Worth the Wait?

One of the disadvantages of trading the more traditional commodity markets, like those of the beans complex, the grains sector and the soft commodities sector, is that they can grind sideways for long periods and make it very easy for us to lose interest.

But they’re also worth keeping an eye on. Some of the most explosive moves will occur, especially in times of great uncertainty. The volatility in these markets can at times be unrivalled. Sometimes they simply go parabolic. Take Soybean Meal futures for instance. Its weekly bar chart for recent market activity is shown below (ProfitSource chart symbol NSM-SpotV). You can see the stark difference between different periods. Look at mid-2018 to mid-2020. Then compare it with mid-2020 to present.

So how can we get onto one of these steep moves? There have certainly been a few underway of late. This article focuses on an example trade that occurred in the above market in January of this year. By mid January, three solid price reasons clustered together at an average of US$385.4 per tonne.

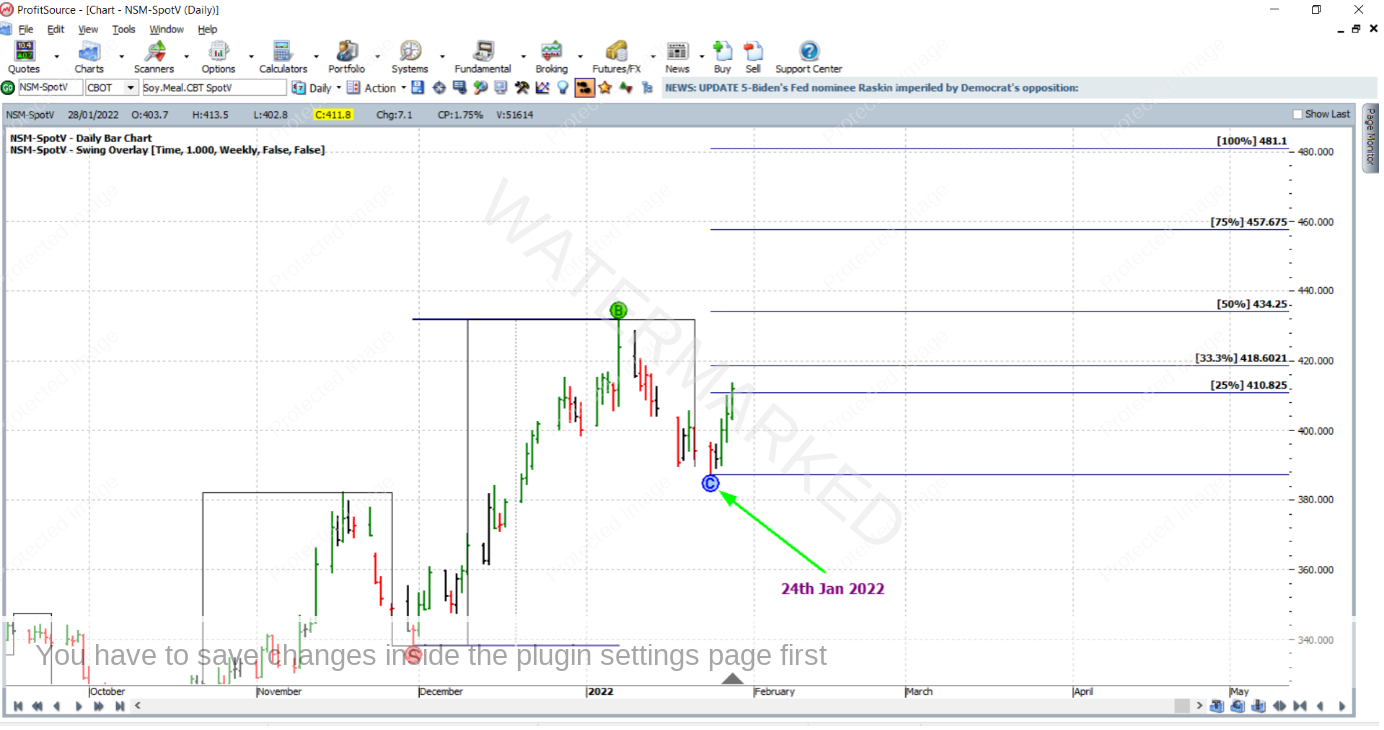

But to begin with, there was something a little less certain about this trade. As you can see below, on 24 January 2022, the market lowed at 387.4 – not quite having reached the price cluster. And nor eventually did it.

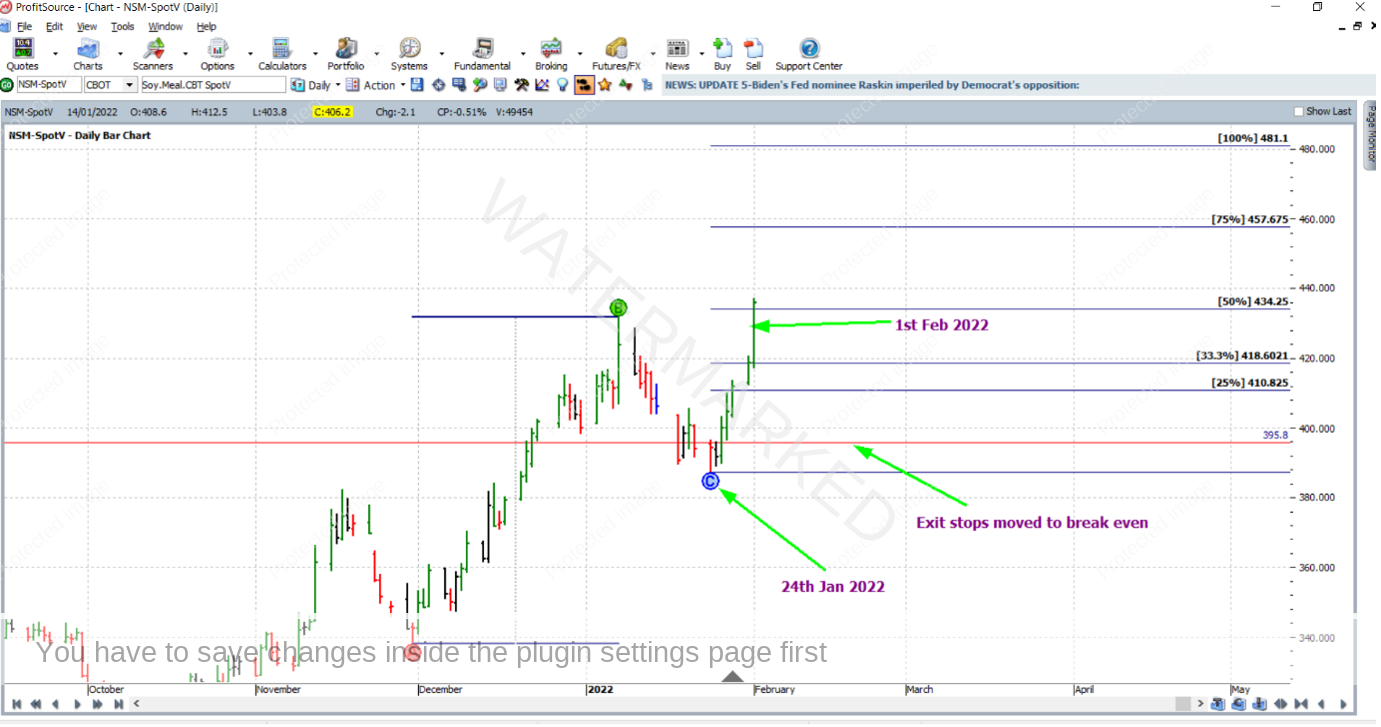

Ideally we like to see the market tag our price cluster as closely as possible – let’s say with a very small false break. But do we always get this? Certainly not. While many of the strongly trending commodities can give us a really precise hit, we still need to be prepared to “wear the market like a loose garment”. So what happened with the trade? As you can see below, entering the upturn of the swing chart would have gotten you in long on 26 January 2022 at 395.8.

Placing an order to go long on 26 January 2022 could have easily been seen as “jumping the gun” as the market had not yet reached the price cluster. A bad outside day could have easily occurred. And the alternative of waiting for the confirmation of a first higher swing bottom on the daily chart would have been safer, but this would have left you behind as the market bolted. Remember, markets like these are big and fast movers.

Therefore in a situation like this, if still wanting to take the trade, there’s not much else we can do. The only entry was an early, risky one. Extra diligence is therefore required with our risk management. An aggressive trade as such is not one for which you’d aim to maximise risk – certainly not the 10% that Gann says. For riskier trades we’re better to opt for the minimum percentage risk that our trading plan allows. This would be 5% at the most.

Analysis wise there is one other important thing not yet mentioned – the fact that there was major trend sympathy with any long trades taken at the time. That is, the weekly trend was up. For this reason you’d rate the entry taken as slightly less aggressive.

The remainder of this article will take the usual approach. The reference range chosen for the trade was the last weekly swing in the same direction. This is shown below with the aid of the weekly swing overlay, and the ABC Pressure Points Tool.

After entry, stops were managed as though in a large ABC trade managed Currency style. On 1 February 2022, the market reached the 50% milestone and stops were moved to break even.

Then on 9 February 2022 the market broke through the 75% milestone and exit stops were moved to lock in profit at approximately one third of the average weekly range (21.6/3=7.2) below the 50% milestone, at a price of 427.0.

And on 24 February 2022, profit was taken at the 100% milestone.

Now let’s analyse the rewards. The Reward to Risk Ratio:

Initial Risk: 395.8 – 387.3 = 8.5 = 85 points (point size is 0.1)

Reward: 481.1 – 395.8 = 85.3 = 853 points

Reward to Risk Ratio: 853/85 = approximately 10 to 1

According to the specifications on the CME Group website, each point of price movement changes the value of one Soybean Meal futures contract by US$10. So in absolute US Dollar terms the risk and reward for each trade of the contract is determined as:

Risk = $10 x 85 = $850

Reward = $10 x 853 = $8,530

At the time of taking profit, in AUD terms this reward was approximately $11,913.

Risking an absolute maximum of 5% of the account size for this trade, the resulting percentage change to the account size after taking profits would be:

10 x 5% = 50%

Trading this market with CFDs will allow for smaller and more flexible position sizing, although relative to position size the commission will be much more expensive.

Keep at least one of the old-fashioned commodities on your watch list – the big moves are certainly worth waiting for!

Work Hard, work smart.

Andrew Baraniak