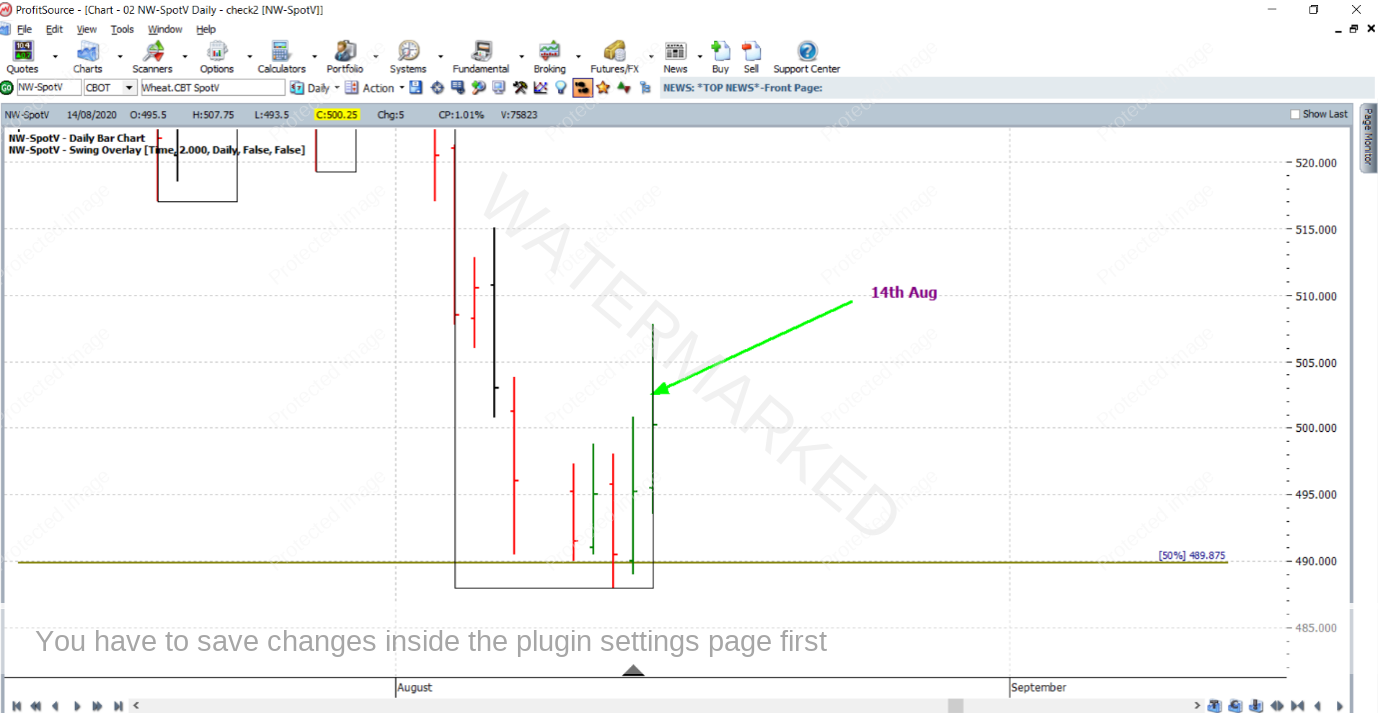

Good thing is though – there is a more conservative entry available – that is at the turning of the 2-day swing chart. Note that the market was yet to give a second day up in a row. So you’d still be in a position to trade the confirmation of a 2-day swing chart low. And remember, a two-day swing is stronger than a one-day swing. This is because it waits for more confirmation.

And this entry was confirmed with the up day that was the 14th of August. Entry stop was at 501 cents, with a simultaneously placed exit stop at 487.75 cents, one point below the low of the newly confirmed 2-day swing chart low. This is shown below, with the 2-day swing chart overlay also applied.

Now that we’re back on board, let’s choose a reference range for the purpose of trade management and an exit target – the last Quarterly swing in the same direction. Note that Point C has been placed on the last significant low – that of the 26th of June 2020 at 471.00 cents.

This trade will now be managed like a large ABC trade. On the 31st of August, the market reached the 50% milestone, and exit stops were moved to break even.

On the 6th of October (of the same year of course), the market reached the 75% milestone, and exit stops were moved to lock in some profit at approximately one-third of the average weekly range (9.00 cents at the time) below the 50% milestone at 549 cents.

The majority of trades will test our patience in some way and this one was no exception. The payoff finally came on the 4th of January 2021 when the 100% milestone was reached.

To conclude this article we now have a break down of the rewards. In terms of the reward to risk ratio:

Initial Risk: 501.00 – 487.75 = 13.25 = 53 points (point size is 0.25)

Reward: 645.00 – 501.00 = 144.00 = 576 points

Reward to Risk Ratio: 576/53 = approximately 11 to 1

According to the CME Group website specifications, each point of price movement changes the value of one Wheat futures contract by USD$12.50. So in absolute dollar terms the risk and reward in USD for each trade of the contract is determined as follows:

Risk = $12.50 x 53 = $662

Reward = $12.50 x 576 = $7,200

In terms of AUD at the time of taking profits this reward was approximately $9,363.

And risking 5% of the trading account size for this trade, the percentage change to the account after taking profits would be calculated as:

11 x 5% = 55%

Many brokers will make this market accessible via a CFD, affording entry to a strongly trending market with much lower capital if need be.

A final thing to note. And it’s a psychological one. After closing out the trade for a healthy profit, at least part of you is bathing in very positive light. While enjoying this, think about how it feels in relation to how you felt immediately after taking that first loss. By plain and simple contrast this should have you feeling even better about the final win. But just as importantly, if not more, it can add motivation to act quickly next time the chance is there to have a second go.

Work Hard, work smart.

Andrew Baraniak