Your Plan

Are you putting in the hours of study but still don’t seem to see a lot of trading opportunities? What are you missing? Well perhaps it’s the lack of a clear setup and a written trading plan?

Trading plans seem to be the least discussed topic in trading circles, probably because of their uniqueness and being so personal, although that shouldn’t subtract from the fact that every trade needs to satisfy your own rules. A trading plan to me is a document that combines the setup, and the bare minimum that needs to come together to take a trade and options on how to manage stops.

Specialising in one market will help you to draw up trading plans that are ‘market specific’ but we can also look for a setup across many markets and become a ‘setup specialist’. A very common, but potentially underrated setup is the Double Top and Double Bottom. David Bowden introduces us to these in the Number One Trading Plan and gave us the 200% rule.

Long term Safety in the Market lead trainer Mat Barnes also shared his take on Double Tops and Bottoms suggesting we should also look for a repeating range with a slight false break. Darren Safety in the Market’s Active Trader Program coach is running a fantastic May challenge with the students, encouraging them to post these kind of setups on the forum for everyone to benefit from.

In this article I want to share with you one of my trading plans with the hope that if you are yet to construct one yourself, this may just give you a few ideas to help you get started. If I scan a bunch of markets with this trading plan in mind a) I know what I’m looking for and b) I can quickly discard a market this isn’t close to ticking the boxes.

Click here to read my Trading Plan

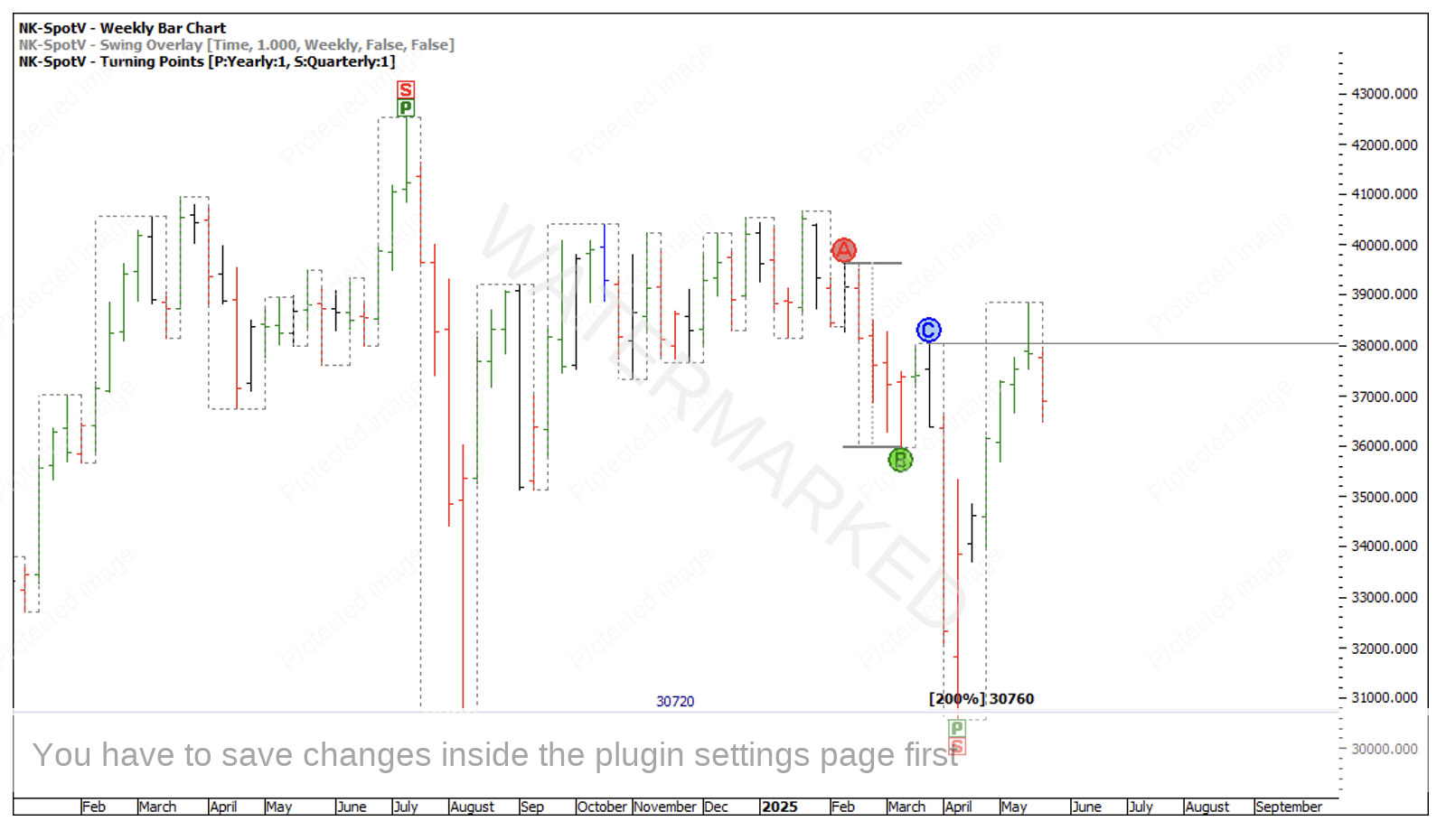

The market that is potentially shaping up to give me a trade is on the Nikkie 225 (NK-SpotV in ProfitSource), which is showing a 200% weekly swing milestone into a false break double bottom, followed by a large Overbalance in Price to the upside and is now looking like it may be shaping up for a Weekly Point C.

Chart 1

Using a simple but extremely effective Ranges Resistance Card and the First Range Out to run milestones, I immediately see a tight cluster starting to take place between 34,705 and 34,835 that fits my trading plan setup.

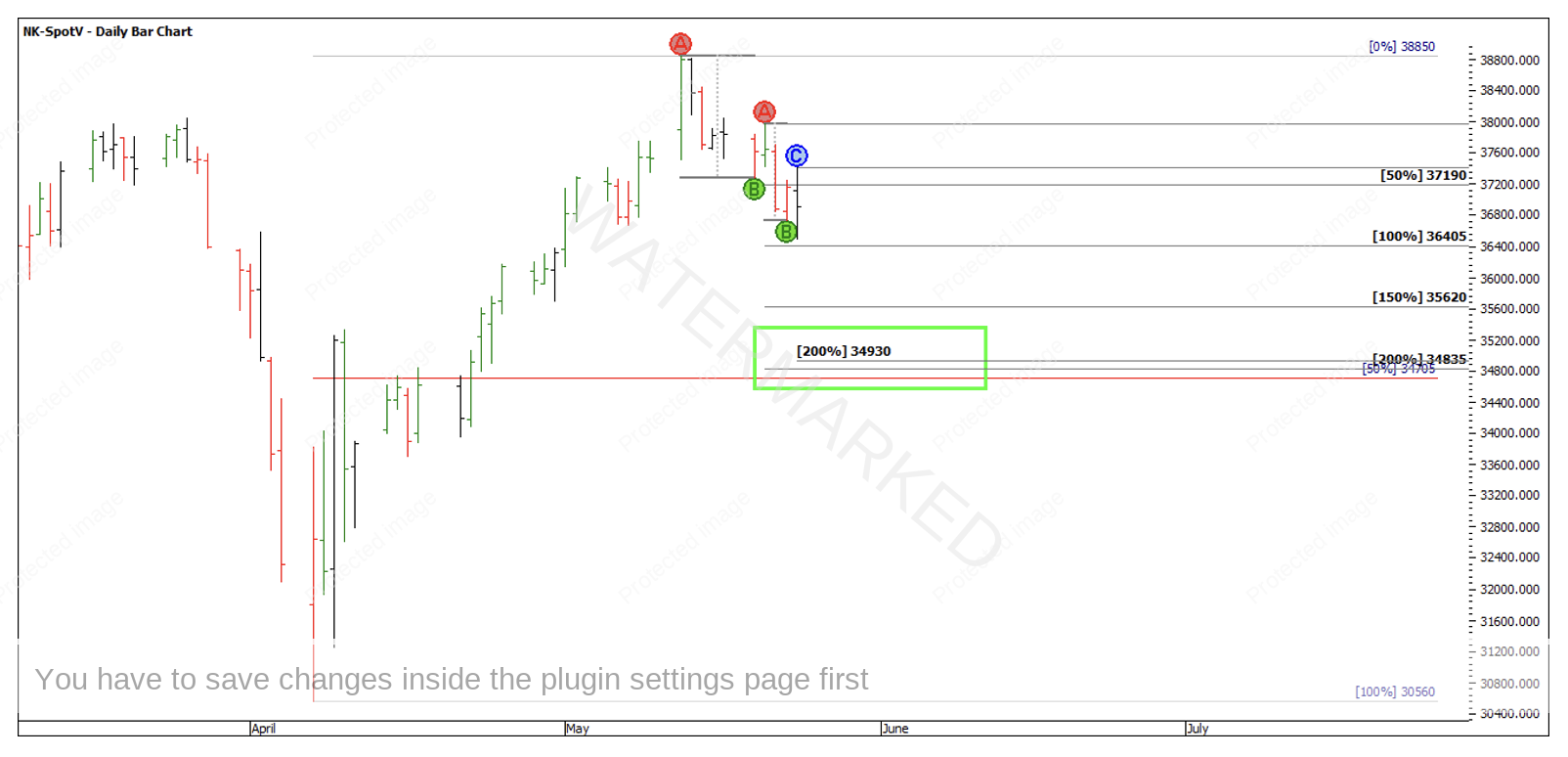

Chart 2

If I run price milestones for the current daily swing the 200% level comes in at 34,930. This now gives me 3 of the 5 price milestones I need to take this kind of trade.

Chart 3

My trading plan says I need 3-4 daily swings into the low or an equal or contracting daily swing into the low. If I now see a 100% daily swing range into this price milestone then I only need one more to make my 5-part cluster.

The Nikkie could take off to the upside and never trade down at the cluster identified and if so, no harm done, it’s taken only a few minutes to identify the setup. Although there’s no harm putting an alert into your trading platform to let you know if the market trades down at that level.

The point is you have a trading plan and can execute it if all the elements come together.

I really encourage anyone yet to write their own trading plan to make that a big part of 2025 and to spend time looking to improve it after each trade. This is one subject I always found hard and shied away from yet could potentially be one of the most important parts of your trading.

Happy Trading

Gus